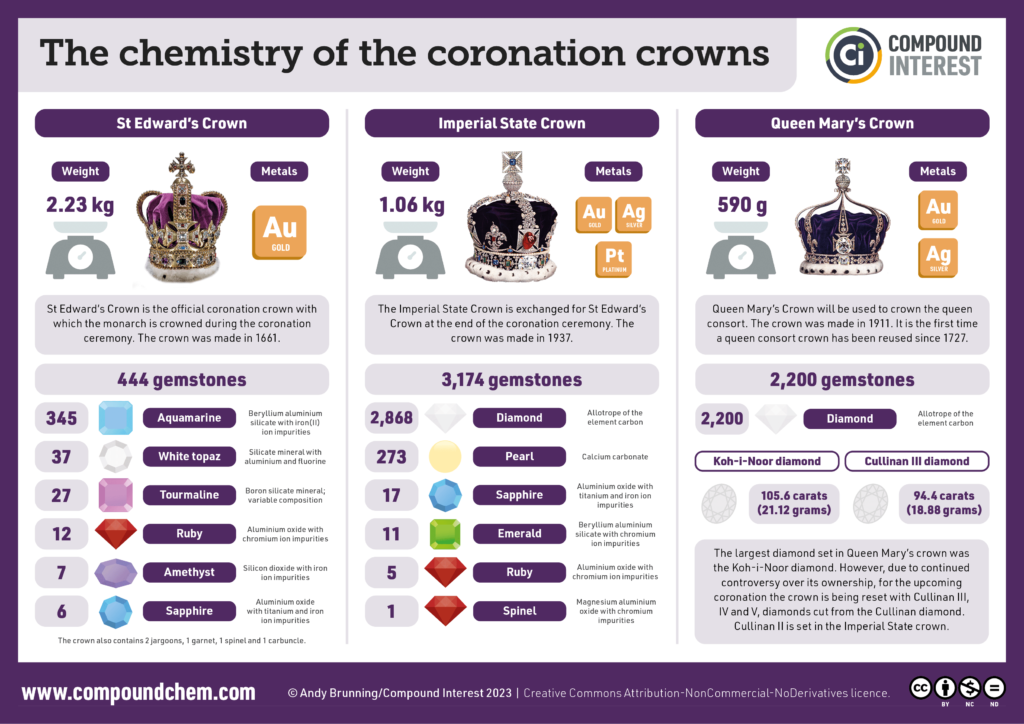

The Crown Jewels of the United Kingdom housed in the Tower of London are fascinating to look at. The Coronation Crowns in the collection are some of the wonderful crowns in the world. While visiting the Tower of London one does not feel like enough time was spent to admire the jewels due to the moving conveyor belt system. With that said, I came the below infographic that shows the amazing amount of precious stones present in three of the imperial crowns:

Click to enlarge

Source: Compound Interest

It would be an interesting task to calculate how much it would cost to build one of these crowns taking into account the cost of all the stones and other materials involved.