Many investors prefer to gain exposure to emerging markets by investing in a fund such as an ETF that replicates an index. However the idea of index investing in emerging markets is not the best way to invest in these markets for a number of reasons. In a recent article last month, Laurent Saltiel of Alliance Bernstein highlighted a few issues with investing in EM using an index such as the popular MSCI Emerging Markets index.

From the article titled Emerging-Market Benchmarks Miss the Mark:

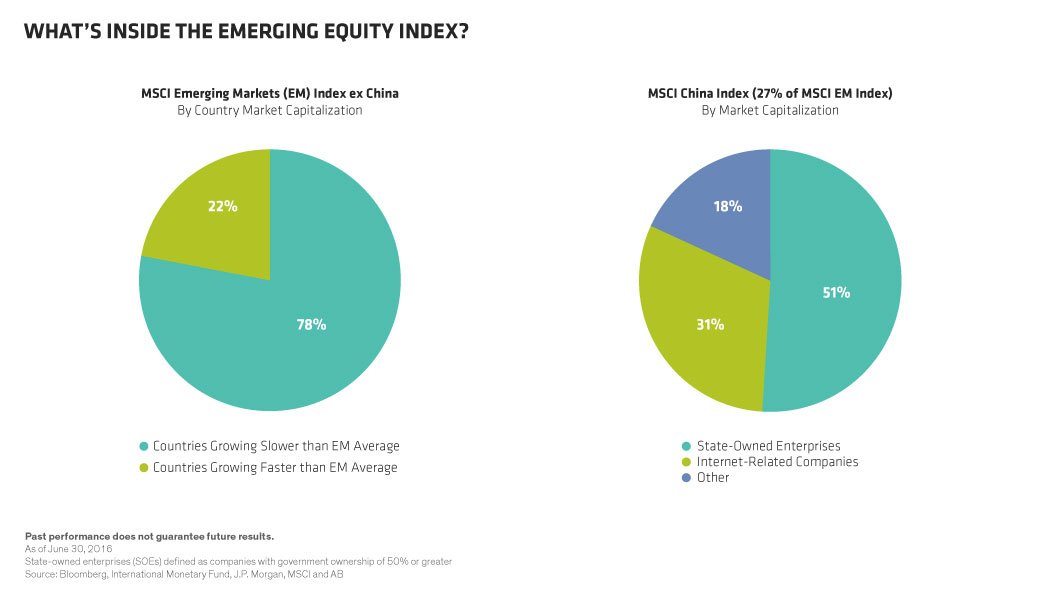

In the MSCI Emerging Markets Index, about 78% of the market capitalization (excluding China) is in countries growing slower than average. For example, Korea and Taiwan (two fairly mature economies) together account for more than a quarter of the total benchmark. Yet India accounts for only 8% of the benchmark, even though it has a population of more than 1.2 billion, attractive demographic trends and a dynamic economy benefiting from numerous market-friendly reforms.

China’s benchmarks also pose concentration risks. The MSCI China Index is heavily skewed toward state-owned companies, which tend to have fairly poor corporate governance and suffer from heavy government intervention. State-owned enterprises also weigh heavily in the benchmarks of other countries like Brazil and Russia. In addition, attractive areas of investment with strong long-term growth prospects like healthcare or education together account for less than 4% of the MSCI Emerging Markets index.

Source: Emerging-Market Benchmarks Miss the Mark, Alliance Bernstein

In addition to the above the following are some of the other issues with investing using indices in EM:

- Country-specific indices for emerging countries tend to be heavy in financials as banks and other financials dominate these economies. For example, the iShares Indonesia ETF has about 37% invested in financials. Having high exposure to any one sector is risky especially in volatile developing countries.

- Many fast-growing firms in these markets are small and medium-sized and they may not be part of the major indices. So to profit from these firms one has to go beyond the indices.

- Passive investing via an index involves less work for an investor. However since an index provider determines the constituents investors can miss undiscovered gems which try to ride the economic booms in these markets.

- Since indices are followed by institutions and other big investors much of the attention goes towards the big firms that form the indices leading to over-crowded trades. By going into areas off the beaten path investors can find niche companies that cater to the local market better.

- Going with index investing prevents an investor from executing a specific strategy such as growth or dividend investing. For example, an income investor may want to capture the high dividends paid out by Chilean banks but buying a fund that replicates an index will not help to implement a dividend investing strategy. This is because the index will constituents firms from sectors such as mining, retail, commodities, etc. that the investor may not be interested in.

In summary, investors must be highly selective when it comes to investing in emerging markets and not follow the crowd by choosing an index fund. Higher returns can be generated from fast-growing firms in these markets by carefully researching and owning then while the majority of market participants avoid them.

Disclosure: No Positions