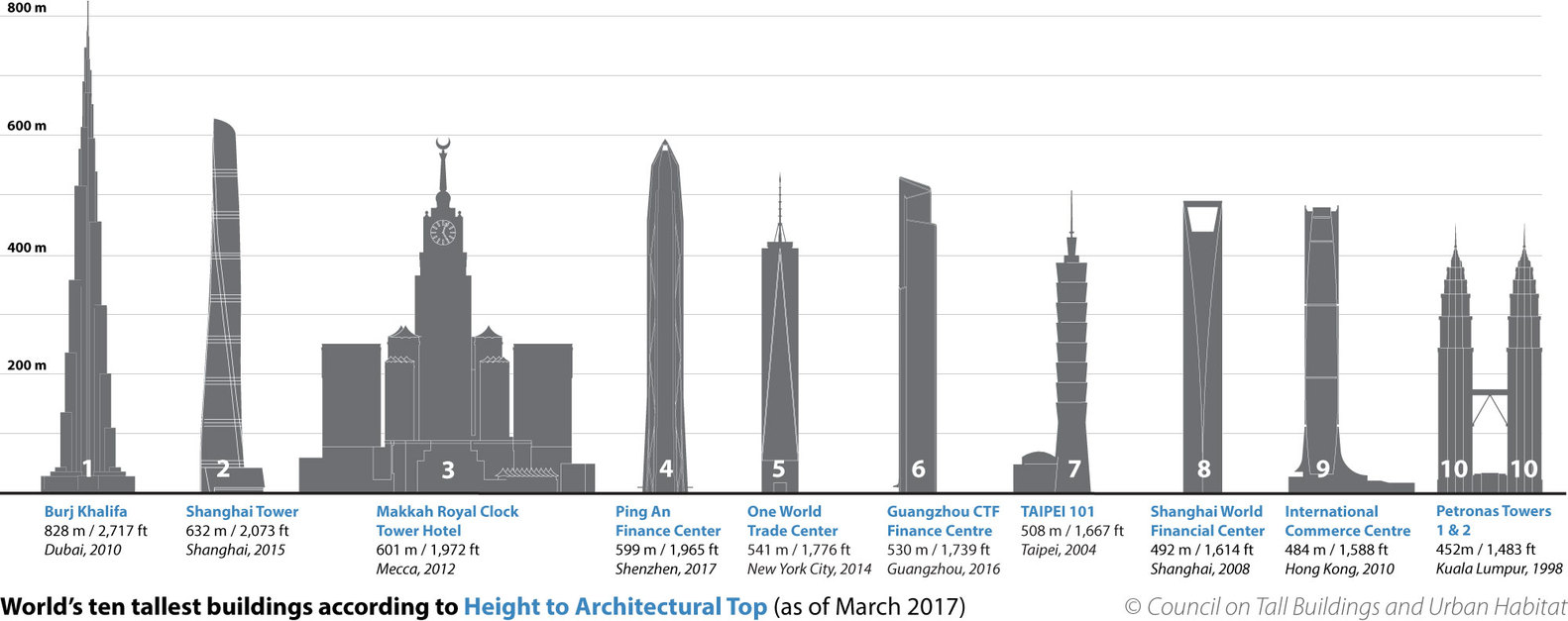

The World’s 10 Tallest Buildings according to height to architectural top as of Mar, 2017:

Click to enlarge

Source: Archdaily

You may also checkout: 100 Tallest Completed Buildings in the World by Height to Architectural Top at the Skyscraper Center.