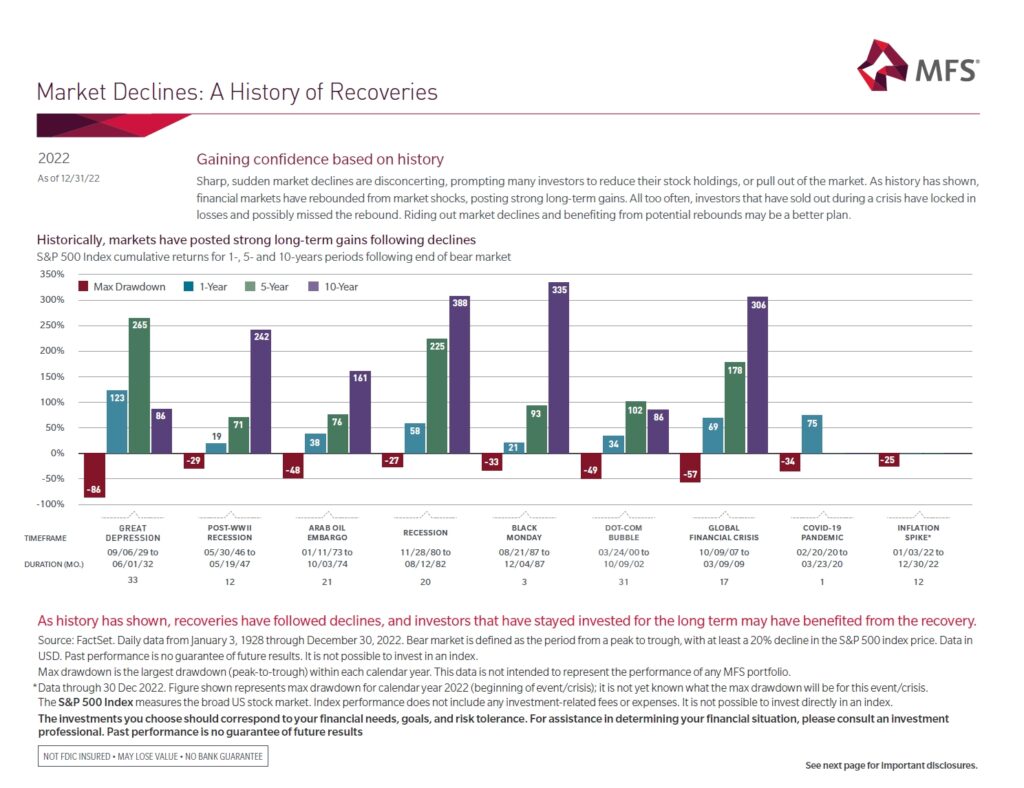

Market declines are common in equity markets. Stocks do not always go up forever. Bull markets are followed inevitably by bear markets and vice versa. They key point for investors to remember is that when stocks decline it is important to stay the course and not bail out. Unless absolutely necessary it is never a good idea to liquidate stocks during bear markets and move to cash. In fact, selling at huge losses only leads to missing out on huge upward moves which is often sharp and dramatic.

The following chart shows the major bear markets in the US markets and the strong recoveries that followed:

Click to enlarge

Source: Market Declines: A History of Recoveries, MFS

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions