Gold is an important asset class that investors should not avoid. Though gold does not produce income such as dividends from stocks for example, they offer many other advantages. For example, gold has low co-relation to equities and traditionally offer downside protection to a diversified portfolio during adverse market conditions. When equity markets crash investors tend to flock safe-have assets such as gold.

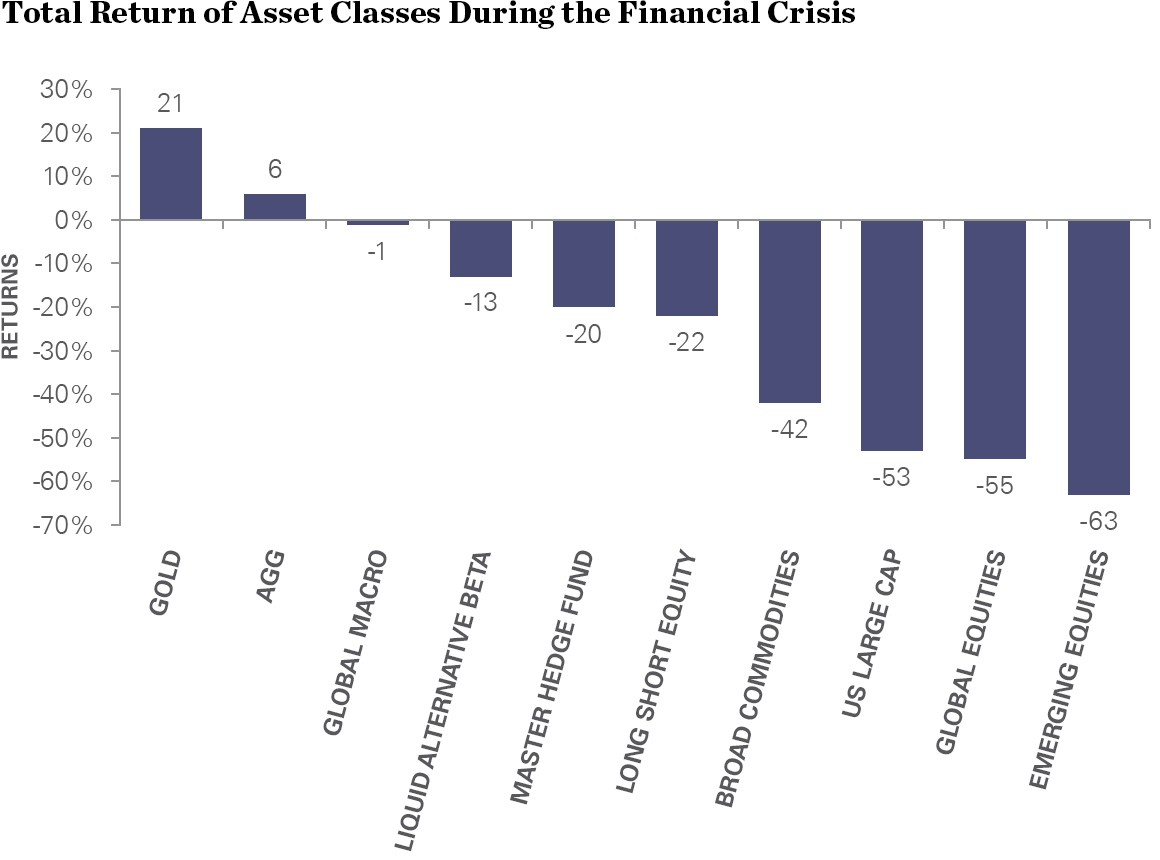

During the recent global financial crisis, equity markets worldwide fell in tandem. However gold offered protection and yielded positive return for investors in the 2007-09 period as shown in the following chart:

2. Protection in a downturn

Gold has historically been used to provide potential tail risk mitigation during times of market stress, as it has tended to rise during stock market pullbacks. As shown below, gold delivered competitive returns and outperformed other asset classes during the 2007-2009 Global Financial Crisis. Many asset classes fell in tandem, but gold’s performance was positive. In addition, gold has delivered competitive returns and outperformed other asset classes during a number of other similar Black Swan events.

Click to enlarge

Source: The Role of Gold in Today’s Multi-Asset Portfolio, SPDR Blog

For some of the other advantages of owning gold please read the above-linked article.

Earlier:

- Why You Should Own Gold in a Well-Diversified Portfolio: Infographic

- Is Gold the Best Asset Class for All Economic Conditions?

- A Historical Gold Prices Chart, Events and Results

Related ETF:

- SPDR Gold Trust (GLD)

Disclosure: No Positons