I came across a fascinating article on lessons learned from experienced investors on braving bear markets at Capital Group. This is indeed a timely article since we are in the grips of a brutal bear. Though market may have shot up yesterday and today, the bear market is not over until it is actually over. So it is not wise to get excited about up days in a bear market. With that said, one of the key points that caught my eye in the article is that we should avoid winners of the last cycle by Lisa Thompson, Portfolio Manager. From the piece:

My experience has taught me that markets have long cycles. I believe the pandemic marked the end of the post-global financial crisis cycle — a cycle dominated by deleveraging, demand shocks and expanding globalization. These conditions led to looser monetary and fiscal policy, low cost of capital and stock price inflation.

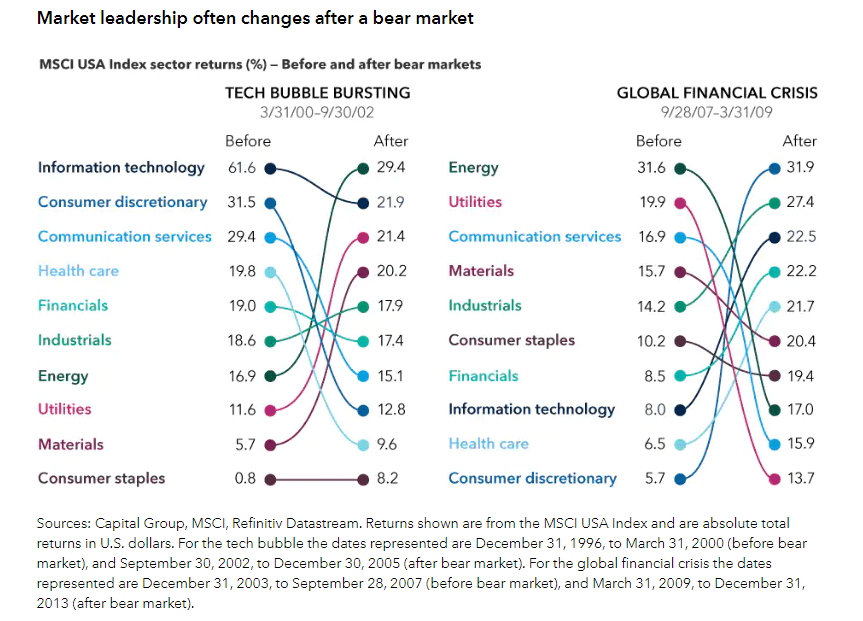

Today we are at the beginning of a new cycle, one that I expect will be marked by deglobalization, a shrinking labor supply and decarbonization — conditions that will lead to a shift from asset price inflation to goods inflation. Profit margins and highly valued stocks will face continued pressure. Because I expect generally higher inflation during this period, I want to steer clear of many of the fast-growing primarily U.S. companies that were the winners of the previous cycle.

Source: Braving bear markets: 5 lessons from seasoned investors, Capital Group

Following this theory, the winners before the current bear market were crypto, technology such as profitless companies, semiconductors, software, e-tailing, streaming, etc., consumer discretionary, fintech firms like BNPL, biotech, meme stocks, etc. Other than a qualified few, most of these companies are bound to disappoint investors in the next cycle. Already many of these stocks have taken severe beatings since the start of the year.

It remains to be see which sectors would be the champions of the next cycle. Value stocks, small and mid cap stocks, railroads, pet food and healthcare, etc. could be better performers.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

- S&P MidCap 400 SPDR ETF (MDY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

Disclosure: No positions