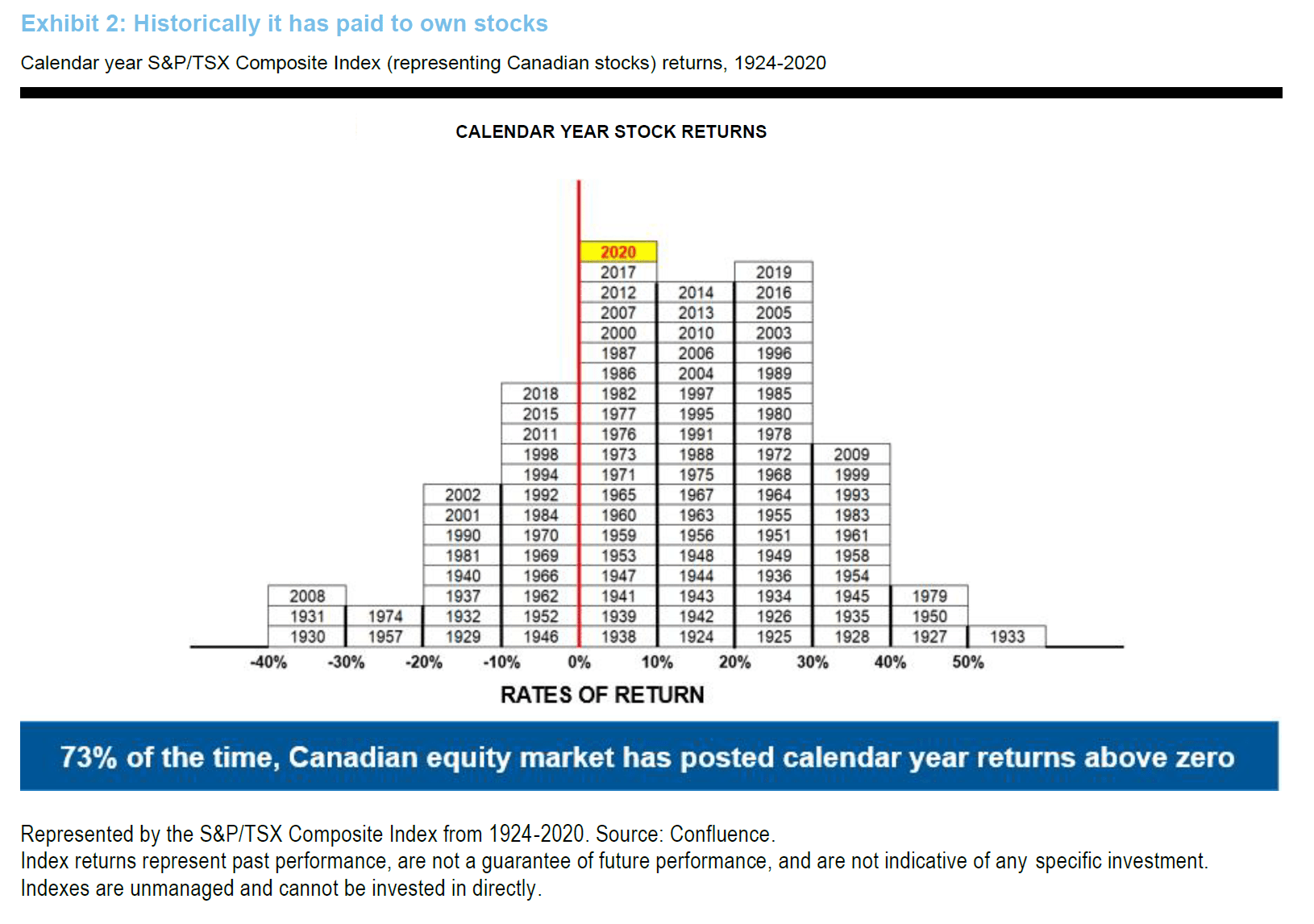

Stocks tend to go up in the long term. Though in the short-term stocks can be volatile or earn negative returns, when considered over many years or even decades stocks usually generate a positive return. This is true in the case of Canadian market also. The following chart shows the calendar year returns of the S&P/TSX Composite Index from 1924 to 2020. In most years the return was positive. Or to put it another way, 73% of the time, Canadian stocks yielded calendar year returns above zero.

Click to enlarge

Source: 3 Guidelines to keep in mind in volatile markets, Russell Investments