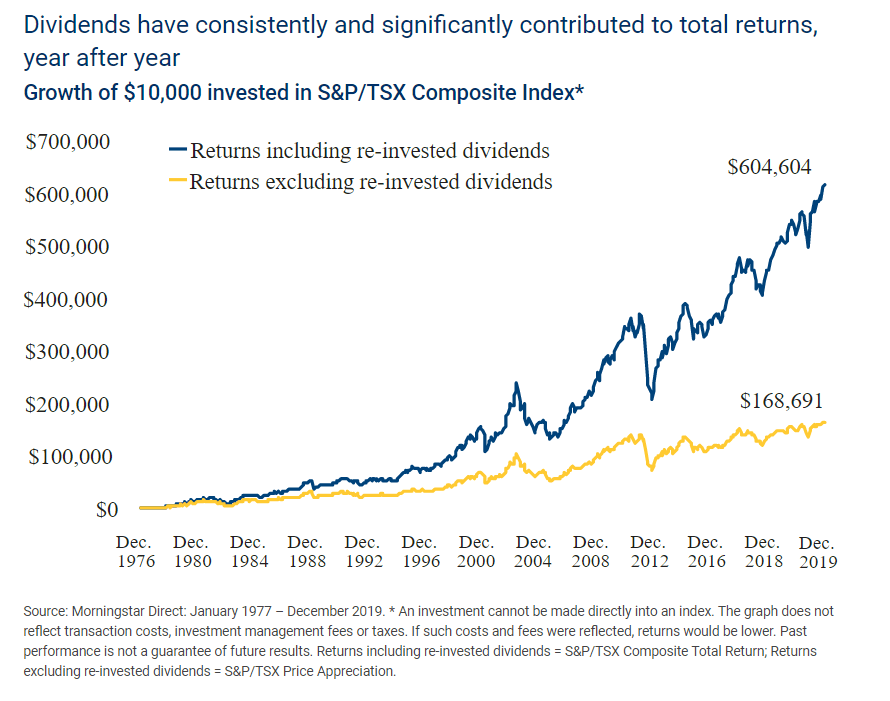

Dividends are important part of a total return of an equity investment. The contribution of dividends to the overall total return cannot be under-estimated. Even if the dividend yields are small over time returns will be amplified many times over due to the power of compounding and dividend reinvestment. As with other equity markets, dividends play a key role in the Canadian equity market also.

The following chart shows the growth of $10,000 invested in the S&P/TSX Composite Index from 1976 to 2019:

Click to enlarge

Source: Morningstar Direct: January 1977 – December 2019. * An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. Returns including re-invested dividends = S&P/TSX Composite Total Return; Returns excluding re-invested dividends = S&P/TSX Price Appreciation.

Note: The amount shown above is Canadian $

Source: The power of dividends, RBC Asset Management

A couple of interesting observations from the article at RBC Asset Management:

- Dividend-growing stocks have returned a compounded annual return of 11.10% from 1986 to 2019 relative to the 5.90% return for the TSX Composite Index and non-payers with just 0.40%.

- Dividend-paying stocks have low volatility over time.

- Over the last 42 years, dividends have contributed an average of 3.2% per year to the S&P/TSX Composite Total Return Index, representing approximately one third of the average annual total return.

The key takeaway is that by investing in dividend stocks and then by reinvesting the dividends investors can boost the returns on the investment substantially over many years.