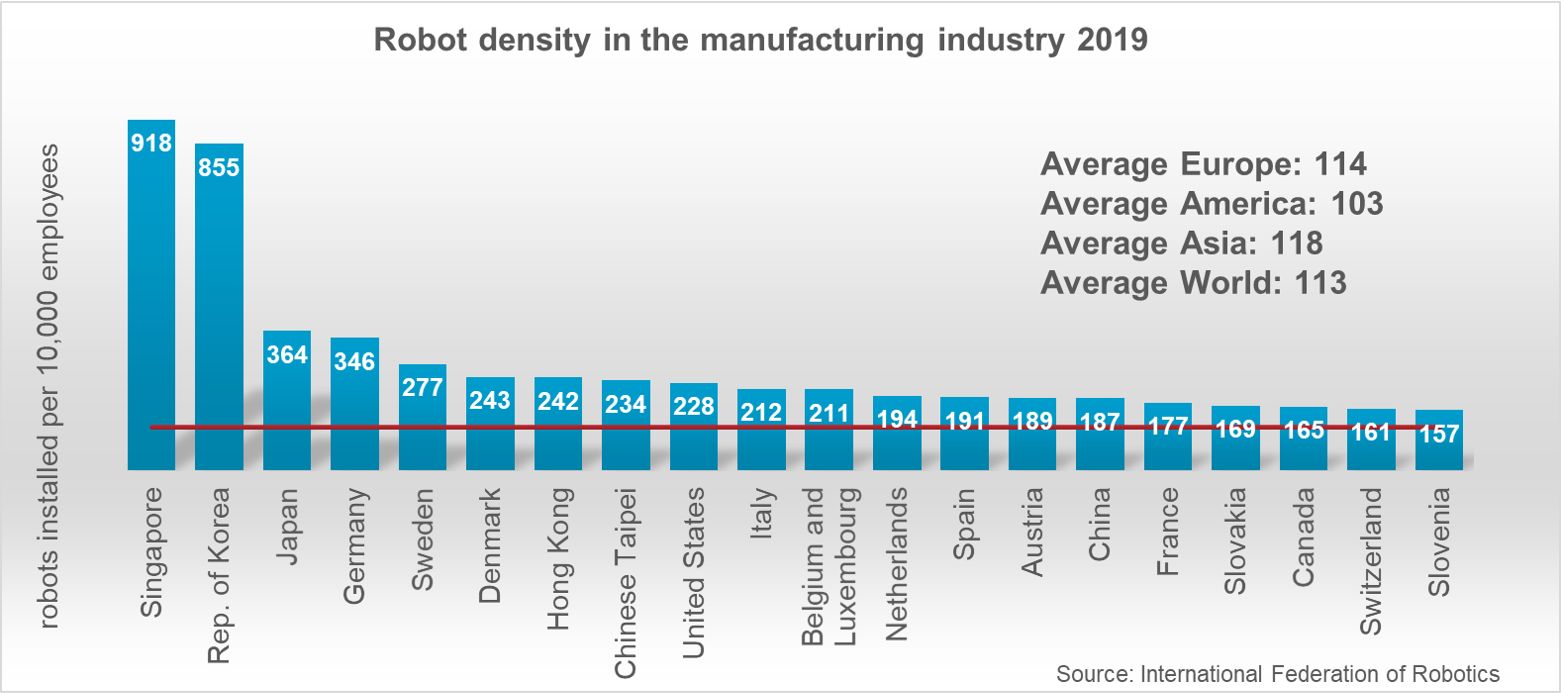

We looked at the chart of annual installations of industrial robots last week. The following chart shows the robot density in the manufacturing industry in 2019 by country. Asian countries top the ranking with Singapore, South Korea and Japan taking the top three spots. Among the developed European countries, Germany leads the list with 346 installed per 10,000 employees.

The US has just 228 robots installed per 10K employees which is lesser than Japan and Germany and far below than South Korea.