The US equity market is in a bear market this year. The S&P 500 is down about 19% year-to-date. After a few months of relentless declines, stocks saw a brief run up during the summer. That brief bull run seems to have ended and equities are heading in the downward direction again. The Federal Reserve is projected to raise interest rates again sharply next week. It remains to be seen if they can tame soaring inflation and avoid the economy going into a recession.

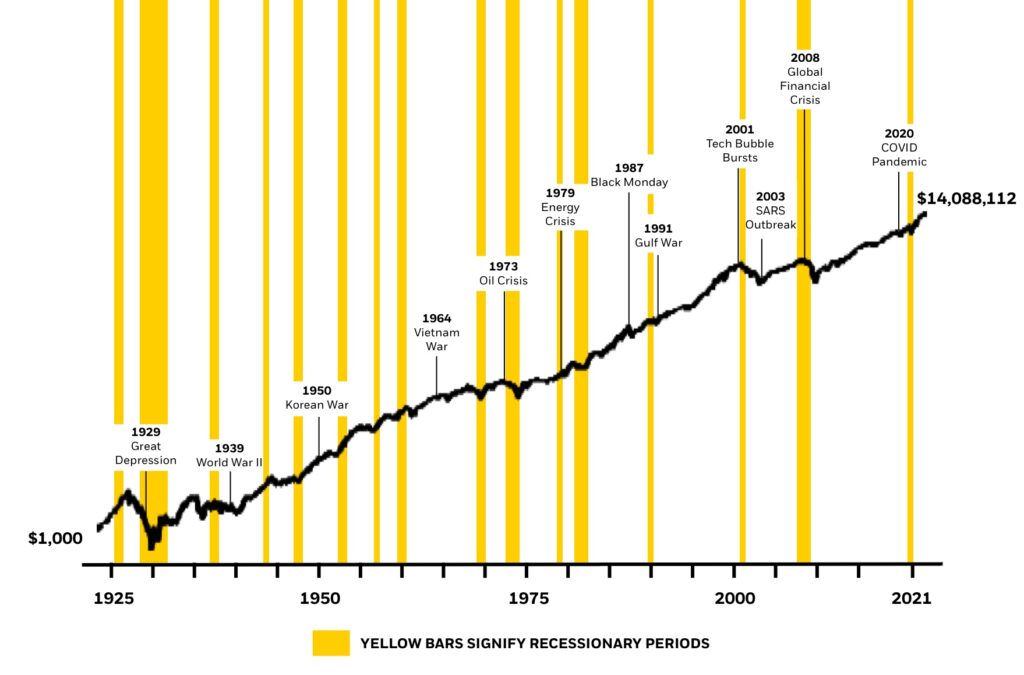

With that said, though bear markets are horrible to go through it is wise to stay invested for the long-term. This is because bear markets tend to end inevitably at some point and stocks tend to go up in the long run. Since it is impossible to predict when markets would turn directions, it is not smart trying to time the market. The following chart shows the growth of $1 from 1926 thru the end of 2021:

Click to enlarge

Source: Morningstar, National Bureau of Economic Research, and BlackRock, as of 12/31/21. Past performance does not guarantee or indicate future results. It is not possible to invest in an index. U.S. stocks are represented by the S&P 500 Index from 3/4/57 to 12/31/21 and the IA SBBI U.S. Lrg Stock TR USD Index from 1/1/26 to 3/4/57, unmanaged indexes that are generally considered representative of the U.S. stock market during each given time period. Index performance is for illustrative purposes only. It is not possible to invest directly in an index. Assumes reinvestment of dividends and capital gains and that an investor stayed fully invested over the full period.

This chart illustrates the long-term performance of the S&P 500 Index going back to the 1920s. Even though the market, as measured by that index, has endured painful selloffs and down periods, such as the Great Depression or the 2008 Global Financial Crisis, over the long term the index has climbed. An investment of $1000 in 1926 would have grown to $14,088,112 by the end of 2021.

Source: Why should investors stay invested during market volatility?, Daniel Prince, iShares

Another important point to note from the above chart is that not many investors are going to hold stocks such a long time. However even during other shorter periods stocks have gone up more than down. For instance, the market has gone through many negative events in recent years including the SARS Outbreak, the bursting of the Tech Bubble, Global Financial Crisis(GFC), etc. Despite all this the S&P 500 is much higher today than before these events.

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No positions