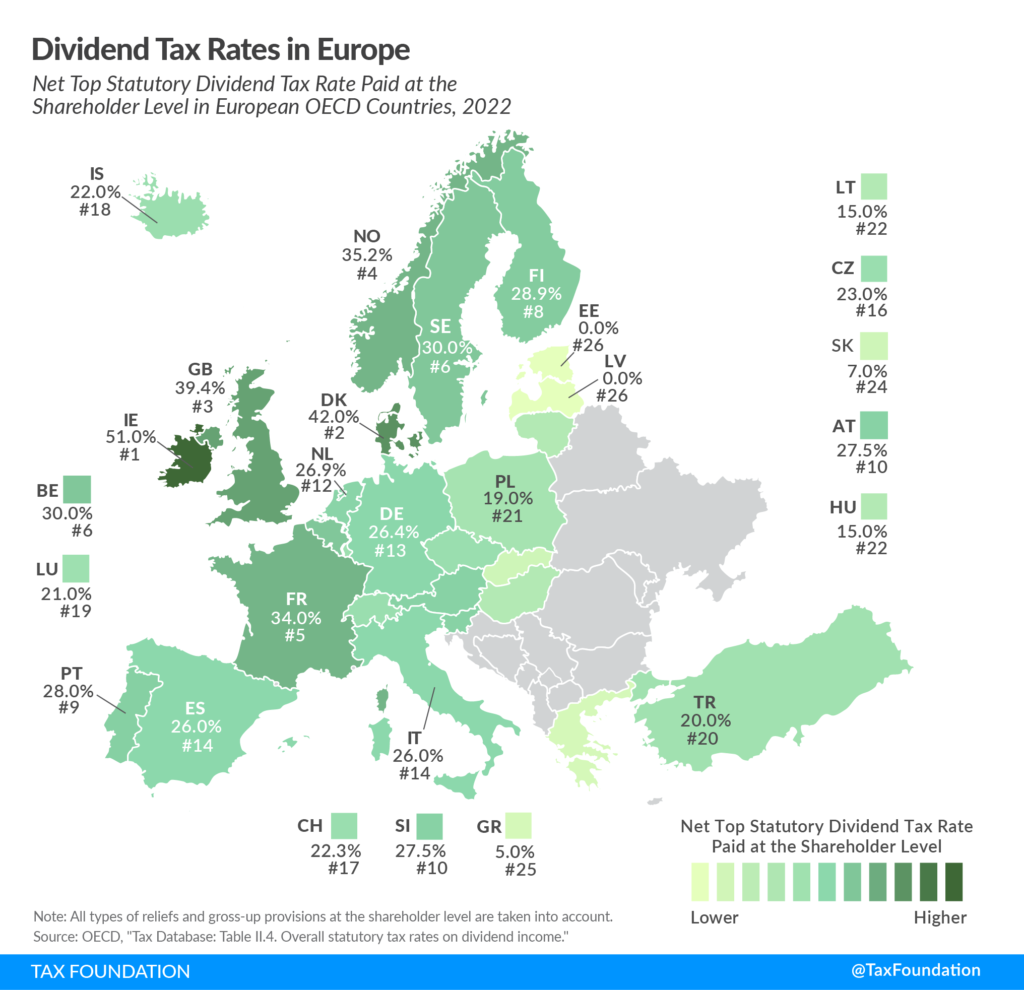

The tax rates on dividends paid out to shareholders by companies are generally higher in Europe than in the US. However European firms tend to have higher dividend yields than their American peers due to the dividend culture. With that said, the following chart from Tax Foundation shows the dividend tax rates in European OECD countries at the shareholder level:

Click to enlarge

Source: Dividend Tax Rates in Europe by Cristina Enache, Tax Foundation

Ireland has the highest dividend taxes at 51% followed by Denmark and the United Kingdom. Estonia and Latvia do not have dividend taxes but they charge companies a corporate tax of 20% on profits distributed to shareholders.

Greece has the lowest tax rate at 5% followed by Slovakia and Portugal.

Overall most of developed Europe have high double-digit dividend tax rates.

US investors may also want to check out Dividend Withholding Tax Rates by Country for 2023.