I have written many time before on the futility of market timing. Since markets tend to go to extreme levels on both the upside and downside trying to get in and out at tops and bottoms will lead to worse outcomes. The wise strategy is to simply stay in the market regardless of volatility and focus on the long term.

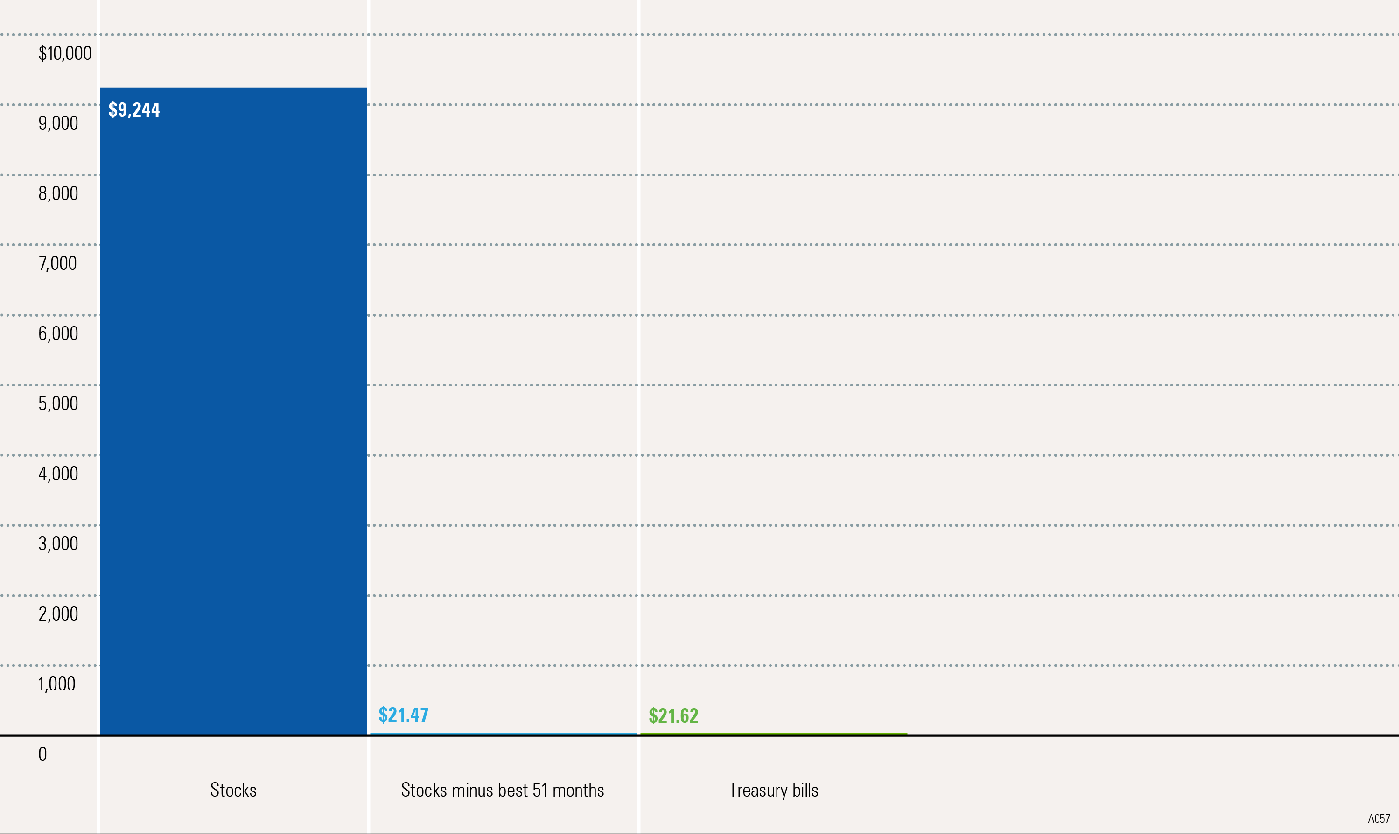

The following chart shows the dangers of market timing:

Click to enlarge

Source: Principles of Investing, Morning Star

A $1 investment in stocks 1926 would have grown to $9,244 in 2019. But missing the best 51 weeks during the many decades between those years would have left with a growth of just $21.47 !.