I have written many times before that time in the market is more critical than timing the market. When markets are volatile such as these days it is tempting to sell out everything to cut down the losses and then buy back at a later date when prices are at their lowest. Though this strategy sounds simple in theory it is not possible to execute it in practice. This is because of the simple reason that nobody knows when the markets will hit the bottom and when it will turn around. Hence the wise strategy for most retail investors is to simply ride out the storm and not worry about things that are beyond their control.

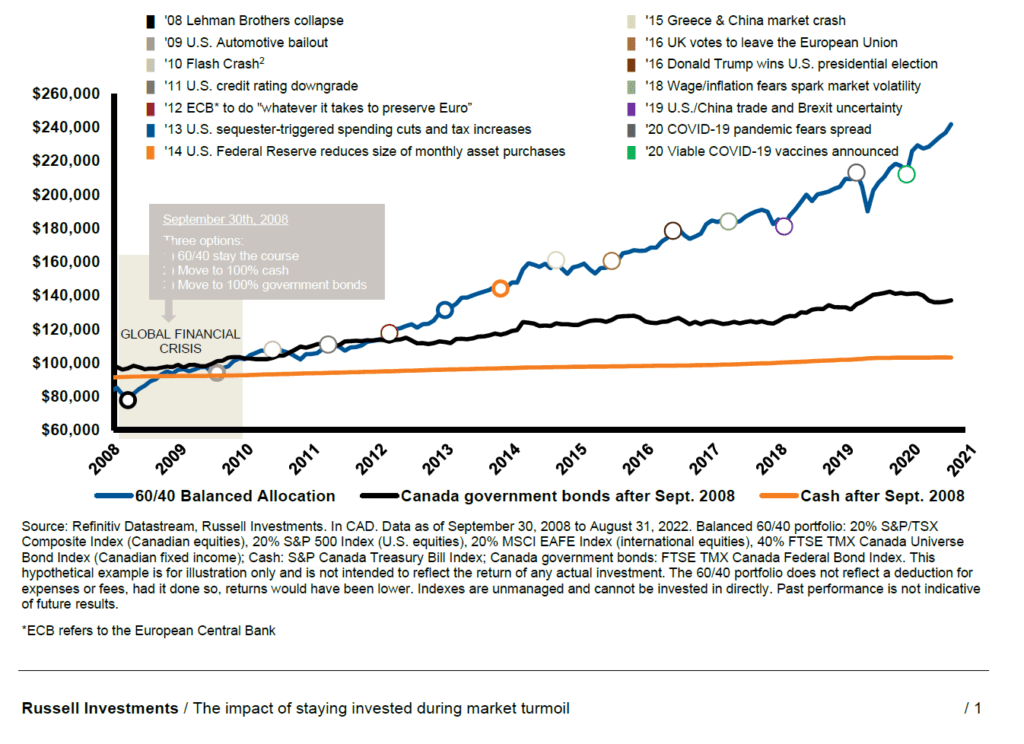

The following chart shows the performance of a 60%(equities)/40%(fixed income) portfolio in 3 different scenarios since 2 weeks of the fall of Lehman Brothers in 2008 thru August 2022. The 3 scenarios are:

1.Stay invested and reinvest dividends

2.Move 100% to cash

3.Move to 100% Canadian Government Bonds

Note: This example is based on the Canadian market

Click to enlarge

Source: The impact of staying invested during market turmoil, Russell Investments

Of the 3 options, the best return was from option #1. Staying invested turned the $100K CAD into $223,143 CAD. The bond option grew to $124,103. The worst return was from the cash option.

So the key takeaway is that it is better to remain invested during adverse market conditions. Trying to sell out and then buy back again is not a wise idea.

Related ETFs:

Disclosure: No positions