Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Compounding simply implies earning interest on interest to multiply one’s cash savings. The power of compounding works well only when the interest rate offered on a savings account is decent. While savings/checking accounts earned 5% of even more in the past, for many years now it hardly earns anything.

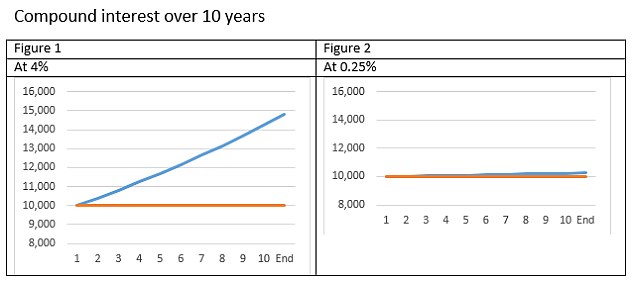

The following chart from an article at This is Money, UK site shows the impact of compounding on an interest rate of 4% vs 0.25%:

Click to enlarge

Source: Has compound interest lost its magic? How saving is NOT the secret to growing cash when rates are so low, This is Money

From the above article:

Let’s do the maths. As an example, let’s say you put £10,000 into a deposit account, with 0.25 per cent interest, accrued daily and paid, and therefore compounded, annually. This is fairly typical of high street deposit accounts.

After ten years, you would have received £252.83 in interest. Almost all of this, £250, is the simple interest, that is, interest before compounding. The total effect of compounding, the interest paid on interest, is £2.83. [Figures 1 & 2]

It is a staggeringly small amount. It is telling us that at current interest rates, saving in the traditional sense, as a means to accumulate capital, is redundant.

Fortunately savers who are willing to take risk have options to earn higher returns than simply stashing their savings in banks. Stocks and bonds are two options where savers can put their money to work. For example, high dividend-paying stocks offer a better alternative than letting the money sit in a savings or checking account. Moreover due to the adverse effect of inflation, a saver earning no or tiny interest rates on savings actually loses money over time.