Dividend yields and payout ratios vary across countries. In the developed world, most countries other than Japan and the US tend to have good dividend yields. In emerging markets, certain countries like Chile, Taiwan have high yields while places like South Korea, India, China, etc. have low yields.

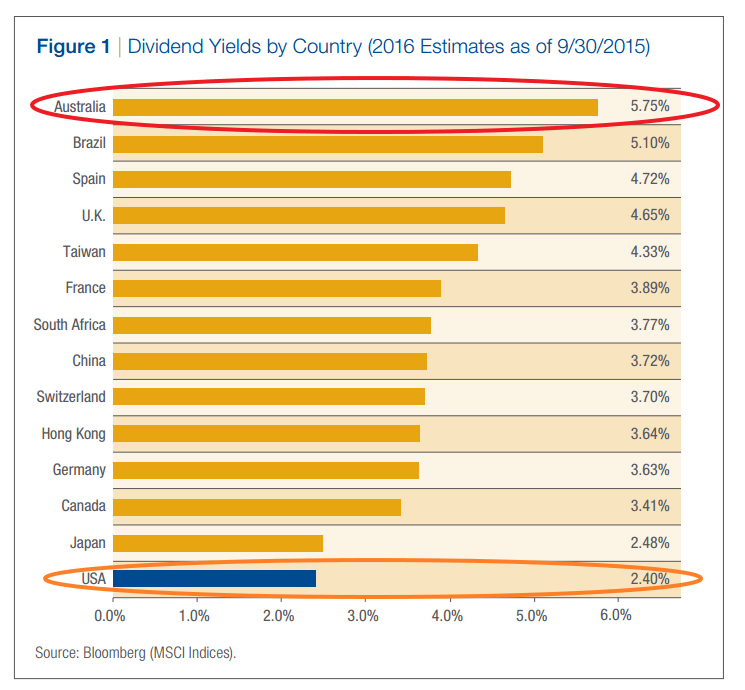

The chart below shows the dividend yields by country as of September, 2015 based on MSCI indices:

Click to enlarge

Source: Investing in Retirement Using a Global Dividend Income Strategy, Thornburg Investment Management

Australian firms’ yields are nearly double that of the U.S. firms.

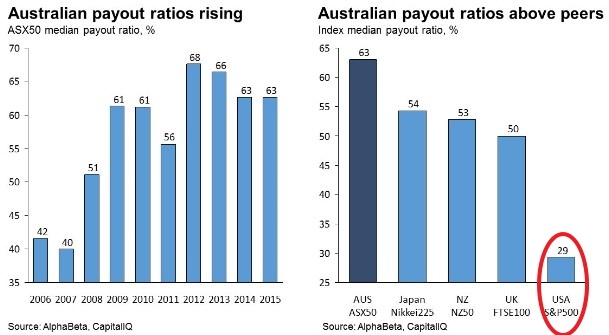

It is not just that the dividend yields are high in Australia. The payout ratio is also the highest in the world. The following chart shows the payout ratio of Australia and select developed countries:

Click to enlarge

Source: Alpha Beta Strategy and Economics via Australia’s dividend doom loop, Macro Business

Australia firms are now paying 63c in every dollar earned to their shareholders in the form of dividends. This is up from 40c a decade ago.

Compared to other countries, Australian companies pay a higher share of their earnings to shareholders. For example, top British firms pay out just 50c in every dollar earned. U.S. firms listed on the NYSE pay out a pathetic 29c for every dollar.

The takeaway here for US income investors is that they should beyond the borders for better income stocks that simply sticking with American firms. As most US firms are not growing greatly and still continue to withhold more than three-fourths of every dollar in profits, it is wise to expand one’s horizons and invest in high-quality foreign stocks.

Currently 11 Australian companies are listed on the NYSE and more than 210 trade on the OTC market. In addition, many ETFs and mutual funds also provide access to the Australian equity market.