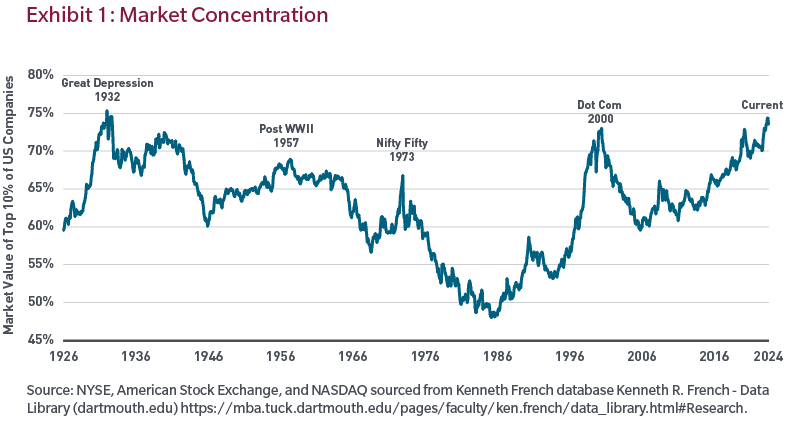

The concentration in the US equity market has been running relatively high for the past few years. I have written many times on this topic as can be found here and here and here. Most of the time, I have discussed the concentration using the S&P 500 as the benchmark. However I came across an article recently that showed the market concentration extends to all US stocks and that the level of concentration is reaching historic peaks. For instance, the current concentration levels exceed the dot-com, nifty-fifty, post World War II eras and is heading towards the Great Depression era peak. This is indeed surprising.

Click to enlarge

Source: What performs best after peaks in market concentration?, by Benjamin R. Nastou, Derek W. Beane, Jonathan Perlman at MFS Investment Management, Australia

I agree with the authors that high concentration does not mean a major decline is coming to the markets but it is wise to pay attention to such facts and make one’s investment decisions accordingly.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF(VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions