The S&P is down 0.97% year-to-date (YTD).Canada’s benchmark S&P/TSX Composite Index on the other hand has declined by 10.6% YTD making it one of the worst performers in the developed world.

The rout in commodity prices and crude oil prices has spooked global investors. These investors have taken a negative view of Canadian equity market.

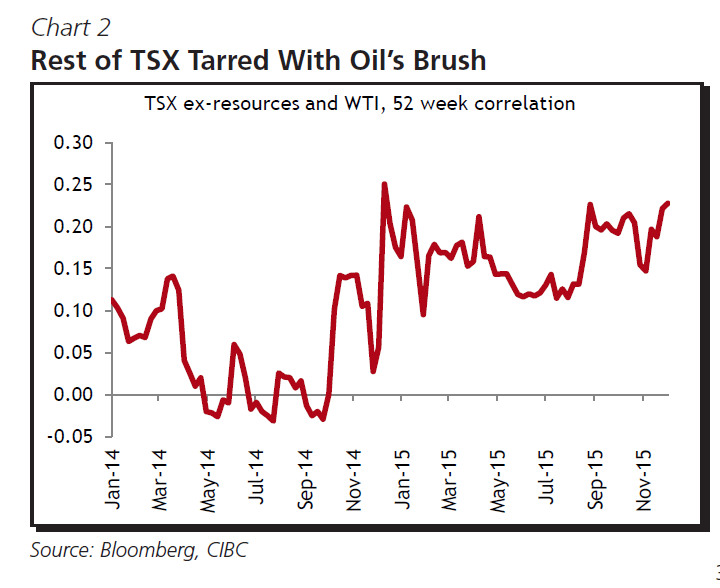

The following chart shows the correlation between oil prices and non-resource stocks:

Click to enlarge

Source: A Not-So-Sweet ‘16, CIBC

The chart shows that there’s been a rising correlation between oil prices and non-resource stocks which include stocks that actually benefit from lower oil prices or the drop in the C$ that oil prices have helped engender.

According to the author Avery Shenfeld, this chart shows that investors are starting to see Canada as another Saudi Arabia. He also noted Canadian stocks to be attractive from a valuation standpoint. From the report:

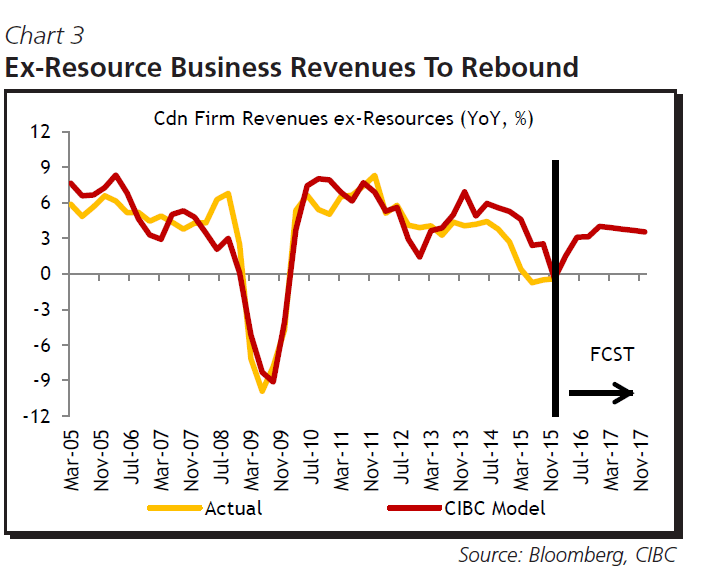

That’s a sign that global investors are starting to see Canada as another Saudi Arabia, a gross overstatement. So too has been the widening of the PE discount on TSX non-resource stocks relative to their S&P 500 counterparts that trade at a multiple some three points higher. Our model, driven off Canadian and US growth, interest and exchange rates, points to a return to moderate gains in non-resource corporate revenues in 2016 (Chart 3). Although some importers will see a margin squeeze, more broadly, non-resource sector firms should see at least some margin improvement on sales generated in US dollars against costs in Canadian dollars. Resource stocks need a better global backdrop, but the rest of the TSX now looks attractive from a valuation perspective.

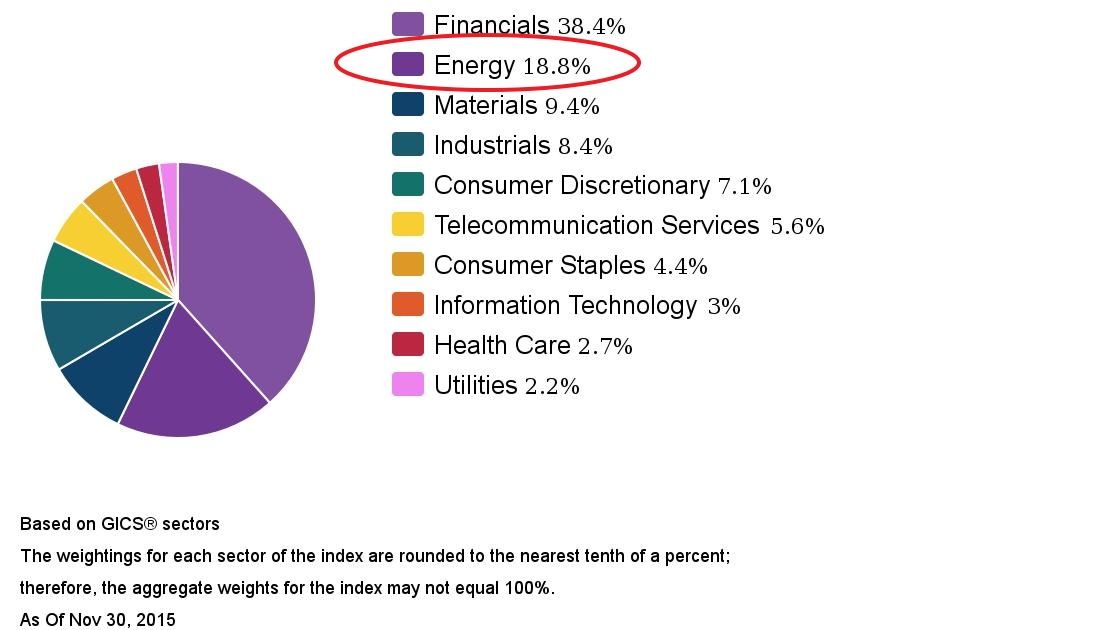

I agree with Avery’s assessment. Canada is more than just oil and other commodities. The chart below shows the sector composition of the TSX Composite:

Click to enlarge

Source: S&P

Energy constitutes only about 19% of the index. However investors not only sold energy names but also financials and others. With respect to financials, investors fear banks’ exposure to the energy industry. But this fear may be unfounded. Though banks have exposures to energy sector, they are well diversified and a bust in the energy sector is not going to derail them completely. So investors with a long-term view can consider adding non-energy Canadian stocks at current levels.

Some of the Canadian stocks that offer long-term opportunities include: Bank of Montreal (BMO), Bank of Nova Scotia (BNS), Royal Bank of Canada (RY), Toronto-Dominion Bank (TD), Canadian National Railway Co (CNI), TELUS Corp (TU), BCE Inc (BCE), etc.

Disclosure: BMO, BNS, EY, TD, CNI