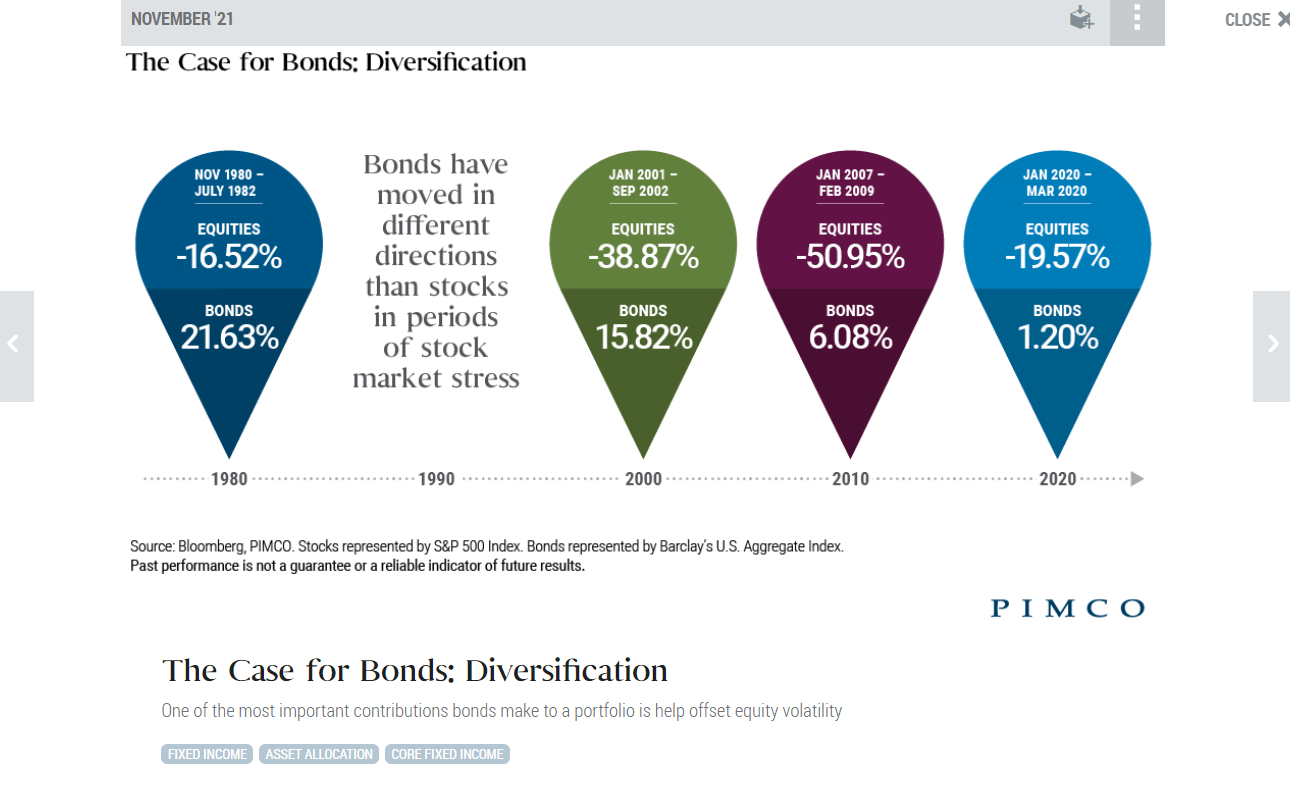

Fixed income is an important asset class to own in a well diversified portfolio. Though bonds do not offer the thrill of stocks and potential high returns, they provide stability and earn a decent income during good times and bad. For instance, in a prolonged bear market for equities even dividends can get suspended or reduced. Bonds will provide a consistent source of income during such periods without interruptions. When equity markets become volatile investors try to seek shelter in bonds and other relatively safe assets. The following chart from PIMCO shows the diversification benefits of owing bonds:

Click to enlarge

Source: PIMCO

Related ETFs:

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- iShares TIPS Bond ETF (TIP)

- Vanguard Total Bond Market ETF (BND)

- iShares Core Total U.S. Bond Market ETF (HYG)

- SPDR® Barclays High Yield Bond ETF (JNK)

Disclosure: No positions