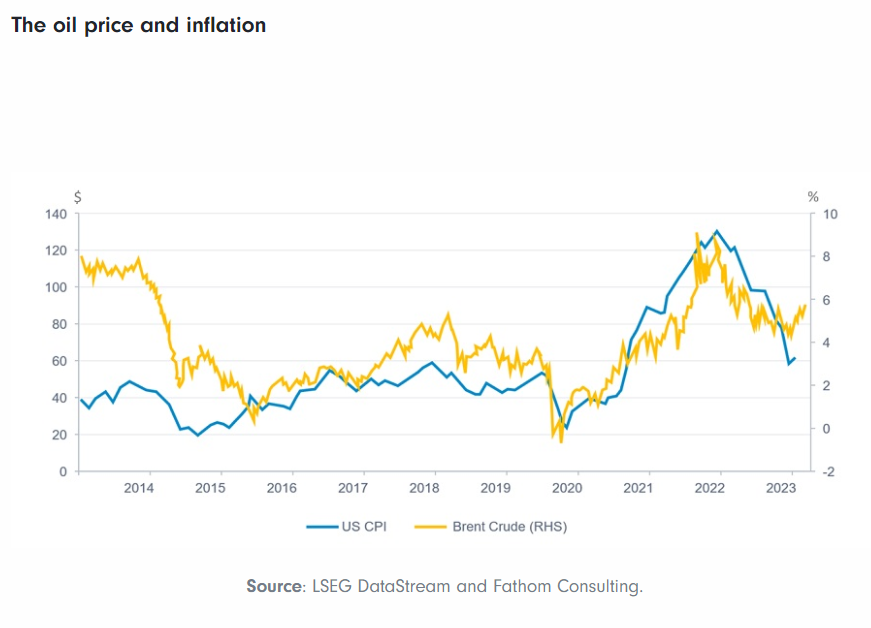

Oil prices have soared in the past year with some experts predicting $100 or $80 per barrel this year. The WTI Crude Oil closed at $71.01 for a rise of over 48% in one year. As oil prices rise so do the stocks of most oil producers.

Some of the exchange-listed foreign oil producers have soared by more than 25% so far this year. The table below shows the year-to-date price returns of foreign oil ADRs:

| S.No. | ADR Name | Ticker | Stock Price (as of May 18, 2018) | Year-to-Date Change(%) | Country |

|---|---|---|---|---|---|

| 1 | Petroleo Brasileiro-Petrobras | PBR | 16.48 | 57.24% | Brazil |

| 2 | Ecopetrol | EC | 21.84 | 47.71% | Colombia |

| 3 | China Petroleum & Chemical | SNP | 102.08 | 40.88% | China |

| 4 | China National Offshore Oil-CNOOC | CEO | 179.17 | 26.73% | China |

| 5 | Statoil | STO | 27.32 | 26.70% | Norway |

| 6 | Eni | E | 39.08 | 17.08% | Italy |

| 7 | PetroChina | PTR | 77.94 | 16.77% | China |

| 8 | TOTAL | TOT | 63.99 | 15.86% | France |

| 9 | BP | BP | 47.19 | 12.73% | United Kingdom |

| 10 | Royal Dutch Shell - B Shares | RDS.B | 76.2 | 11.04% | United Kingdom |

| 11 | Sasol | SSL | 37.93 | 10.76% | South Africa |

| 12 | Royal Dutch Shell - A Shares | RDS.A | 73.33 | 8.87% | United Kingdom |

| 13 | YPF | YPF | 20.07 | -12.31% | Argentina |

| 14 | Petrobras Argentina | PZE | 11.26 | -16.63% | Argentina |

| 15 | Transportadora de Gas del Sur | TGS | 17.81 | -20.06% | Argentina |

| 16 | CGG | CGG | 2.9 | -35.12% | France |

Note: Returns shown above are based on price only (excluding dividends).

A few observations:

- The best performer in the above list Brazilian oil major Petrobras(PBR). After a major corruption scandal the stock fell from over $60 a few years and now is on the path to recovery.

- Colombia’s EcoPetrol(EC) used to be another hi-flier that fell back to earth to trade at below $10 a share. Currently the stock on a nice upward trajectory and as tensions in middle east increase oil producers in other regions rise faster. Ecopetrol paid out a decent dividend earlier this year and could double from current levels by next year.

- Compared to the performance of emerging market oil producers the developed market companies have not performed very well. For example, Italian oil producer Eni(E) is up 17% and France’s Total(TOT) has shot up by only 16% year-to-date.

For US oil and gas producers check out the following links:

- The Complete List of Oil and Gas Producers Trading on the NYSE

- The Complete List of Oil and Gas Producers Stocks Trading on NASDAQ

Disclosure: Long EC, PBR