Gold is always a better investment than gold mining companies. This is because unlike physical gold gold miners involve more risk. For example, miners are exploration firms who do no know if and how much gold can be extracted from the ground. Even if gold is mined efficiently prices of the precious metal can be volatile. And of course mining operations are not cheap in any way either. I have noted these points before on this blog and have always suggested that investors are better off going with gold than gold miners.

I recently came across an article at MoneyWeek that discussed this very topic. The following is an excerpt from the piece:

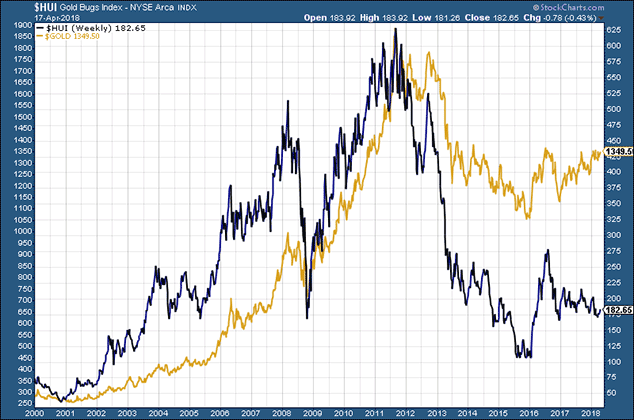

This first chart shows the relative performance of the two since 2000 overlaid. Gold is in gold and the miners are in dark blue.

You can see that over the last 18 years gold has gone from below $300 an ounce to $1,350, or thereabouts, yesterday. The HUI has gone from just below $75 to $182. So the HUI is up around 150%, while gold is up around 350%.

In terms of relative performance, in short, gold has annihilated the miners.

Miners are supposed to provide leverage to the gold price. That is why one speculates in them. If gold rises, say, 20% or 30%, you should be looking at at least a 50% gain in the mining company.

After all, you are taking on the additional risk of buying a mining company – the risk of the competence of the management, the political risk, the operational risk – and the compensation for that risk is the reward of greater gains.

Except that palpably has not happened. You would have been far better off just buying the metal. Far less risk; far greater gain.

Source:Why gold is a better bet than gold miners by Dominic Frisby, MoneyWeek

The full article is worth a read for gold investors.

Related ETF:

- SPDR® Gold Shares Trust (GLD)

Disclosure: No Positions