In the universe of equity markets, the developed world has the most advanced and efficient market. Emerging markets occupy the next place followed by frontier markets. Most major emerging markets are widely followed and get major coverage in the media as well. However frontier markets do not get as much attention since these markets are considered to be the wild west of investing.

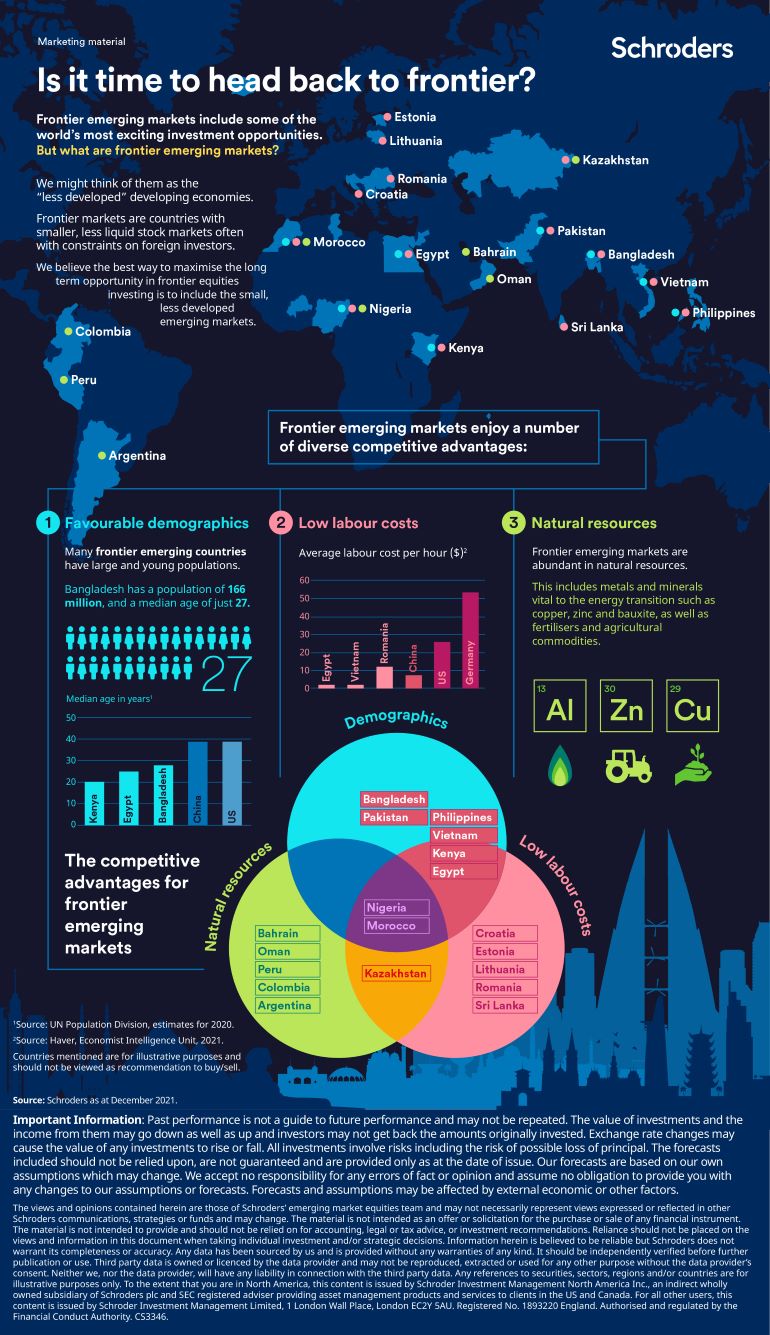

The index provider MSCI currently classifies 27 countries as frontier markets in the MSCI Frontier Markets Index. These include markets like Vietnam, Morocco, Bahrain, Iceland, Kazakhstan, etc. Other notable countries in the frontier markets include Colombia, Peru, Argentina, Philippines, etc. According to Schroders, frontier markets offer some of the exciting investment opportunities in the world due to their competitive advantages over other markets. The following is an infographic showing some of the competitive advantages of these markets:

Click to enlarge

Source: Schroders

Related ETF:

- iShares MSCI Frontier and Select EM ETF (FM)

Disclosure: No positions