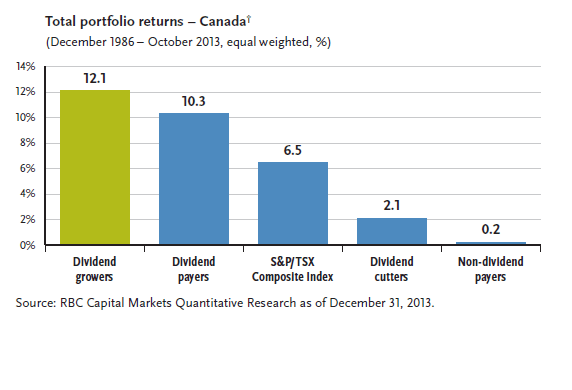

Dividend-paying stocks generally yield better returns than non-dividend payers in the long run. However companies that increase their dividend payments consistently over the years perform even better in terms of total return than dividend payers.

The following chart shows that dividend growers were the best in total returns for the period shown from a Canadian market perspective:

Click to enlarge

Source: Earning Dividend Income Just Makes Sense, AGF Management Limited

Note: The returns shown are based on the domestic market (C$).

Ten Canadian dividend stocks are listed below to consider:

1.Company: Bank of Nova Scotia (BNS)

Current Dividend Yield: 3.65%

Sector: Banking

2.Company: Bank of Montreal (BMO)

Current Dividend Yield: 4.06%

Sector: Banking

3.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 3.77%

Sector: Banking

4.Company: Toronto-Dominion Bank (TD)

Current Dividend Yield: 3.47%

Sector: Banking

5.Company: Suncor Energy Inc. (SU)

Current Dividend Yield: 2.18%

Sector: Oil & Gas

6.Company: Canadian National Railway Co (CNI)

Current Dividend Yield: 1.51%

Sector: Industrials

7.Company: Canadian Natural Resources Limited (CNQ)

Current Dividend Yield: 2.02%

Sector: Oil & Gas

8.Company: Enbridge Inc. (ENB)

Current Dividend Yield: 2.70%

Sector: Oil & Gas

9.Company: Manulife Financial Corporation (MFC)

Current Dividend Yield: 2.60%

Sector: Insurance

10.Company: Canadian Pacific Railway Ltd. (CP)

Current Dividend Yield: 0.76%

Sector: Industrials

Note: Dividend yields noted above are as of June 6, 2014. Data is known to be accurate from sources used. Please use your own due diligence before making any investment decisions.

Disclosure: Long BNS, BMO, CNI, TD and RY