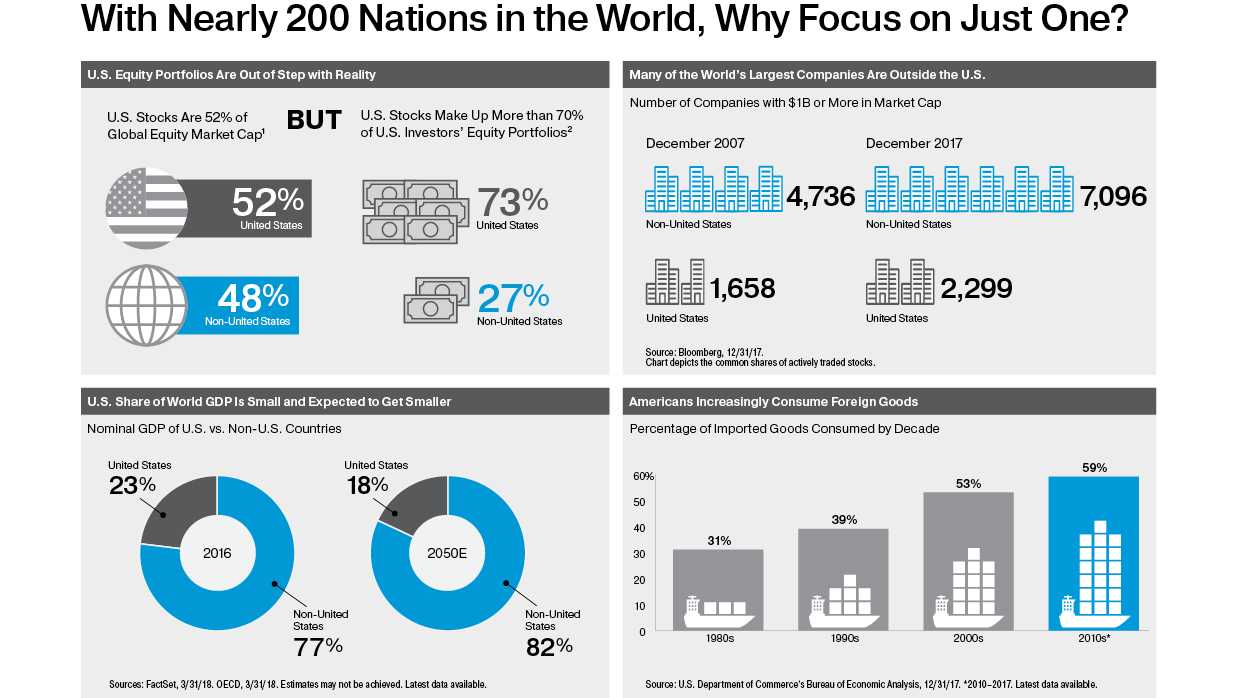

Investing in foreign stocks has many advantages. Despite living in a globalized world, many Americans have low exposure to foreign stocks. Going overseas can not only help diversify one’s portfolio but also offers the potential to boost returns. The following small infographic lists a few reasons to invest in foreign stocks:

Click to enlarge

Source:In a World of Opportunity, Why Limit Your Choice?, Oppenheimer Funds