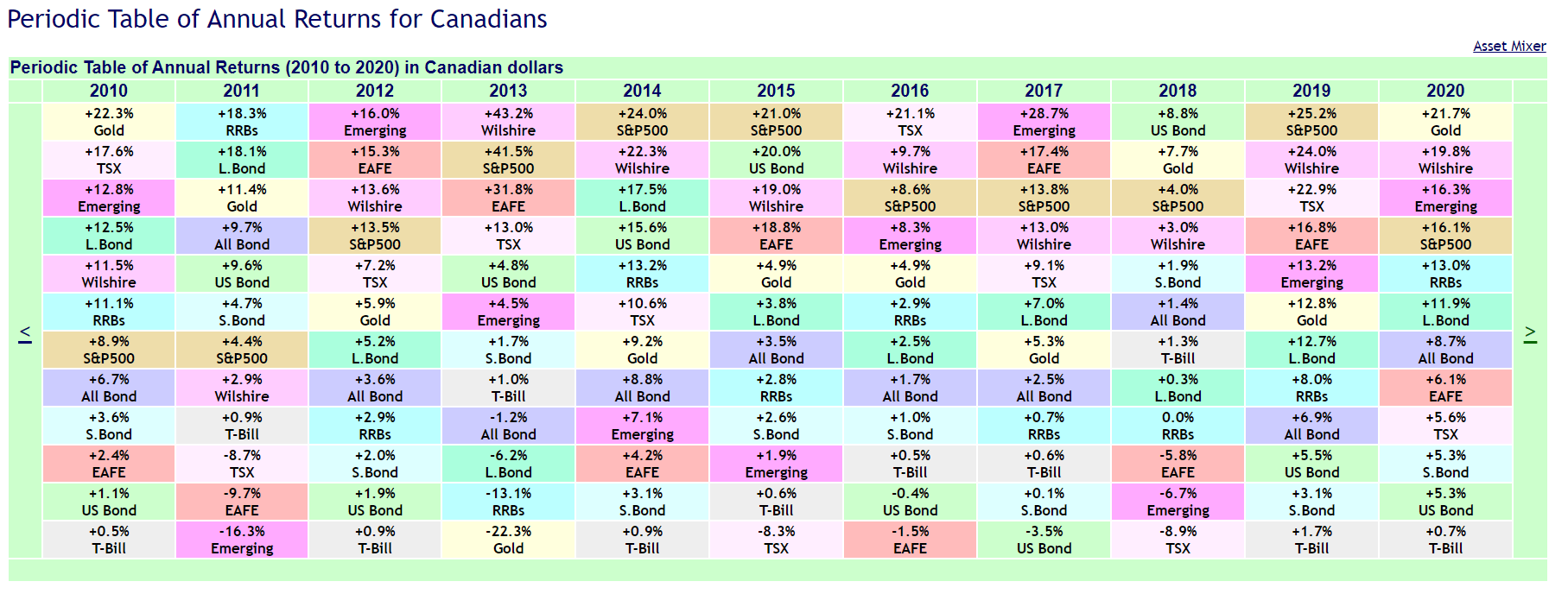

The Periodic Table of Annual Returns in Canadian Dollars from 2010 to 2020 is shown below. In 2020 the TSX index returned 5.6% compared to 16.1% for the S&P 500 in Canadian Dollar terms.

Click to enlarge

Credits: Many thanks to Norbert Schlenker at Libra Investment Management for collecting the data that this calculator uses. Original public data sources include: Bank of Canada, BC Government Statistics, Canadian Institute of Actuaries, Economagic.com, Financial Post, Globe & Mail, globefund.com, Kitco, Libra Investment Management Inc., MSCI, Prof. Werner Antweiler (UBC), Scotia Capital, BMO, Standard & Poors, Statistics Canada (Table 326-0001), DH&A, and Wilshire Associates.

Source: Stingy Investor