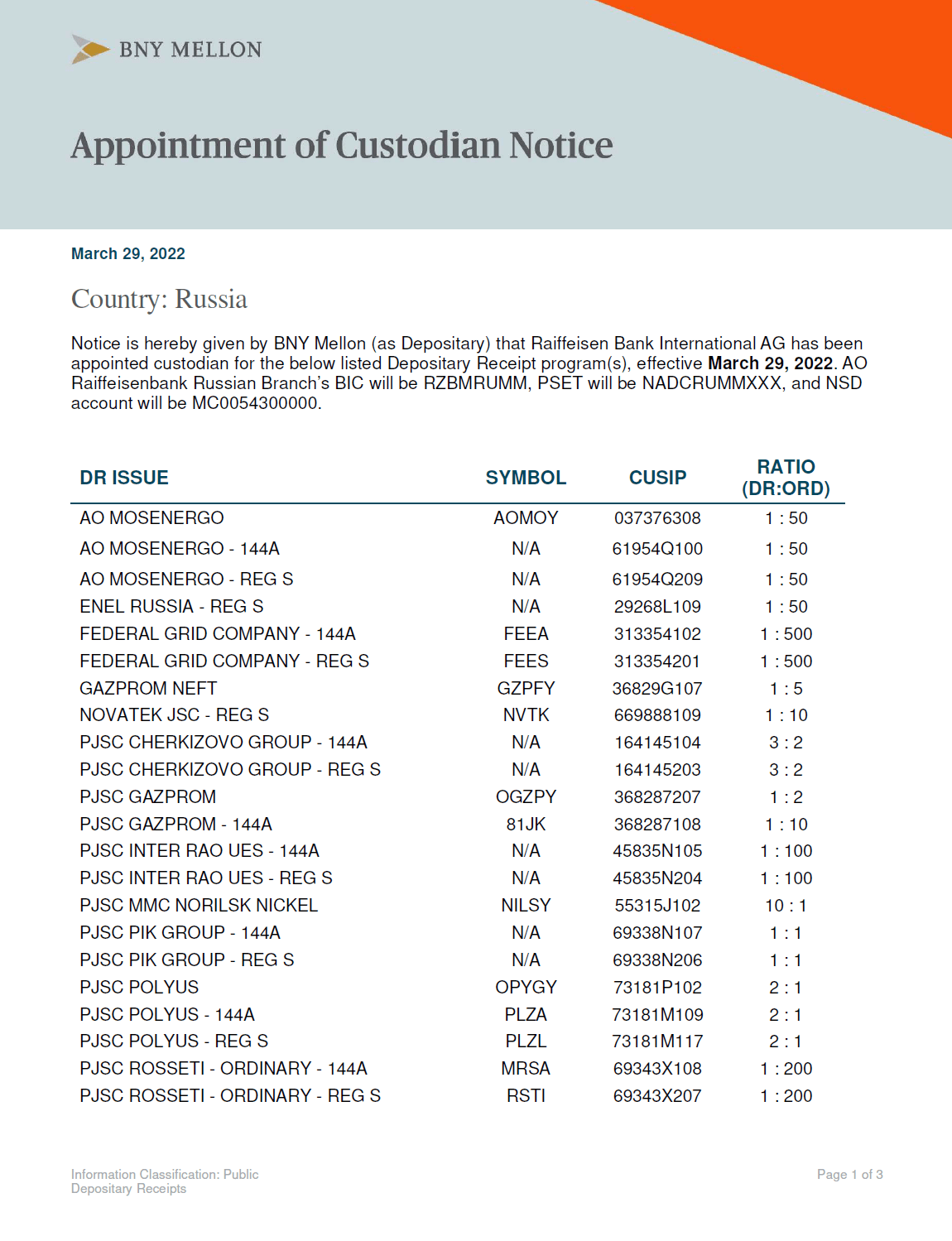

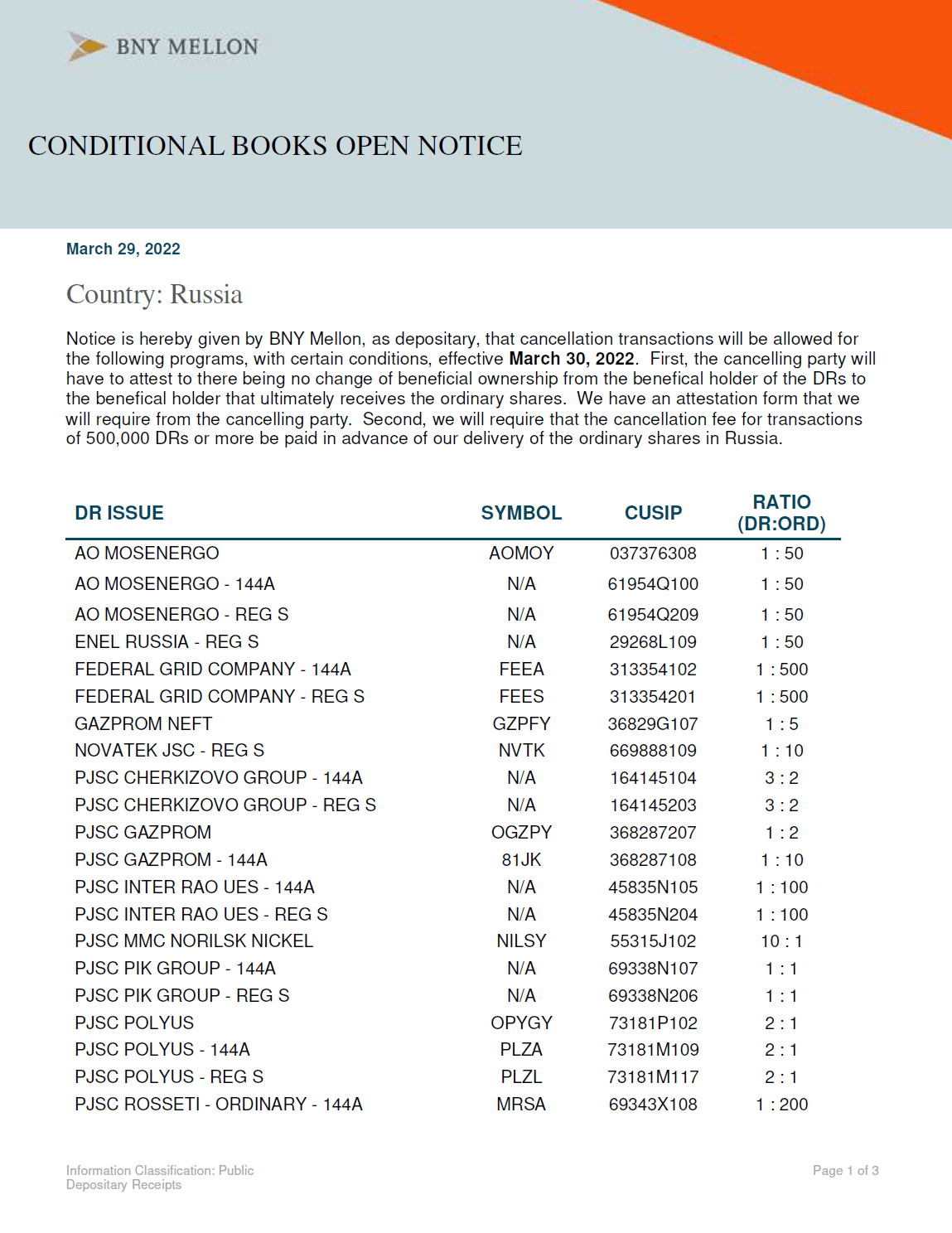

BNY Mellon, the depository for many Russian ADRs and other depository programs has offered to exchange ADRs for ordinary shares that trade on the Moscow Stock Exchange for a select group of companies. With this program, ADR holders can convert their ADRs to ordinary shares. Trading of all companies started on the local exchange this week. Below is the announcement at BNY Mellon’s site:

Notice is hereby given by BNY Mellon, as depositary, that cancellation transactions will be allowed for the following programs, with certain conditions, effective March 30, 2022. First, the cancelling party will have to attest to there being no change of beneficial ownership from the beneficial holder of the DRs to the beneficial holder that ultimately receives the ordinary shares. We have an attestation (link) form that we will require from the cancelling party. Completed attestations should be emailed to: [email protected]. *Note, parties cancelling through Euroclear will be asked to attest electronically and will not be required to submit the physical attestation. In addition, we will require that the cancellation fee for transactions of 500,000 DRs or more be paid in advance of our delivery of the ordinary shares in Russia via SPO or fedwire. Wire instructions can be obtained from [email protected].

Source: CONDITIONAL BOOKS OPEN NOTICE, BNY Mellon

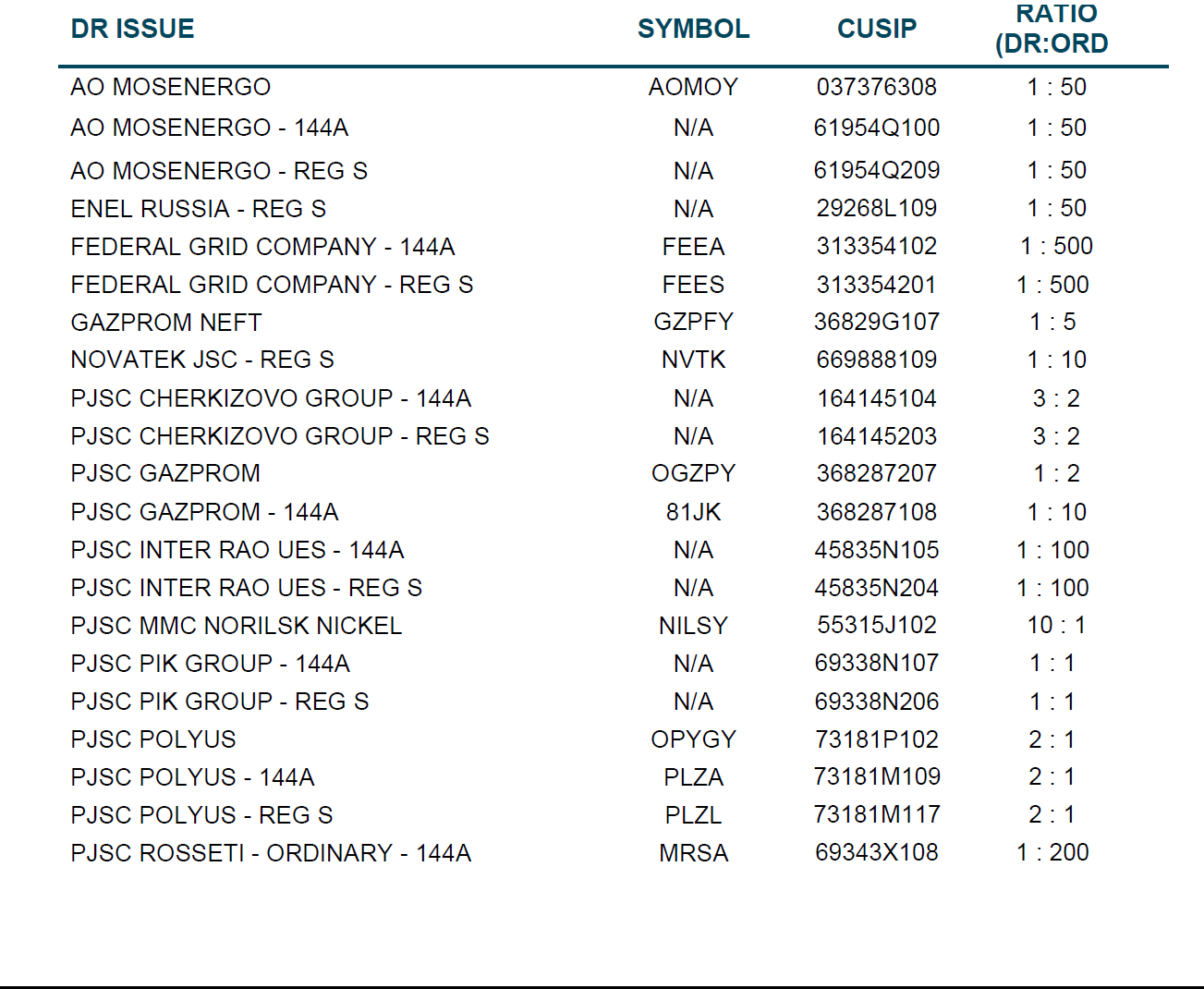

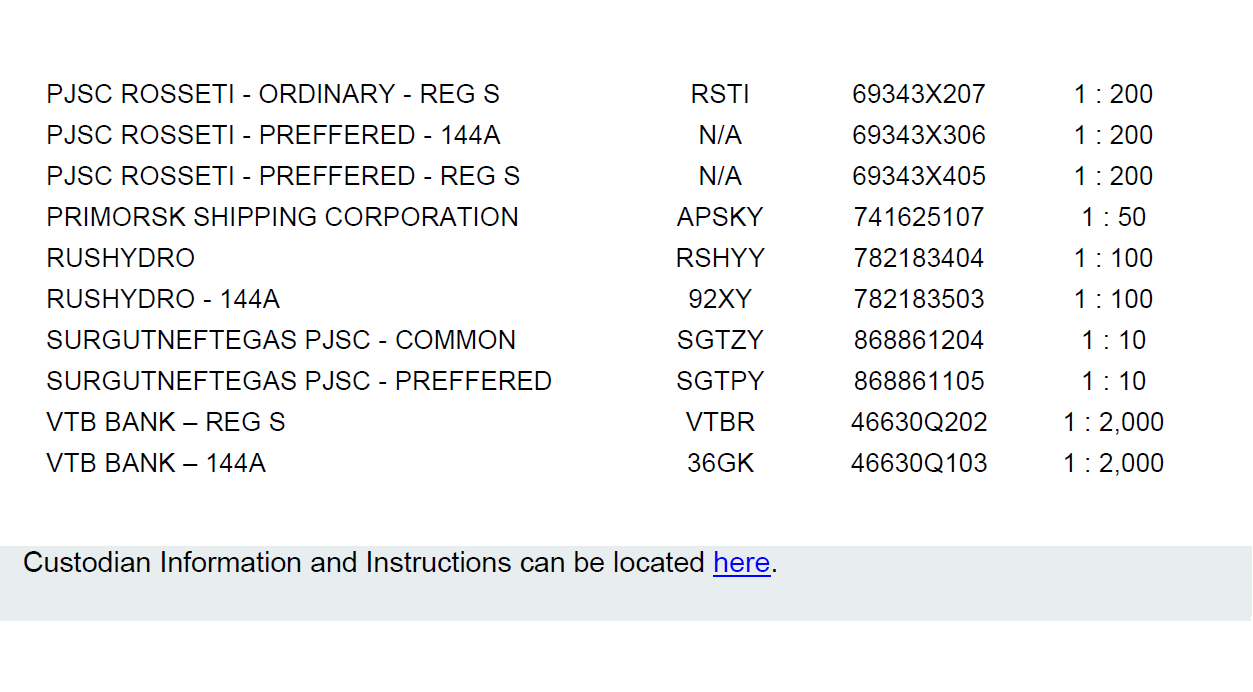

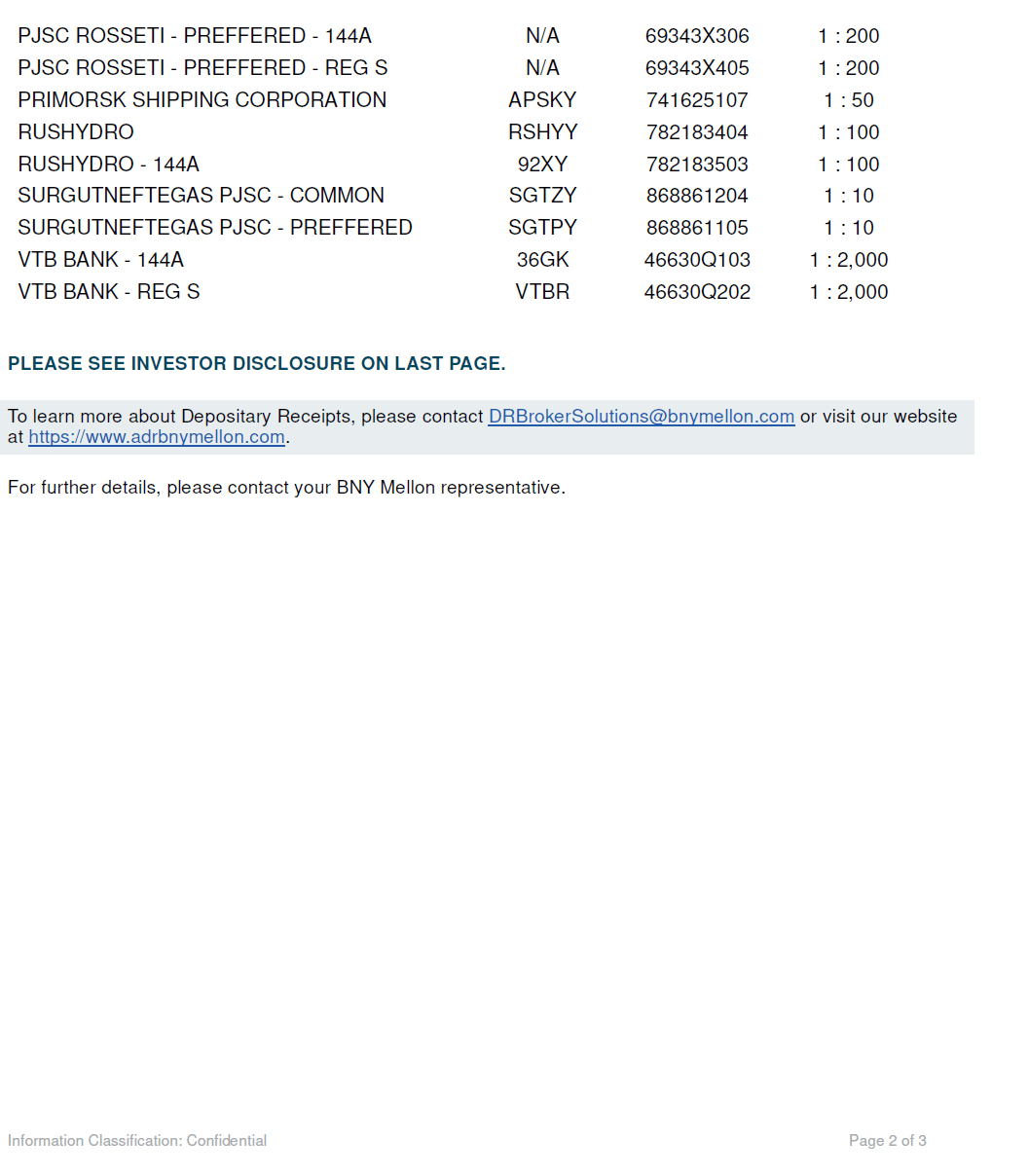

The following ADRs can be exchanged under this program:

Source: BNY Mellon

Some of the major depository programs that can be converted include:

Some useful questions and answers:

1.Is there any fees for the conversion?

Yes. There is a cancellation charged by BNY Mellon. For the exact amount reach out to them

2.Will BNY Mellon directly work with me to do this conversion?

Nope. You have to ask you broker to send the details to BNY Mellon. The depository will not work with retail investors for this process.

3.When this offer become effective?

This offer became effective March 30th, 2022

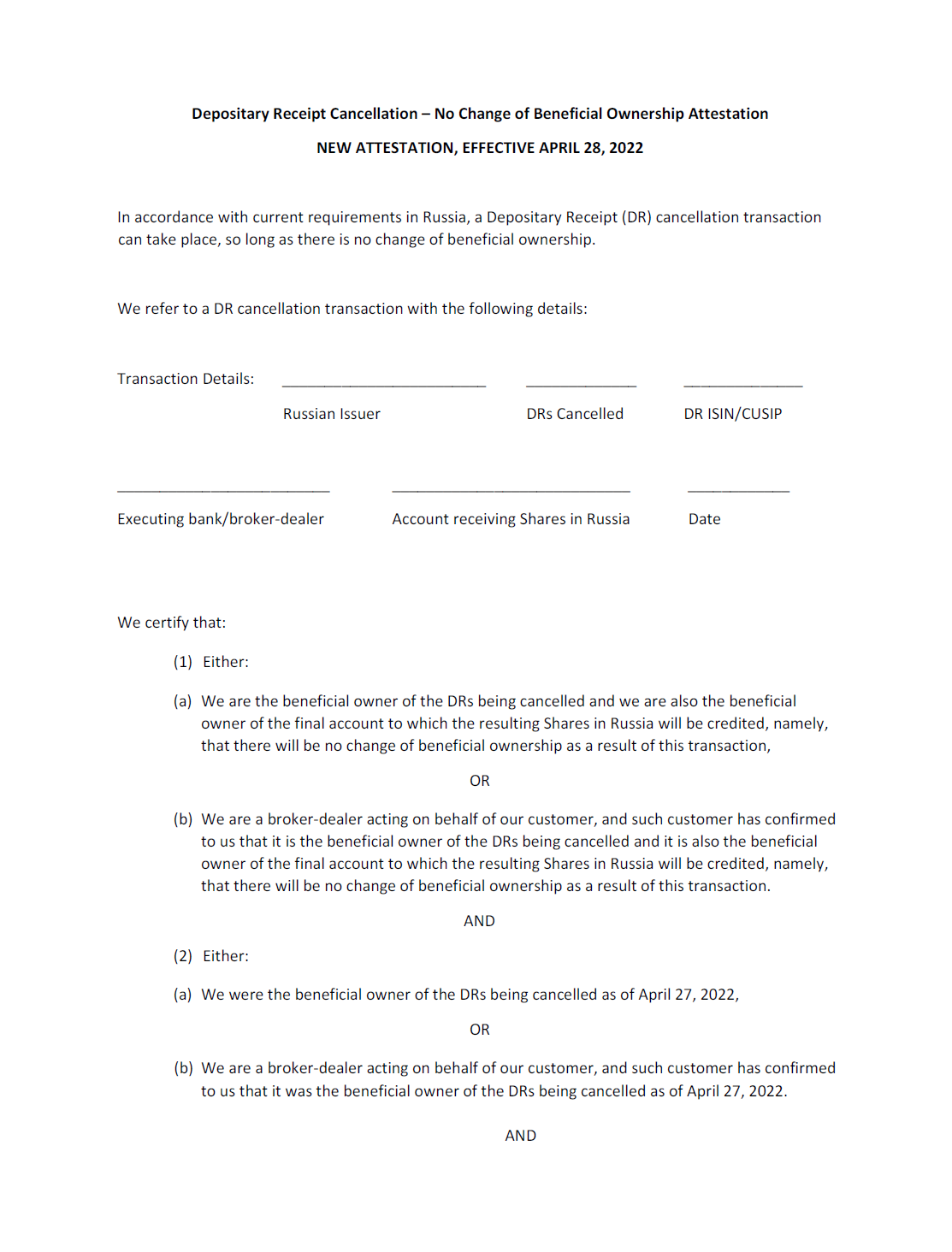

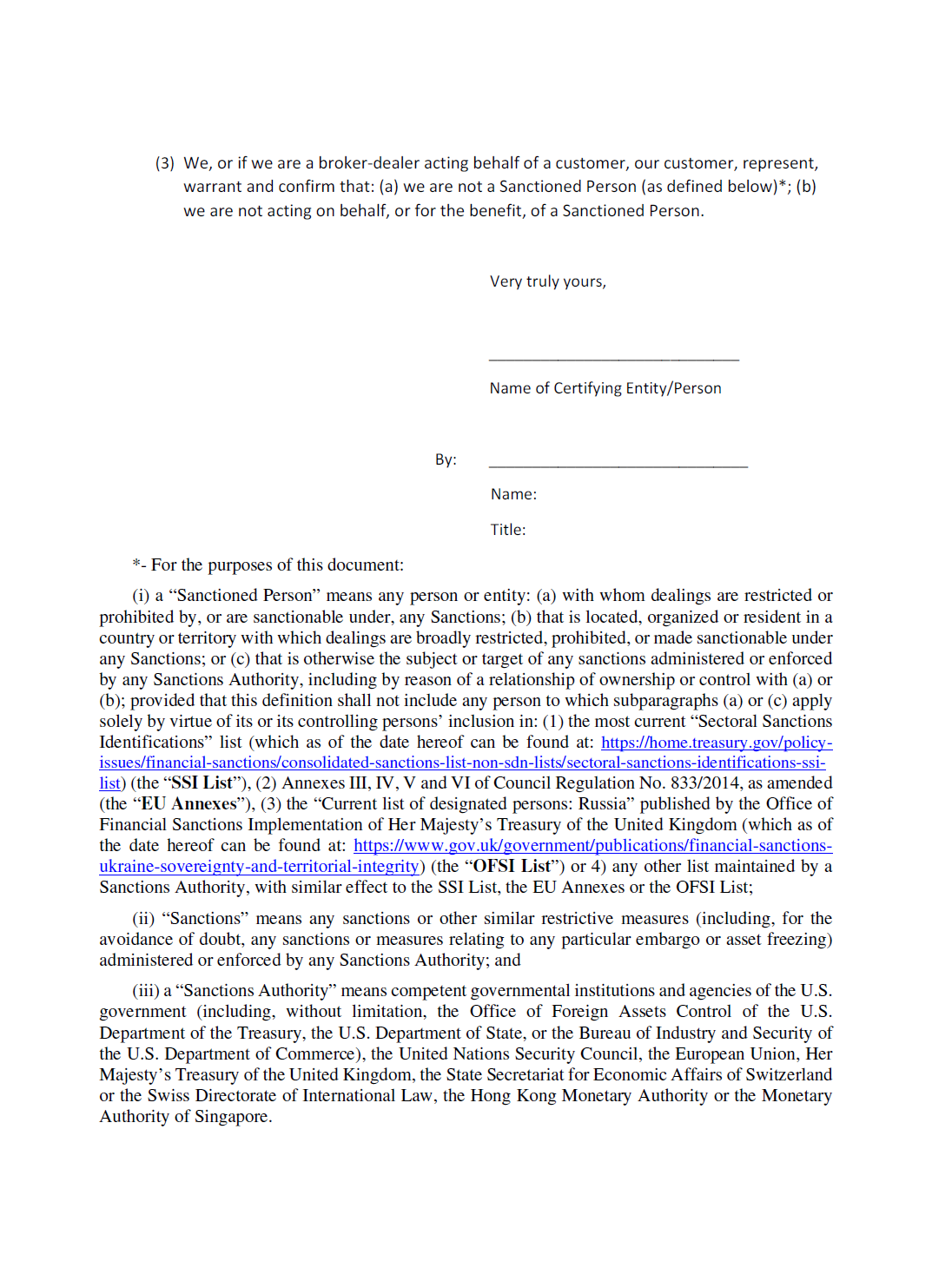

4.Is any attestation required for the ADR cancellation?

Yes. The ADR owner must attest that they would continue be the owner of the securities after the conversion. The following form must be submitted:

Revised Cancellation Attestation Form (4/28/22):

You can download the pdf form here.

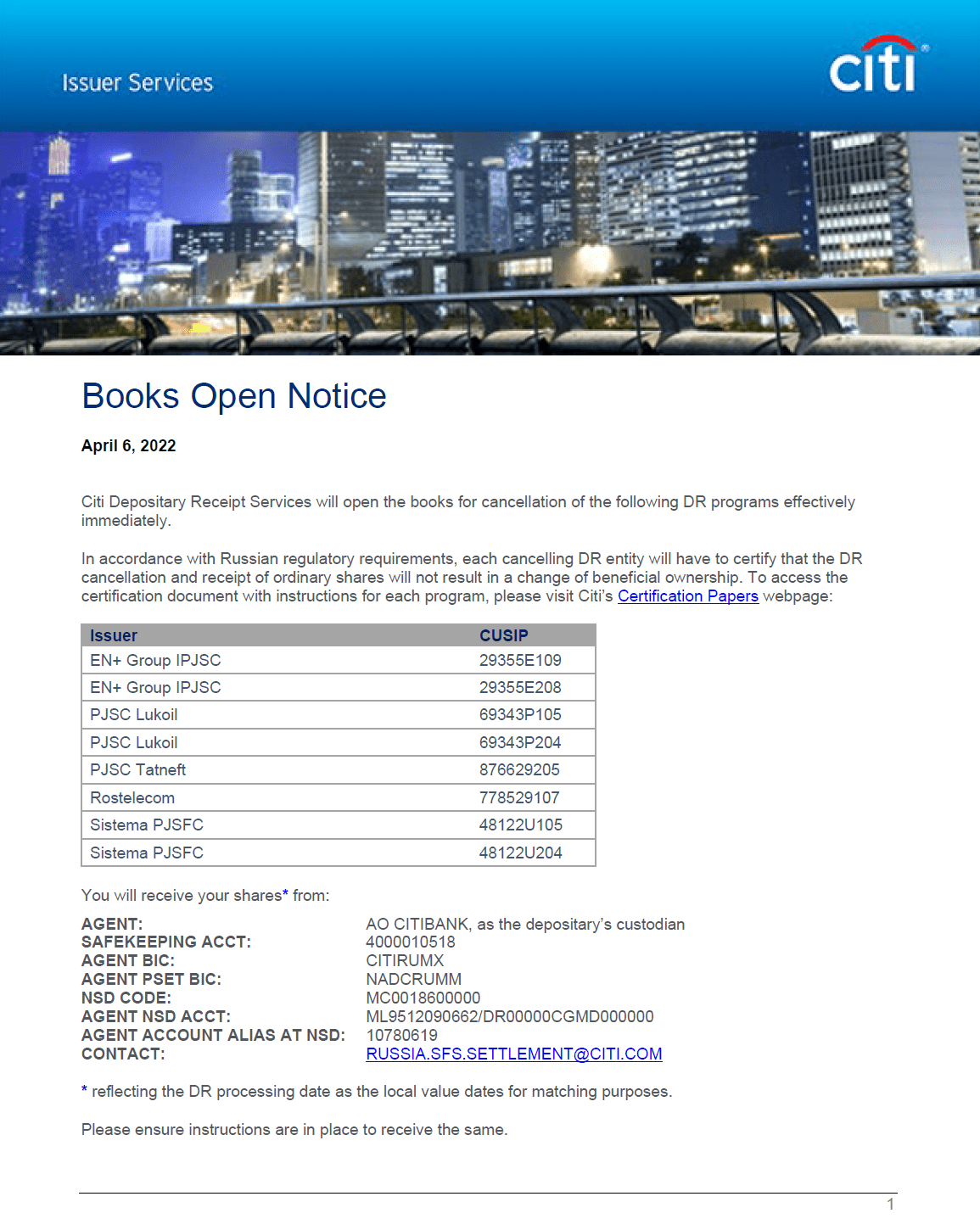

Update (4/11/22):

Citi Depositary Receipt Services – Books Open Notice:

Lukoil ADR(LUKOY) holders can reach out to Citi for the conversion to ordinary shares.

Click to enlarge

Source: Citi

Disclosure: No positions

Related articles:

- Putin signs decree to remove Russian stocks from overseas exchanges in huge blow to the nation’s billionaires, Yahoo Finance, April 19, 2022

- BNY offers to swap overseas shares in Russian groups with local stocks, FT

- Russian lawmakers vote for delisting of Russia-registered firms from foreign bourses, April 6, 2022 Reuters

- Exclusive: Russian companies, global banks could reap windfall from depositary receipt delisting, Reuters

- Moscow says firms’ foreign-listed depositary receipts will be forced to return to Russia, Reuters

- UPDATE 2-Russia mulls delisting Russian firms’ depositary receipts from foreign exchanges – IFX cites source, Reuters (Mar 29, 2022)

- To Up the Pressure, Washington Must Sanction Russian ADRs, National Interest

- Russia GDRs face extinction on sanctions and market closures, Risk,net

- The death of Russian companies’ depositary receipts, Intellinews (from 2018 but still useful)

- What to do if you want to eliminate Russian securities from your investment portfolio, FM

ADR Conversion to Ordinary Shares – articles:

- How to Convert ADR to Ordinary Shares, Zacks

- How to Convert ADR to Ordinary Shares, PocketSense