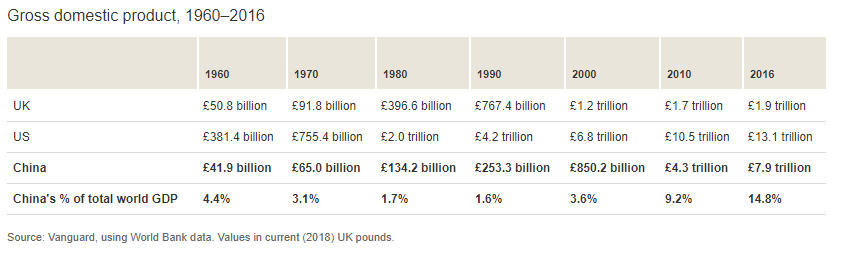

The economy of China has undergone an astonishing growth rate since the 1990s. For instance, China acocunt for just 1.6% of the world GDP. But by 2010, it jumped to 9.2% of the world total GDP. Rising further, China’s GDP reached about 15% of the global economy in 2016.

The table below shows the growth of China’s economy relative to the US, UK and the world:

Click to enlarge

Source:Why invest in China?, Vanguard UK

From the above article:

In 1960, the economy of the United Kingdom was almost 20% larger than that of China. In 2006 China’s GDP surpassed the UK’s, and by 2016 the Chinese economy was more than six times larger. Between 2000 and 2016, China’s share of total global GDP more than trebled, from 4% to 15%, putting it in second place, behind the United States, whose GDP share decreased from 40% to 25% in the same time frame.1

1 Vanguard, using data from World Bank.