I have written many times in the past on the importance for staying invested for the long haul. Having patience and staying focused on the long-term goals is especially difficult during adverse market conditions such as the bear market we are currently in. Simply quitting the market by selling everything and staying on the sidelines will not be helpful to say the least. This is because it is foolish to sell when stocks are their lowest levels. In addition, while selling is easy buying back at the bottom is not. Markets can turn almost overnight and it is impossible to predict when is the right time to jump back in. So to put it another way, in order to time the market one has be right two times – once to sell and another to buy back again. For most investors this is not humanly possible – especially being right twice.

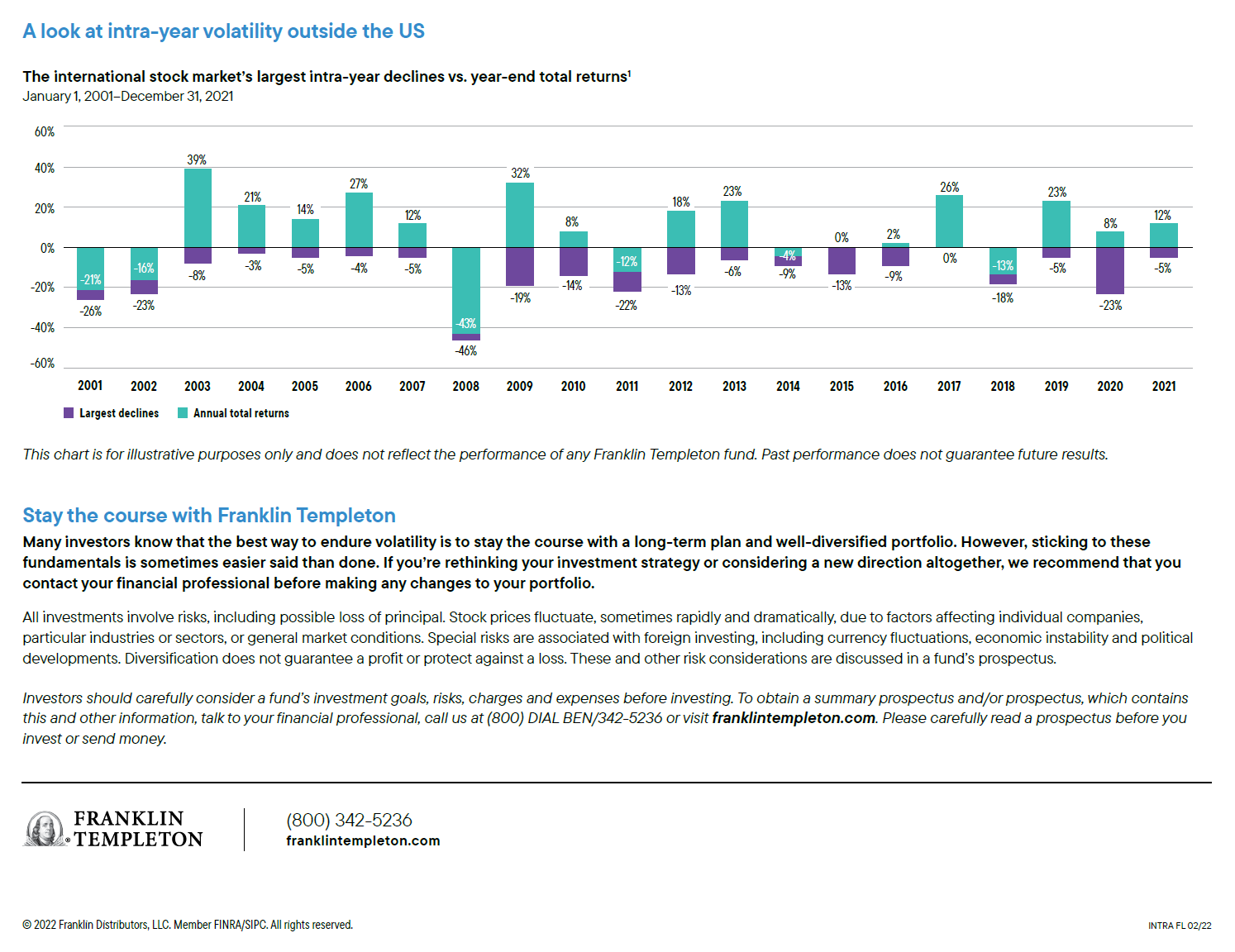

Similar to the popular chart for the S&P 500, the following chart shows the largest intra-year declines and the year-end returns for international stocks as represented by the MSCI EAFE Index. Definition of this index from MSCI:

“The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. With 799 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country.”

The MSCI EAFE Index’s largest intra-year declines vs, year-end total returns from 2001 to 2021:

Click to enlarge

Source: The Power of Perseverance, Franklin Templeton

The above chart shows that perseverance pays off. For instance, in 2020 international stocks declined by 23% but still ended the year with a positive total return of 8%. Similar scenario has occurred over the years from 2001.

Related ETF:

- Vanguard Developed Markets Index Fund ETF (VEA)

Disclosure: No positions