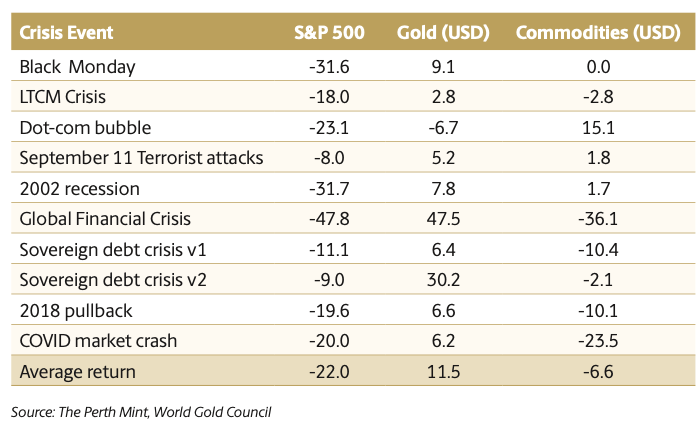

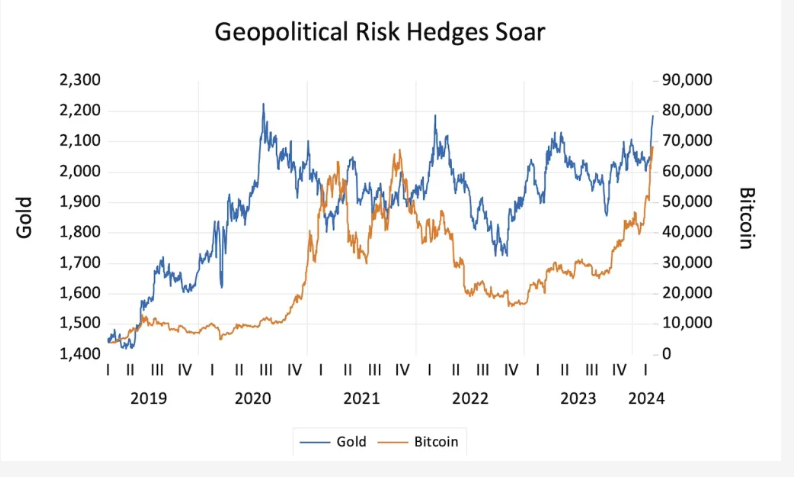

Gold is an important asset class to own in a well diversified portfolio. The performance of gold is negatively co-related to risky assets such as the S&P 500. In this post, let’s review the return of gold vs. the S&P 500 during major crises in the past few decades.

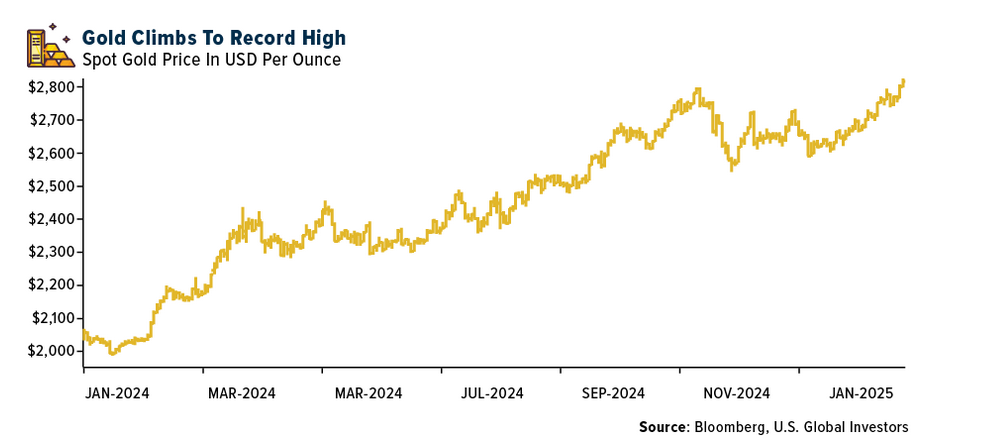

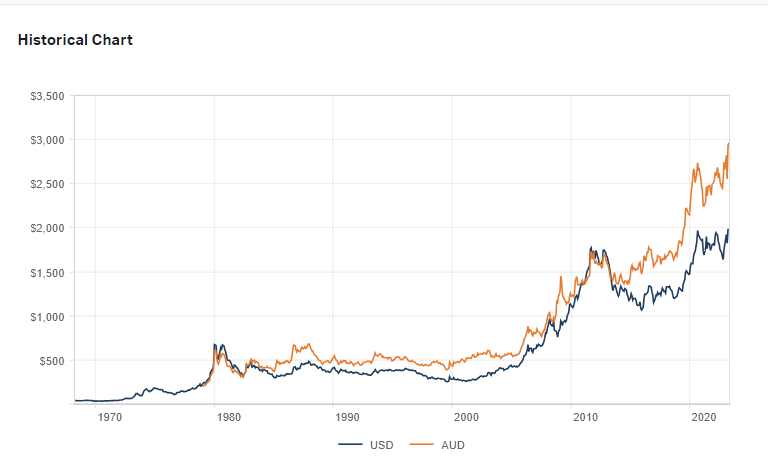

Before we get to that a quick note on the price of gold. Gold topped out at over $2,000 during the pandemic last year. This year gold has been an average performer so far. Yesterday gold prices closed at $1,775.00 an ounce. From a historical perspective, gold has returned 516% since 2000.

Click to enlarge

Source: Kitco

As mentioned above, gold tends to have strong growth when stock prices decline and vice versa. This is because gold is considered a safe haven asset and as investors flee from risky stocks they try to take shelter in gold. In addition, gold is traditionally regarded as good source for holding value. So when the world is engulfed in major crisis gold attracts hordes of investors. For example, during the Covid crash of 2020 S&P 500 plunged 20%. But gold was a winner with just over 6% gain. The case for gold was even more pronounced during the Global Financial Crisis when stocks crashed by about 48% and gold rose over 47%.

Click to enlarge

Source: The case for a modest allocation to gold in super funds by Jordan Eliseo, First Links, Australia

The key takeaway is gold can cushion a portfolio when equities fall. So it is wise to allocate some portion of assets to gold.

Related ETF:

- SPDR Gold Trust (GLD)

Disclosure: No Positions