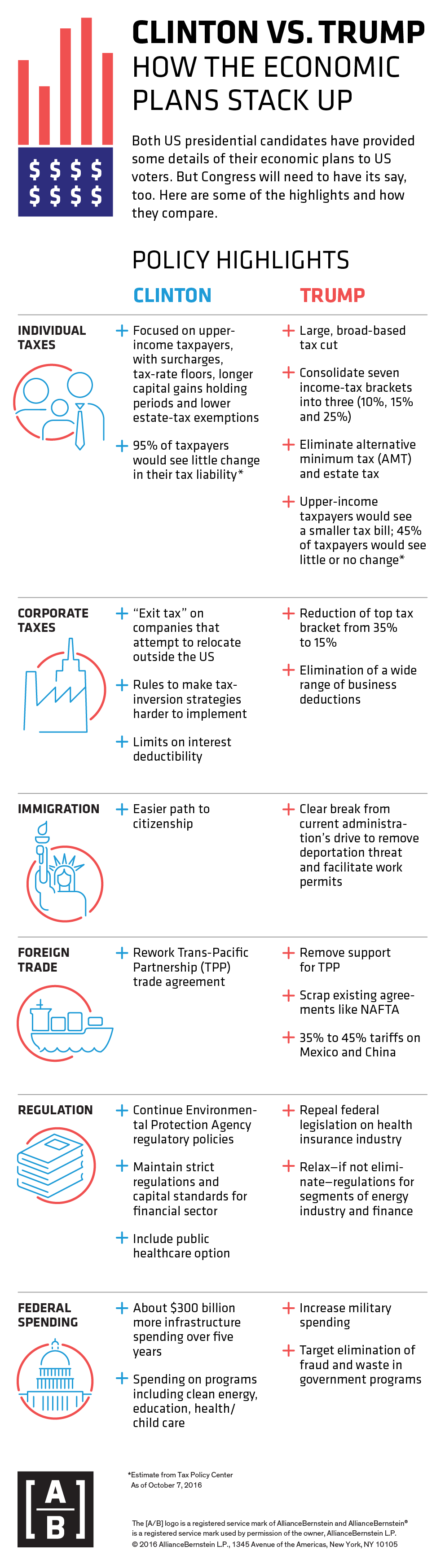

The stunning victory is now behind us and the next step for investors is to figure out how to position their portfolios for the new administration. More specifically investors can buy stocks of certain sectors that are projected to perform well while avoiding some sectors. This is because based on the economic plans put forward by Mr.Trump some sectors will be winners while others will be losers.

Some sectors that may perform well under the Trump administration are listed below:

- Coal Industry – A list of coal stocks can be found here.

- Railroads – Coal mined must be transported to their destinations such as power plants. Railroads that investors can consider include CSX, NSC, UNP, CNI and CP.

- Banking industry – Banking stocks may benefit when regulations are reduced.

- Biotech and Drug industries – GILD, TEVA, AMGN, JNJ, GSK, LLY, etc.

- Healthcare industry

- Companies in the Defense sector – Examples include GD, LMT, NOC, BA, etc.

- Industrials – Firms in this industry include CAT, MMM, GE, etc.

Disclosures: Long CNI, CSX, NSC and UNP