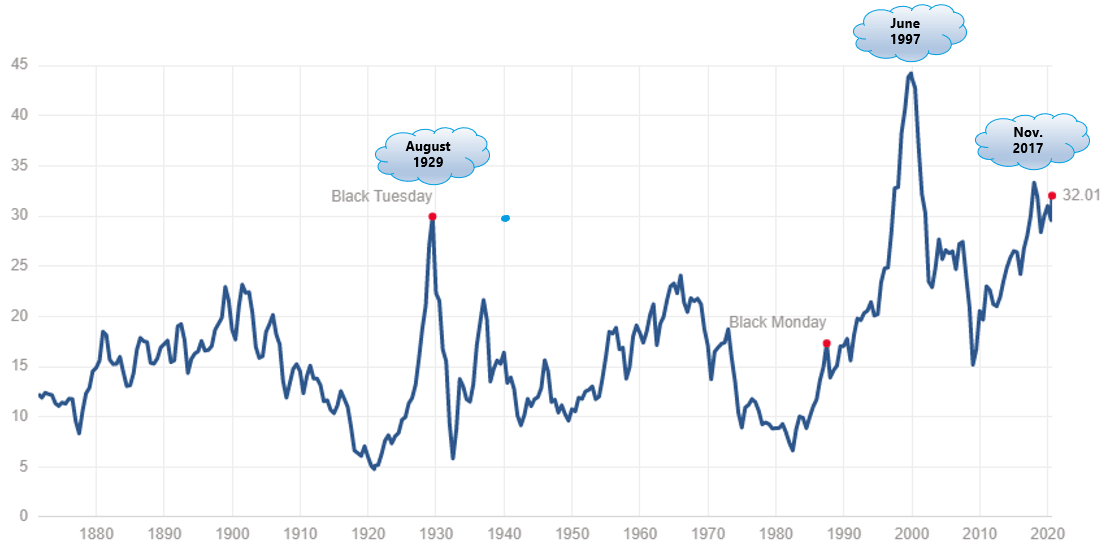

U.S. stocks have performed extremely well so far this year until the recently one day big decline. However rising stock prices have also led to the expansion of the Price/Earnings ratio. According to Niels Clemen Jensen of Absolute Return Partners, US stocks are currently trading at a massive 32x earnings even with cyclical adjustment. Writing in the latest edition of the Absolute Return Newsletter, he noted in the past 150 years, they have been this high only three times as shown in the chart below.

Exhibit 7: S&P 500 CAPE ratio since 1872

Source: multpl.com

Below is an excerpt from the piece in the newsletter:

Past experience suggests that when the CAPE ratio is above 20x, one should switch the amber warning light on. When it goes above 25x, the amber light should turn red and, when it exceeds 30x, everybody should run for the hills. With the CAPE ratio now at 32x, now is not the time to take much risk in equities. That is at least the case in the US. Elsewhere, valuations are less steep, so you cannot necessarily draw the same conclusion all over the world, although a bear market in the US will have a meaningful impact on equities elsewhere.

Source: The Sad Case of TINA, Absolute Return Newsletter – September 2020

Caution is warranted with investing in US stocks due to the high multiples. Certain sectors and companies have very high P/E ratios as investors assume the best case scenario.