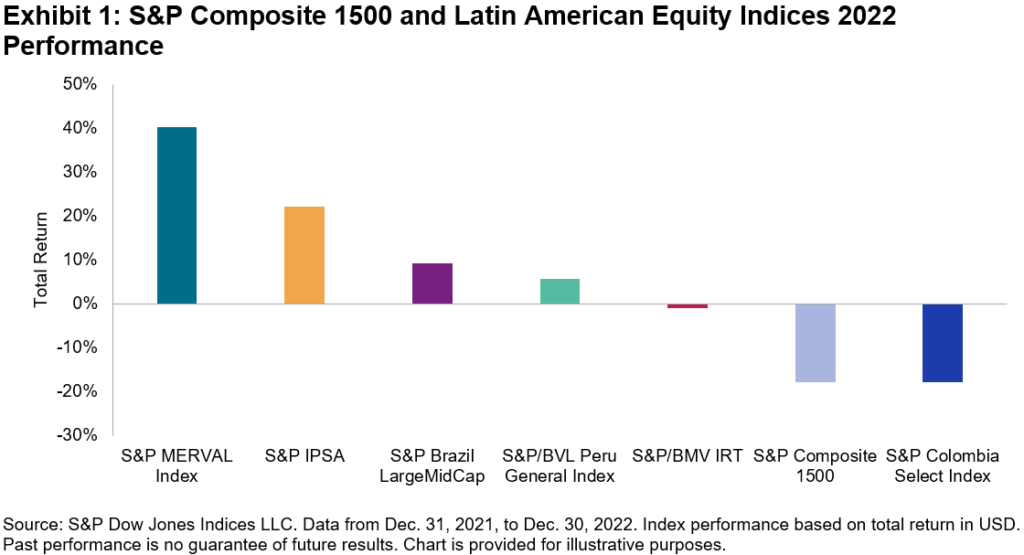

US equities has one of the worst returns in recent years in 2022. Other developed markets did had similar performance as well. However some emerging markets shined. For instance, Latin American equity markets had a good year relative to their US counterparts. The following chart shows the performance of major Latin American indices in 2022 in US dollar terms:

Click to enlarge

Source: Latin America in the Long Term: A Potential Application of U.S. Equities by Cristopher Anguiano, S&P

The reason Latin American counties performed better than US equities is because their equity indices have less exposure to two sectors that got hit bad last year – Information Technology and Consumer Discretionary. Instead of heavy weightage to these sectors, Latin Indices have more allocation to Energy, Financials, Materials and Consumer Staples as shown in the table below according to an article by Cristopher Anguiano at S&P:

Click to enlarge

Source: Latin America in the Long Term: A Potential Application of U.S. Equities by Cristopher Anguiano, S&P

The key takeaway for investors that diversification across countries and regions is important. While developed equities had a poor year Latin stocks had a decent year since the sectoral composition of their indices is different.

Related ETFs:

- iShares MSCI Mexico Capped Investable Market (EWW)

- iShares MSCI Brazil Index (EWZ)

- iShares MSCI All Peru Capped Index (EPU)

- Global X FTSE Colombia 20 ETF (GXG)

Disclosure: No Positions