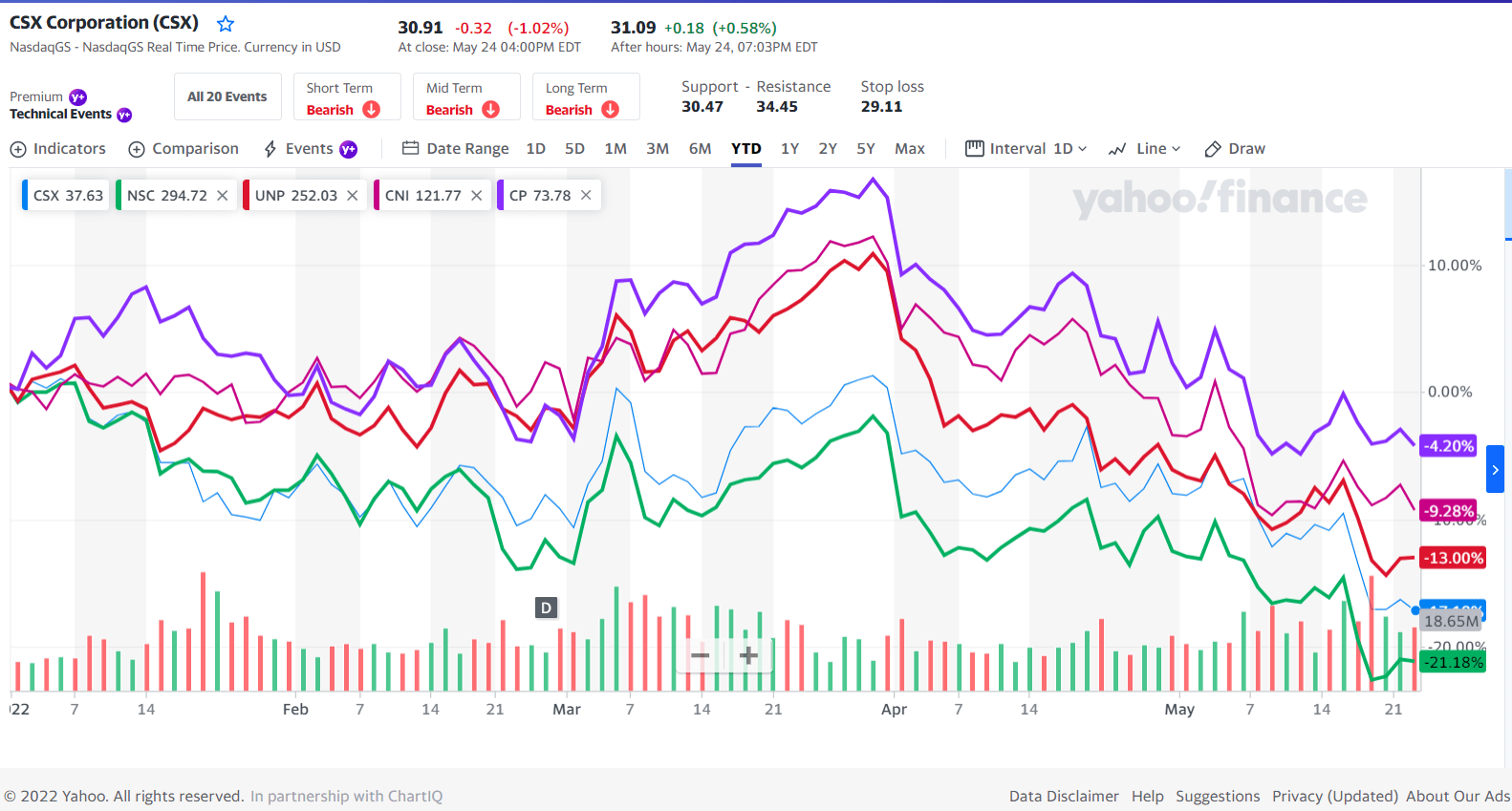

CSX Corporation, of the major US railroads has announced a stocks split in the ratio of 3:1. This move follows Canadian Railroad Canadian Pacific’s (CP) stock split last month. When the news release came out on Friday, CSX closed at $99.62 and the 52-week high was $104.87. Below is an excerpt from the announcement:

JACKSONVILLE, Fla., June 04, 2021 (GLOBE NEWSWIRE) — CSX Corporation (NASDAQ: CSX) today announced that its Board of Directors has approved a 3-for-1 stock split to be distributed to shareholders as a stock dividend. Each shareholder of record at the close of business on June 18, 2021, will receive two additional shares of CSX common stock for each share held as of this record date. The new shares will be distributed on June 28, 2021.

The regular, quarterly cash dividend of $0.28 per share payable on June 15, 2021, will not be impacted by the stock split. Based on the current dividend rate, the post-split quarterly dividend on the company’s common stock would be $0.093* per share.

*On a post-split basis, the dividend will be carried out six decimal places to most closely approximate the current dividend amount.

Source: CSX ANNOUNCES STOCK SPLIT, CSX, 6/4/21

CSX has had 4 stock splits so far. The last split of 3 for 1 was in 2011. Investors holding CSX will see the additional two shares for each share they own on June 28, 2021.

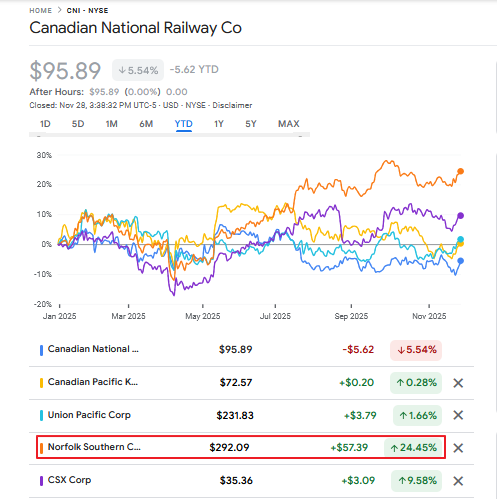

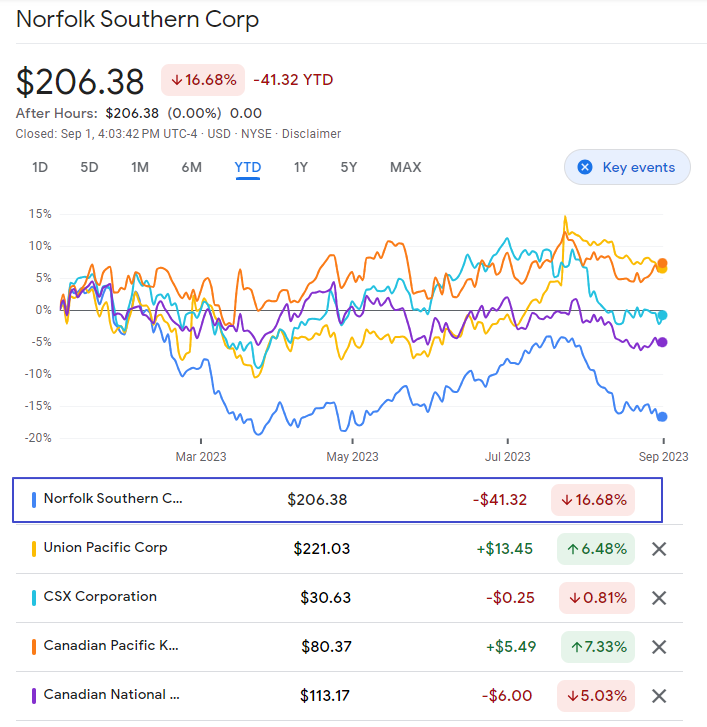

It is possible that the other US railroads – Union Pacific(UNP) and Norfolk Southern Corp(NSC) – may also split their stocks following the trend. Both the stocks are trading at high price levels. Norfolk Southern closed at over $279 and Union Pacific at over $226 on last Friday.

Disclosure: Long CSX, NSC and UNP