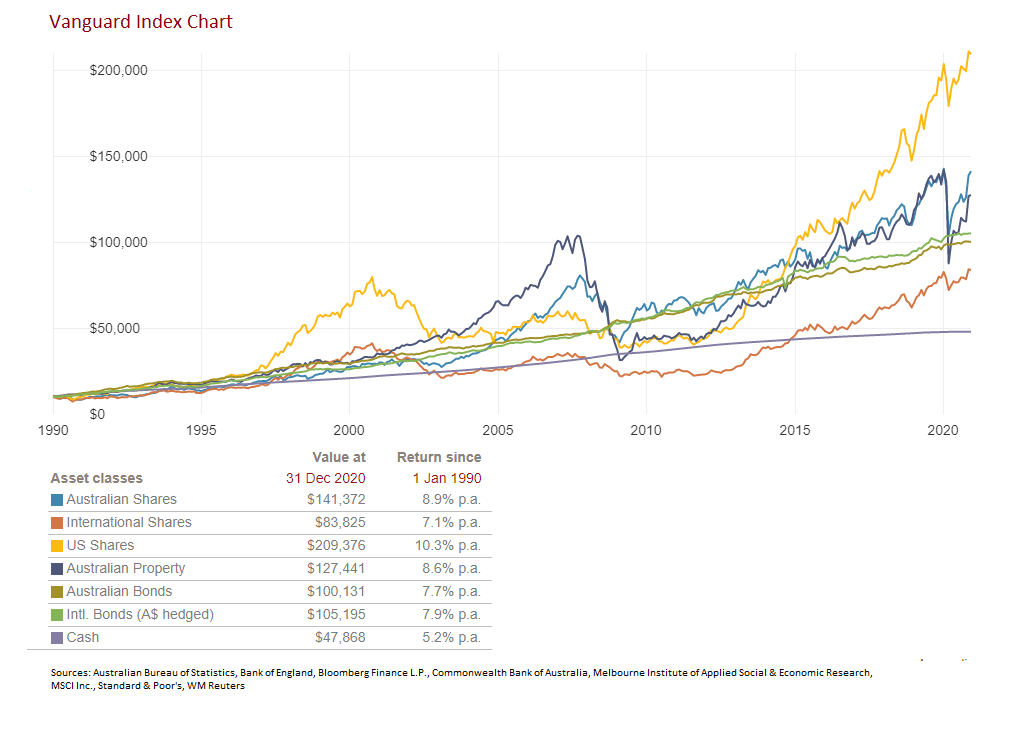

In order to be successful with investing in equities it is important to note that time in the market is more important than simply timing the market. Despite many ups and downs staying invested during all times is the wise strategy. Any investor that tries to get in and out of the market at opportune times is not wise. With that brief intro, the following chart from Vanguard Australia shows the need to be in the market:

Click to enlarge

Source: COVID crash: one year on, Vanguard Australia

An excerpt from the above article:

Looking back over the past 30 years, it also shows that all asset classes have provided consistent growth over time, and some much more than others.

Taking the Australian share market, for example, up until the end of December it had delivered an average return of 8.9 per cent per annum over three decades, assuming all distributions had been fully reinvested.

Using a base amount of $10,000 invested back in 1990, a person holding Australian shares through an ETF or managed fund tracking the whole Australian market would have turned their initial holding into more than $141,000. That’s a total return of well over 1,000 per cent, excluding any fees, expenses and taxes.

A $10,000 investment into U.S. shares over the same time frame would have returned 10.3 per cent per annum and be worth more than $200,000 using the same assumptions as above.

Even cash, the lowest-returning asset, would have delivered a total return of 5.2 per cent per annum and turned $10,000 into almost $50,000 with the benefit of compounding returns.

That’s the ultimate power of being focused on time in the markets, instead of trying to time markets.

More recently the dramatic decline in market in March last year and the following spectacular recovery is another classic example of why staying in the market is better strategy.

Related ETFs:

Disclosure: No Positions