The Federal Reserve announced the launch of the third Quantitative Easing (QE) program (or the QE3 program) in September this year. This program involves the Fed buying bonds of agency mortgage backed-securities from the market for $40.0 billion per month. Earlier programs were called as QE1 and QE2. The current QE3 program differs from earlier programs in that it is open-ended and has no set duration or amount. QE programs were implemented not just in the U.S. but in the UK and other countries as well.

Here is a brief description of Quantitative Easing from the BBC:

What is quantitative easing?

Usually, central banks try to raise the amount of lending and activity in the economy indirectly, by cutting interest rates.

Lower interest rates encourage people to spend, not save. But when interest rates can go no lower, a central bank’s only option is to pump money into the economy directly. That is quantitative easing (QE).

The way the central bank does this is by buying assets – usually government bonds – using money it has simply created out of thin air.

The institutions selling those bonds (either commercial banks or other financial businesses such as insurance companies) will then have “new” money in their accounts, which then boosts the money supply.

Prior to 2008, QE had never been tried before in the UK.

Is this printing money?

These days the Bank of England does not have to literally print money – it is all done electronically.

However, economists still argue that QE is the same principle as printing money as it is a deliberate expansion of the central bank’s balance sheet and the monetary base.

QE programs artificially inflate prices of riskier assets such as stocks, housing prices, etc. By implementing the QE programs and keeping interest rates at rock bottom rates, the Fed expects Americans to invest in risky assets whose prices continue to be pushed up regardless of the fundamentals of the US economy. As interest rates on bank deposits remains at practically zero people looking for decent yields have no option but to invest in equities or other assets. Printing unlimited amount of money out of thin air inflate asset prices has other impacts such as rising inflation, depreciation of the US dollar even further, increasing the amount of outstanding public debt, etc. In addition to paper assets such as stocks and bonds, Quantitative Easing programs impact physical assets such as gold.

What is the impact of QE programs on gold prices?

In a recent research report CIBC World Markets states that the latest QE program sets the foundation for increases in gold bullion. From the CIBC report:

Click to enlarge

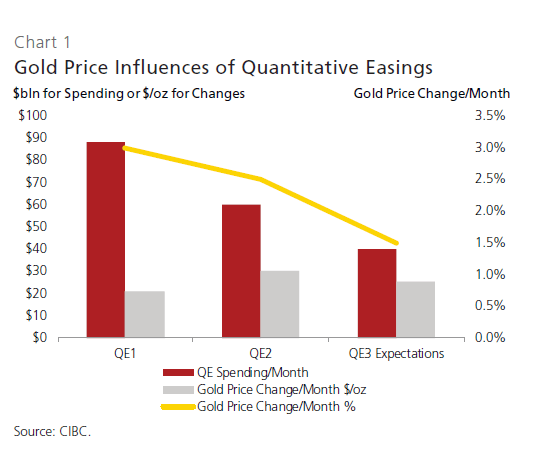

In looking at the prior quantitative easing events and equating them to QE3 nomenclature, QE1 injected US$88 billion per month while QE2 injected US$60 billion per month into the economy (Chart 1). Gold price movements during these periods were US$360/oz for QE1 and US$300/oz for QE2. On a per month basis, gains were US$21/oz or about 3% for QE1 and US$30/oz or about 2.5% for QE2. We would expect that QE3 will have a more muted impact compared to the first two stages of quantitative easing, although that assumption is likely to be complicated by events in Europe. It is our view, however, that when thinking of gold prices in US dollar terms, the actions in the US carry much more weight than those in Europe and, Therefore, any impacts of further bailouts of either Greece or Spain would have less effect on the US dollar gold price. The same may not be true for the euro gold price as recently it has hit an all-time high.

Source: A look to the future, 2013 Edition, CIBC World Markets

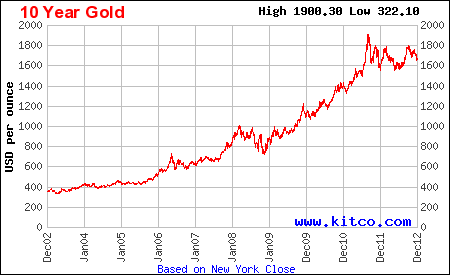

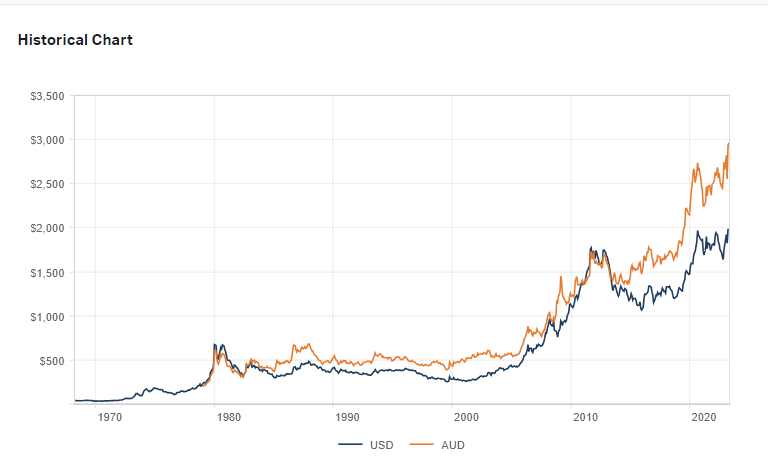

Today gold prices closed at $1,662.90/oz in New York. In the past five years, gold has had an incredible run reaching a record high of just over $1,900.00/oz last year. Since then gold prices have followed an inconsistent pattern. The dramatic rise in gold prices in the past few years can be attributed directly to the QE programs. Though equity market volatility and fears of prolonged recession played a part in gold price increases, the main reason is that investors fled to the safety of gold in order to protect themselves from the depreciation of the dollar.At the height of the global credit crisis, investors lost confidence not only of the equity markets but also about the future of the dollar. All these factors naturally led to the strong rise in gold prices. The 10-year gold price chart is shown below:

Click to enlarge

Source: Kitco

CIBC forecasts gold prices to reach US$2,000/oz in 2013.

As the Fed remains steadfast on inflating asset prices with the QE programs even if that debases the dollar more, the $2,000/oz gold price prediction may not be too far off the mark. Investors not looking for dividend income but are looking to invest in gold for diversification and other reasons discussed above may want to allocate some portion of their portfolios to gold. While ideally holding physical gold may be the option, most investors prefer to invest in gold via ETFs or gold mining stocks.

Related ETF:

SPDR Gold Trust ETF (GLD)

Disclosure: No positions