The UK equity market is cheap compared to other global markets. Investors have avoided UK stocks for a while now due to all the unknowns related to the dreaded Brexit saga. The UK left the European Union (EU) on January 31, 2020. A transition period is now in place until December 31, 2020. Though an agreement has not been finalized changes between the UK and EU are inevitable after the end of the year.

The UK’s FTSE 100 has shot up over 14% this month on the heels of the vaccine announcements from a few firms including UK-based pharma giant AstraZeneca(AZN). Despite the rise, the index is still down over 15% year-to-date. On a global basis, British stocks are at historically low levels according to an article by Rory Bateman at Schroders. While British large caps are cheap he argues small caps are even cheaper. From the article:

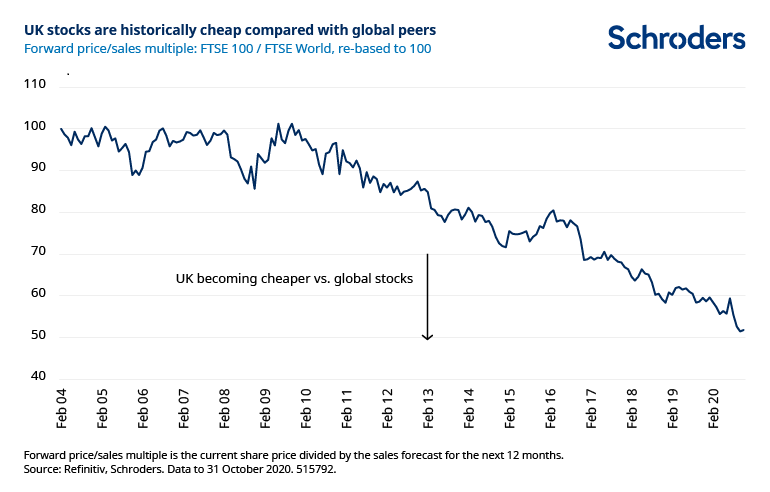

UK stocks are cheap vs global peers

The scene could well be set for a change in fortunes. Whereas US stocks have rarely been more expensively valued across multiple different measures of “value”, UK stocks are outright cheap, based on data at the end of October. Given that US stocks make up around 60% of the global stock market, this is a headwind for typical global stock portfolios. In relative terms, based on the forward price/sales multiple[1], UK stocks have never been cheaper than global stocks.

However, we believe the real opportunity is for those investors who are prepared to look beyond the big name companies that are so familiar to us all. If we dive down into the mid-sized companies which are in the FTSE 250 index (median market capitalisation of £1 billion, as at 31 October 2020), and even further down into the companies in the FTSE small cap index (median market capitalisation of £216 million as at 31 October 2020), then that is where the greatest potential opportunities are likely to lie.

Source: UK companies are cheap: the smaller the cheaper, Schroders

For US investors the added benefit of owning British stocks is that there is no dividend withholding taxes paid out by British firms (excluding REITs). Though many firms have suspended or slashed dividend payouts, as the global economy recovers next year dividend payments should resume.

From an investment standpoint, it is better to avoid the banking sector. The once powerful and strong UK banking industry has been a disaster to investors ever since the financial crisis.

Three sectors that investors can consider oil and gas, consumer goods and tobacco according to article at Hargreaves Lansdown. The author Nicholas Hyett identified the following picks in each of the three sectors:

1.Tobacco:

The P/E ratios of British American Tobacco(BTI) and Imperial Brands(IMBBY) are much lower than their international peers like Japan Tobacco and Philip Morris

2.Oil and Gas:

Royal Dutch Shell(RDS-A) and BP(BP) are lower in valuation relative to global peers like Total(TOT) and Exxon Mobil(XOM).

3.Consumer Goods:

The P/E ratio of Unilever(UL) and Reckitt Benckiser(RBGLY) have declined by about 20% in the past while the P/E of peers like Proctor & Gamble(PG), Nestle(NSGRY) and Colgate-Palmolive(CL) has increased substantially.

Other attractive opportunities are in the pharma sector with GlaxoSmithKline(GSK) and AstraZeneca(AZN) as leading picks.

Source: Are UK shares undervalued?, Hargreaves Lansdown

For US investors, the simply and easy way to invest in UK small cap stocks is via the iShares MSCI United Kingdom Small-Cap ETF (EWUS). Unlike the large companies smaller UK firms are focused mostly on the domestic economy. So they perform well when the British economy is in expansion mode.

Disclosure: Long RBGLY