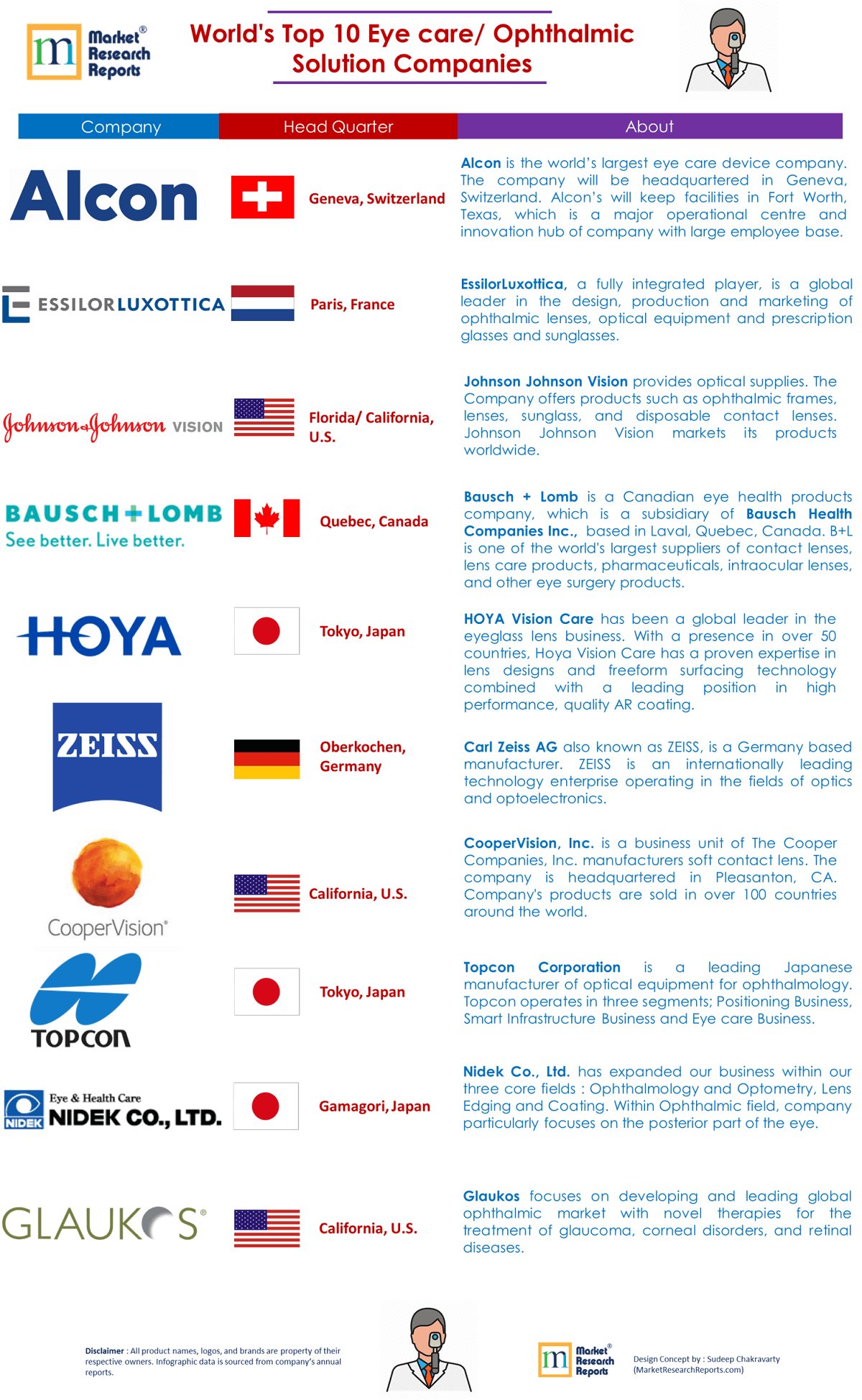

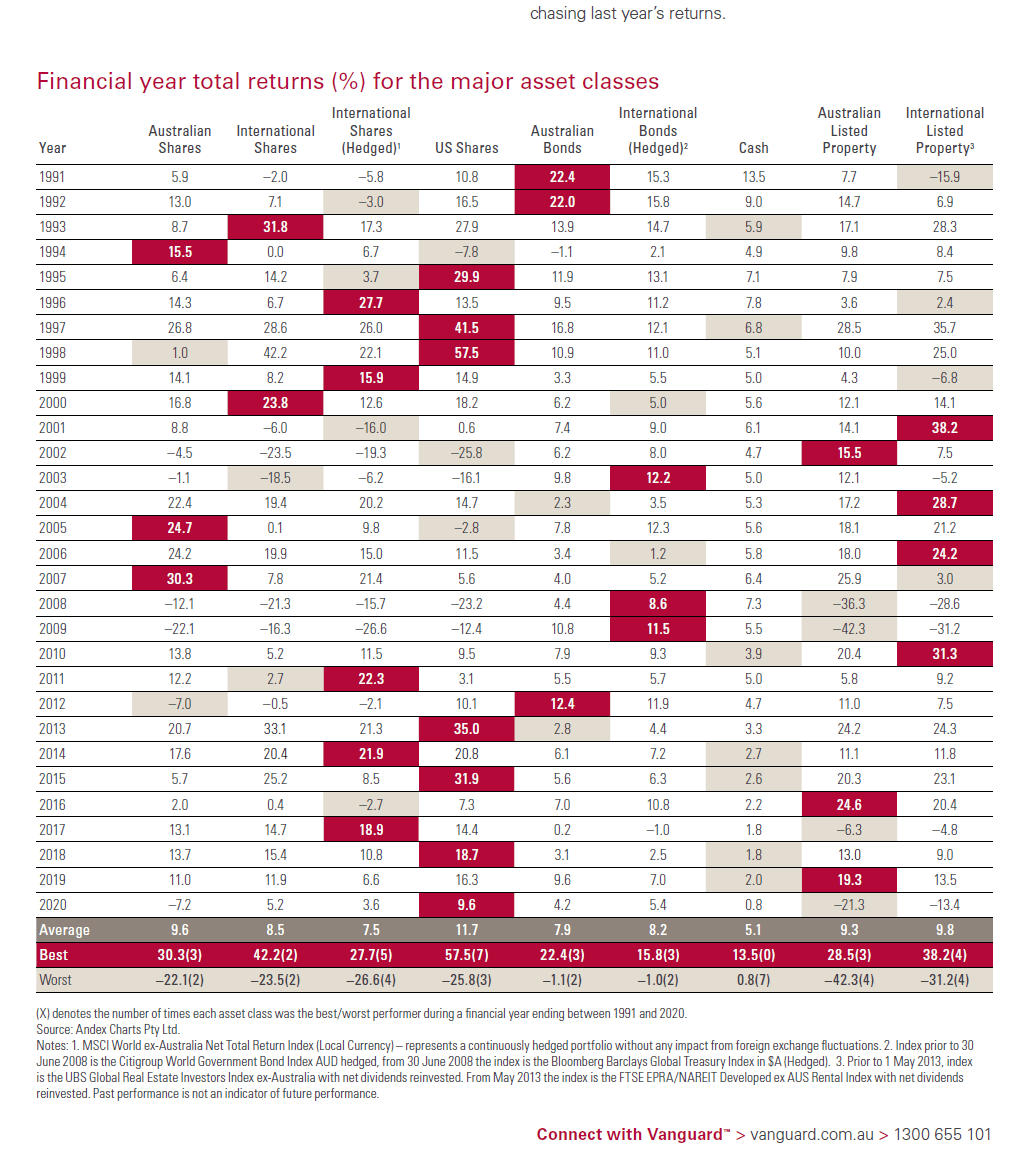

The global eye care industry is a multi-billion dollar industry. Millions of people in the world require eye care as they get older. Cataract for example affects millions of people world wide. Dry ice is another condition that requires use of eye drops on a regular basis. The following chart shows The World’s Top 10 Eyecare/Ophthalmic Solution Companies:

Click to enlarge

Publicly-listed companies in the above list are:

- Alcon Inc (ALC)

- Johnson & Johnson (JNJ)

- EssilorLuxottica Société anonyme (ESLOY)

- Bausch Health Companies Inc. (BHC)

- HOYA Corporation (HOCPY)

- Carl Zeiss Meditec AG (CZMWY)

- The Cooper Companies, Inc. (COO)

- Glaukos Corporation (GKOS)

Source: Market Research Reports