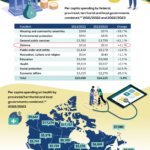

Equity markets in most countries go through periods of bull and bear markets on a regular basis. Bull markets propel valuations to astronomical levels sometimes and that leads to a eventual plunge. Bear markets, though painful, are not a time for investors to thrown in the towel. The recent decline during the Covid-10 pandemic was a classic scenario of this case. Stocks fell dramatically only to recover strongly in a few months. According to a report by TD Asset Management, Canadian equities have also recovered strongly after bear markets based on historical data. So it is important to remain invested even during bear markets as an investor can miss the strong recovery and further gains. The following chart shows the bull and bear markets in the Canadian equity market based on the S&P/TSX Composite Index returns from 1977 to Oct, 2023:

Click to enlarge

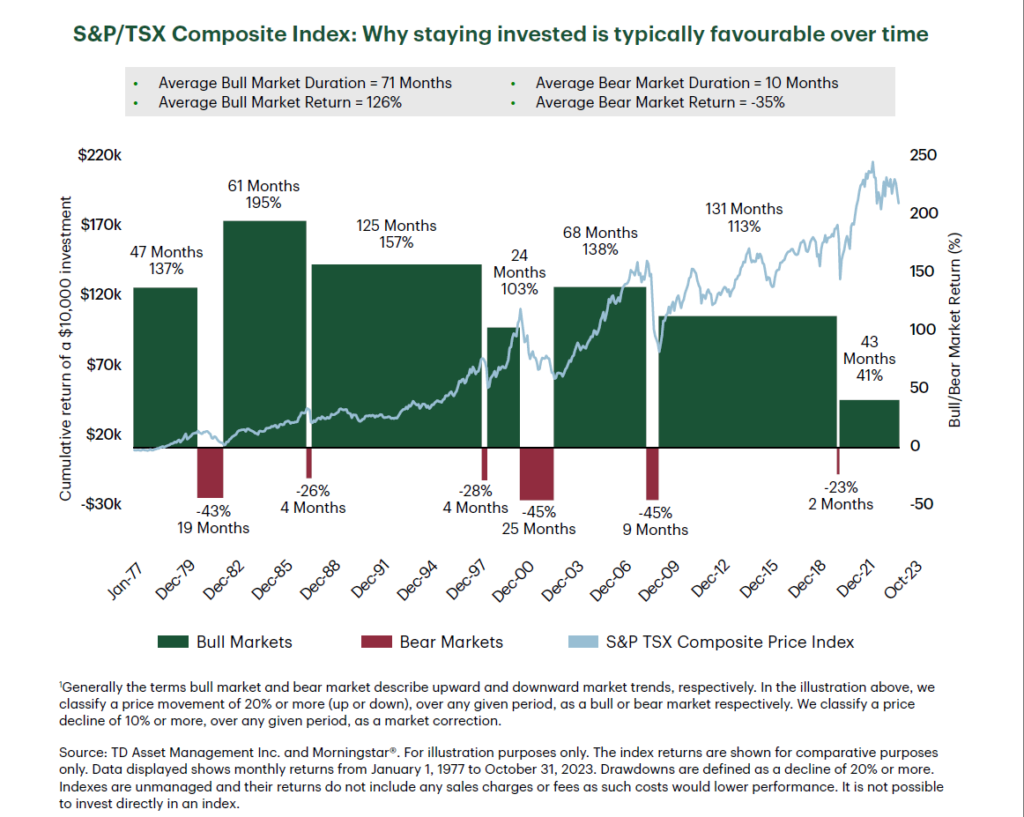

Missing a few trading days can make a big difference in returns especially over the long-term as the following chart shows:

Source: Bulls & Bears: Let History be your Guide, TD AM

The duration of bear markets are smaller than the duration of bull markets for Canadian stocks also.

Related ETF:

- iShares MSCI Canada Index Fund (EWC)

Disclosure: No positions