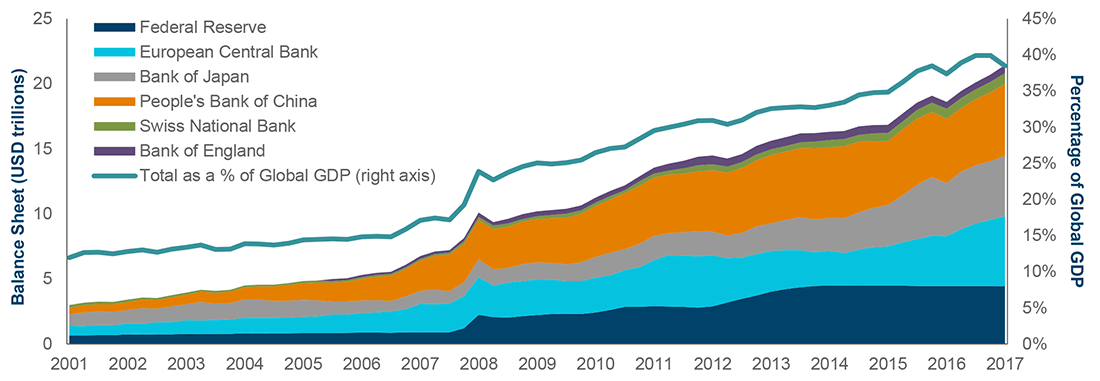

The balance sheets of major global central banks have steadily increased since the Global Financial Crisis of 2008-2009. The chart below shows the balance sheet figures measured against the percentage of Global GDP:

Click to enlarge

Source: The Long Unwinding Road—Navigating Regime Shift, T.Rowe Price