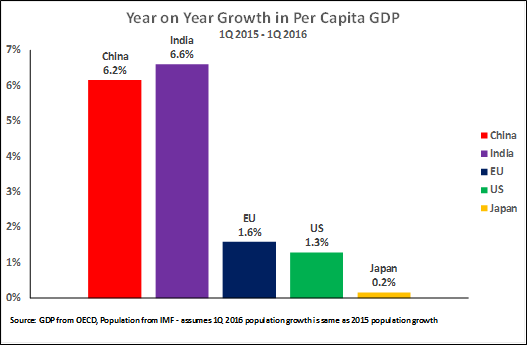

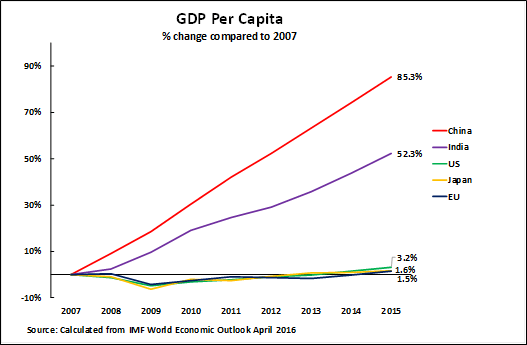

The emerging economies of China and India are growing fast compared to developed economies. This year China and India grew at 6.7% in second quarter and 7.9% in first quarter respectively. GDP growth rates of high=single digits are for these economies are considered low by some relative to their higher growth rates in the past. Western economies have smaller growth rates than these figures.

According to Professor John Ross, a Senior Fellow at Chongyang Institute for Financial Studies, Renmin University of China the cause for this big difference in growth rates is state investment. Basically he argues that governments of China and India continue to invest heavily on infrastructure and other sectors has led to high growth while in the developed western countries the high dependence on private investment and very low state investment has created a low growth economic environment.

From a recent article by Professor Ross:

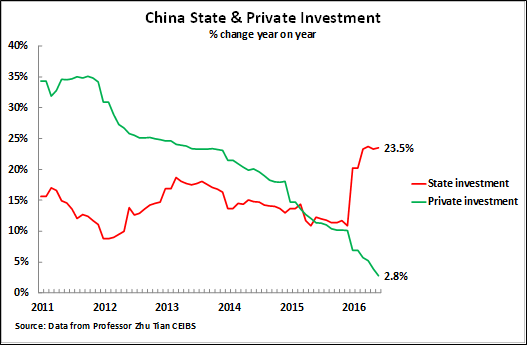

The world’s two most rapidly growing major economies are China and India. Both China and India show a common pattern of development which differs sharply from the slowly growing Western economies. China and India’s fast expanding economies have rapidly growing state investment while their private investment is either growing very slowly or declining. In contrast the slowly growing Western economies rely on private investment with no rapid growth of state investment. It will be shown below why rapid expansion of state investment is correlated with fast economic growth, while reliance on private investment leads to slow economic growth.

This economic reality highlights the importance of China’s dictum ‘seek truth from facts’. It is also crucial for China’s practical economic policy as it seeks to achieve its goal of a ‘moderately prosperous society’ by 2020 and a ‘high income economy’ by World Bank standards shortly thereafter.

But the facts of this global economic trend are also crucial for economic theory and analysis. According to the dogmas of ‘neo-liberalism’ and the ‘Washington Consensus’ private investment is supposed to be ‘good’ while state investment is supposed to be ‘bad’. The facts show the exact opposite trend is occurring. Rapidly rising state investment is associated with high economic growth (China and India): reliance solely on private investment is associated with low growth (US, EU and Japan).

Source: Why Are China and India Growing So Fast? State Investment, Key Trends in Globalisation

Below are three charts from the above article:

a) China – State vs Private Investment

Click to enlarge

b) Per Capita GDP Growth – Year on Year

c) GDP Per Capita

Mr.Ross notes that US economic recovery is hindered due to the ideology of the state namely that “state=bad’ and “private=good”.

In the US it is not possible or necessary for the state to play a major role in the economy like in China. While policies can be set to drive solid economic growth and prosperity economic policies of the state has failed and has caused a situation where the middle-class is hollowed out and the poor becoming poorer. In summary, in China the state is sitting in the driver’s seat of a moving car while in the US and other western countries the state is a passenger sitting in the back leather seat playing video-games or enjoying the beautiful scenery….