US equity markets have been more volatile in the past few weeks. Investors are worried about a variety of factors such as growing debt, rising bond yields, China, excessive valuations and of course the most important of all – inflation.

It is widely accepted that stocks are the best asset class to own to beat inflation in the long-term. But what about the short and medium-term? Does inflation negatively impact stock returns? A recent post at Dimensional provides some answers. From the article:

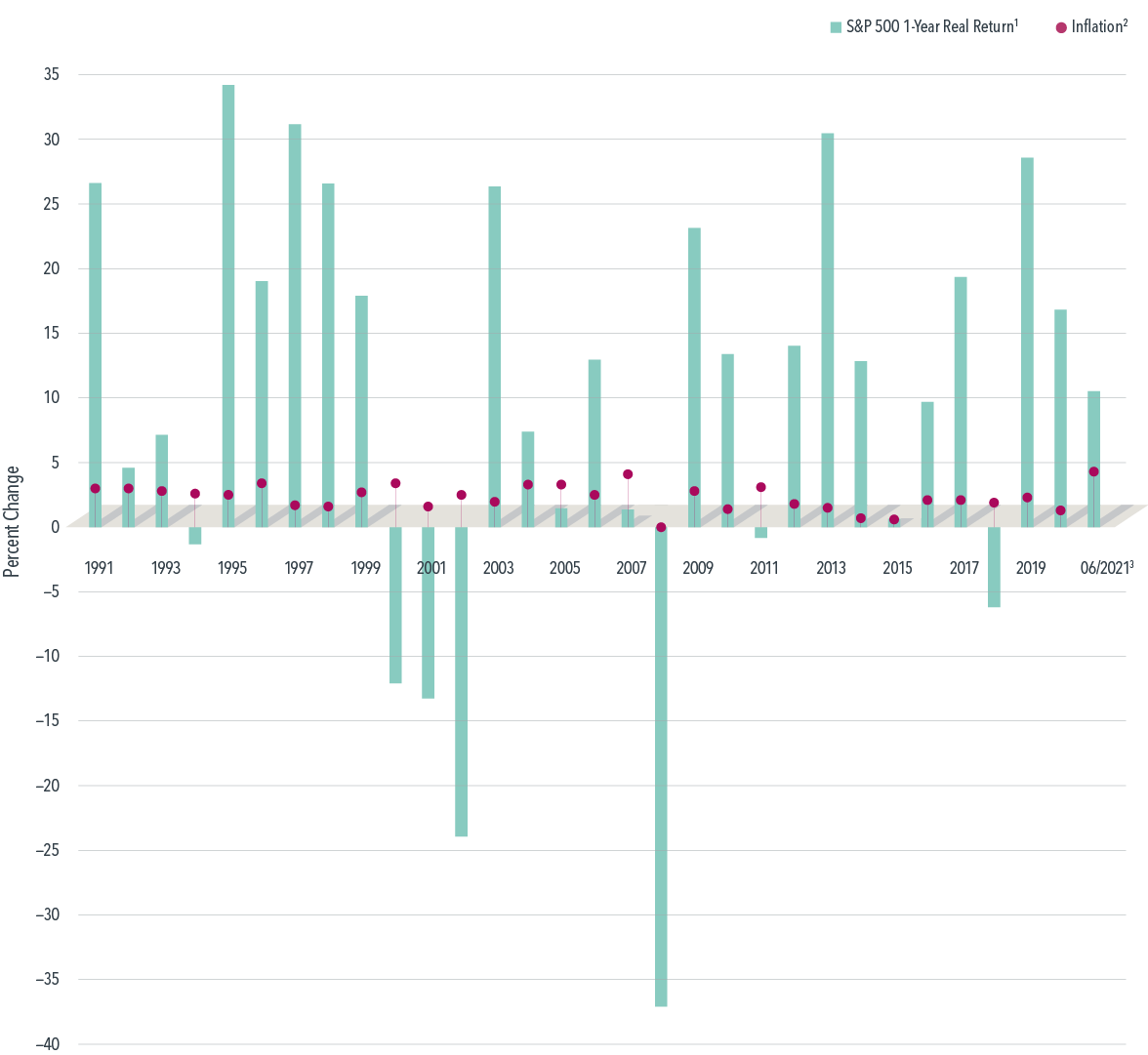

Since 1991, one-year returns on US stocks have fluctuated widely. Yet weak returns occurred when inflation was low in some periods, and 23 of the past 30 years saw positive returns even after adjusting for the impact of inflation. That was the case in the first six months of 2021, too (see Exhibit 1).

Past performance is no guarantee of future results.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Copyright 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.Over the period charted, the S&P 500 posted an average annualized return of 8.5% after adjusting for inflation. Going all the way back to 1926, the annualized inflation-adjusted return on stocks was 7.3%.

Source: Will Inflation Hurt Stock Returns? Not Necessarily., Dimensional Fund Advisors

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions