Globalization has been a boon to global economic growth in the past few decades. Millions of people in the developing world have been lifted out of poverty and entered the middle class. However globalization is a zero-sum game with clear winners and losers. In the developed world workers who lost their jobs due to globalization can be considered as losers while those who had capital to deploy and profit from the process have been winners. A recent article in the journal discussed how Apple led to a creation of an Apple city in China employing some 250,000 workers. Clearly they are beneficiaries of globalization and US workers who lost their jobs in the electronic manufacturing industry or who might have been employed in the industry are losers.

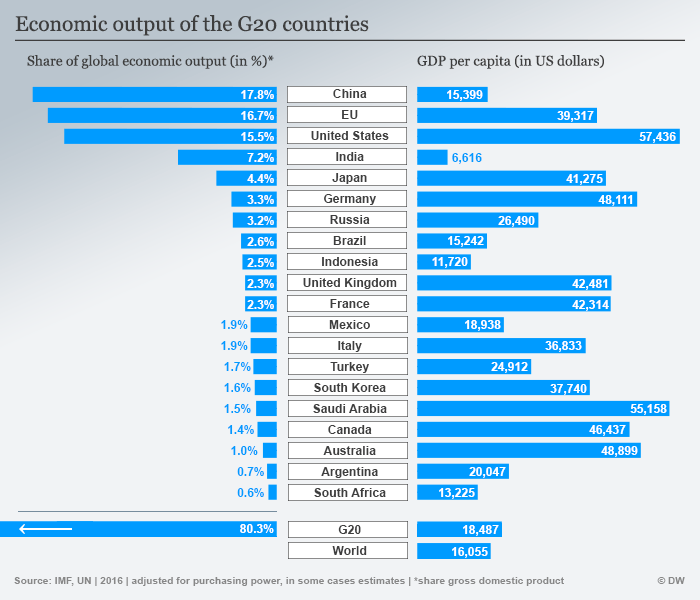

At a country level, some countries are winners of globalization while others were left behind. According to Amrita Narlikar, a professor and the president of the German Institute of Global and Area Studies the concept of globalization is not clearly explained by policy markers to their constituents. From a DW article quoting her:

For all intents and purposes, one of the G20’s declared goals is to try to advance globalization – a tall order in a world where many countries either feel left behind or refuse to subscribe to the concept.

Amrita Narlikar, a professor and the president of the German Institute of Global and Area Studies, who has written extensively on globalization, sees reason for concern about its future. “There is a level of inadequacy, and there is a backlash, not just in terms of poor people feeling left behind but also in how US President Trump’s stance on trade and climate change and in the rise of right-wing and left-wing movements,” she told DW.

One of the most pressing issues is how to transfer the wealth and prosperity gained through globalization to those people who have been left behind or have been hardest hit by the effects of globalization and are increasingly putting their faith in anti-globalization movements. “Policymakers are doing a bad job of explaining what (globalization) means, even though there is plenty of clear evidence,” Narlikar said.

Globalization works – sometimes

Narlikar pointed to the correlation between globalization and the alleviation of extreme poverty. Though there were 1.9 billion people globally classified as living in extreme poverty in 1990, that figure fell to 836 million in 2015, a decline of 14 percent. Narlikar laments that that “kind of message is not getting out with the passion of intensity that is needed to impart information.”

Angel Gurria, the secretary-general of the Organization for Economic Cooperation and Development, argues in a similar vein. “It’s because we are mostly focused on the growth element rather than inclusion,” he told DW. “We need to focus on what we call the nexus between productivity and inclusion,” Gurria said. “Of course, the idea is to increase productivity, but, if you do not have the element of inclusion, what will happen is that productivity will run into a wall; there will be rejection.” However, Gurria pointed out, if the focus is merely on redistribution growth will suffer.

Source: Pursuing globalization after G20 resistance in Hamburg, DW

It remains to be seen how the next phase of globalization will play out.