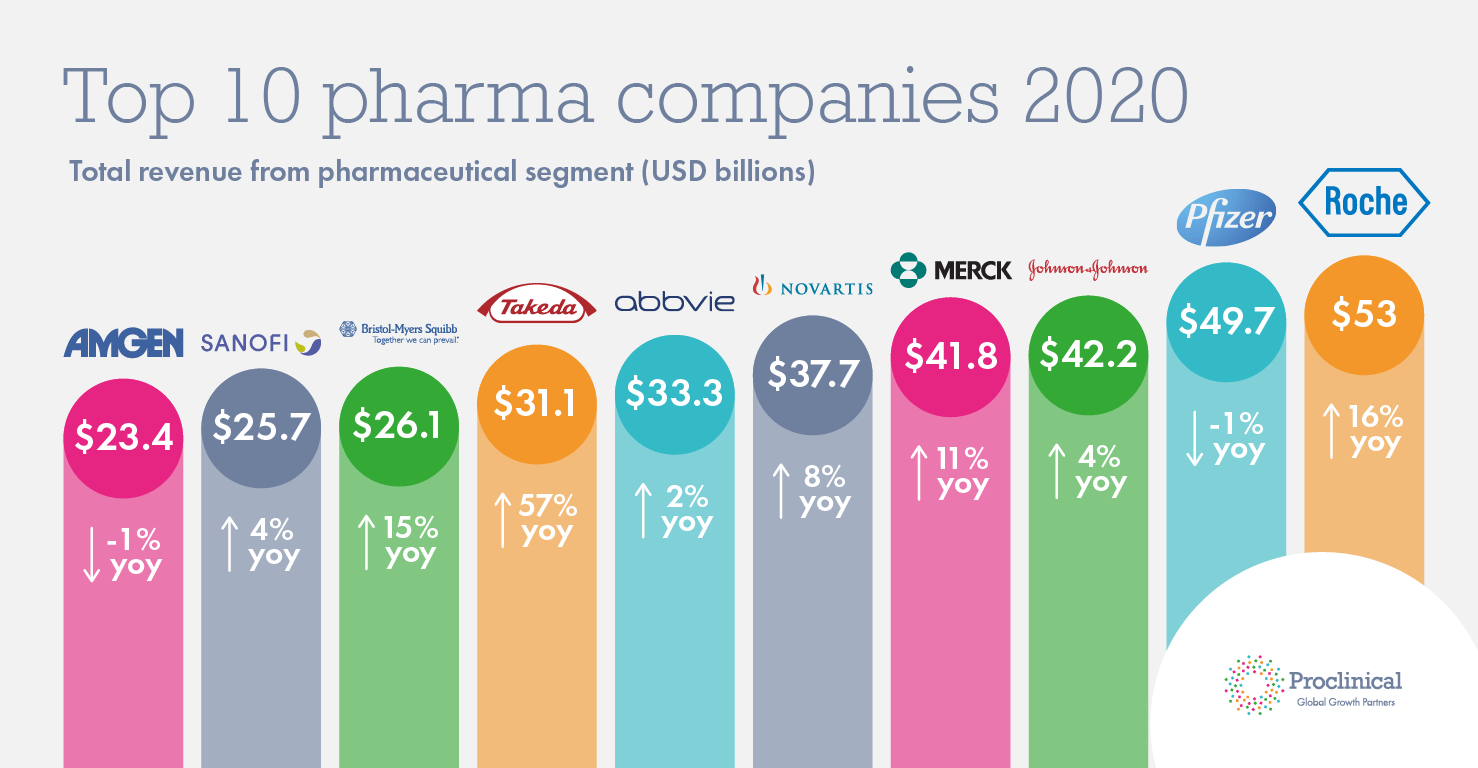

The Top 10 Pharmaceutical Companies in the World for 2020 based on their 2019 revenue are shown in the graphic below. The Top 3 firms were Roche, Pfizer and Johnson & Johnson.

Click to enlarge

Source: Proclinical

The tickers of the companies shown above are:

- Roche Holding AG (RHHBY)

- Pfizer Inc (PFE)

- Johnson & Johnson (JNJ)

- Merck & Co Inc (MRK)

- Novartis AG (NVS)

- AbbVie (ABBV)

- Takeda (TAK)

- Bristol-Myers Squibb Co (BMY)

- Sanofi (SNY)

- Amgen (AMGN)

Disclosure: No Positions