The top companies by market value change over time especially in a decade or sometimes even every year. As the saying goes, change is the only constant in equity markets. Accordingly investors have to calibrate their holdings and not become overconfident in holding the leadership positions by today’s market leaders. Just like a revolving door, scores of companies have attained top rankings only to lose it in the following years. During the dot com era, networking giant Cisco(CSCO) used to be one of the largest firms with an astonishing market capitalization. Then when the bubble burst, Cisco lost that status and the stock went nowhere for many consecutive years. Even today, Cisco is a former shell of itself and is just another tech giant that lost it shine long time ago. Investors in Cisco stock at the height of the dot com boom, lost dearly over the years. On the other hand, investors that picked up stocks of the food supplier Sysco(SYY) instead reaped a huge gain during the same time period.

In the recent Berkshire Hathaway AGM Warren Buffett discussed how extraordinary things can happen in equity markets over 30 years. From an article by Emma Rapaport at Firstlinks, Australia:

Extraordinary things can happen

“I would like particularly new entrants to the stock market to ponder just a bit before they try and do 30 or 40 trades a day in order to profit from what looks like a very easy game.”

Buffett took time to remind people, particularly newer investors, of the extraordinary things can happen in stock markets. He included a list of the 20 largest companies in the world by stock market value on 31 March 2021. Apple was number one worth just over US$2 trillion with United Health at number 20, worth around US$330 billion.

Looking back at the top 20 from 1989, Buffett noted that none of the top 20 today appeared on the list 30 years ago. He said:

“None. Zero. There were then six US companies on the list and their names are familiar to you. We have General Electric, we have of Exxon, we have IBM Corp. None made it to the list 30 years later, it was zero.”

Source: Berkshire Hathaway AGM, Bloomberg, EQS Function

Buffett then invited the audience to think about how many of the companies in the 2021 list will still be on the list in 30 years. He said:

“It’s not going to be all 20. It may not even be all 20 today or tomorrow. You’d think it could be repeated … Yeah, it seems impossible and maybe it is impossible, but we were just as sure of ourselves as investors and Wall Street was in 1989 as we are today, but the world can change in very, very dramatic ways.”

The lesson for investors is that the world will change in dramatic ways. Don’t get too sure of yourself.

Source: Buffett says stock picking is too hard for most investors, Firstlinks

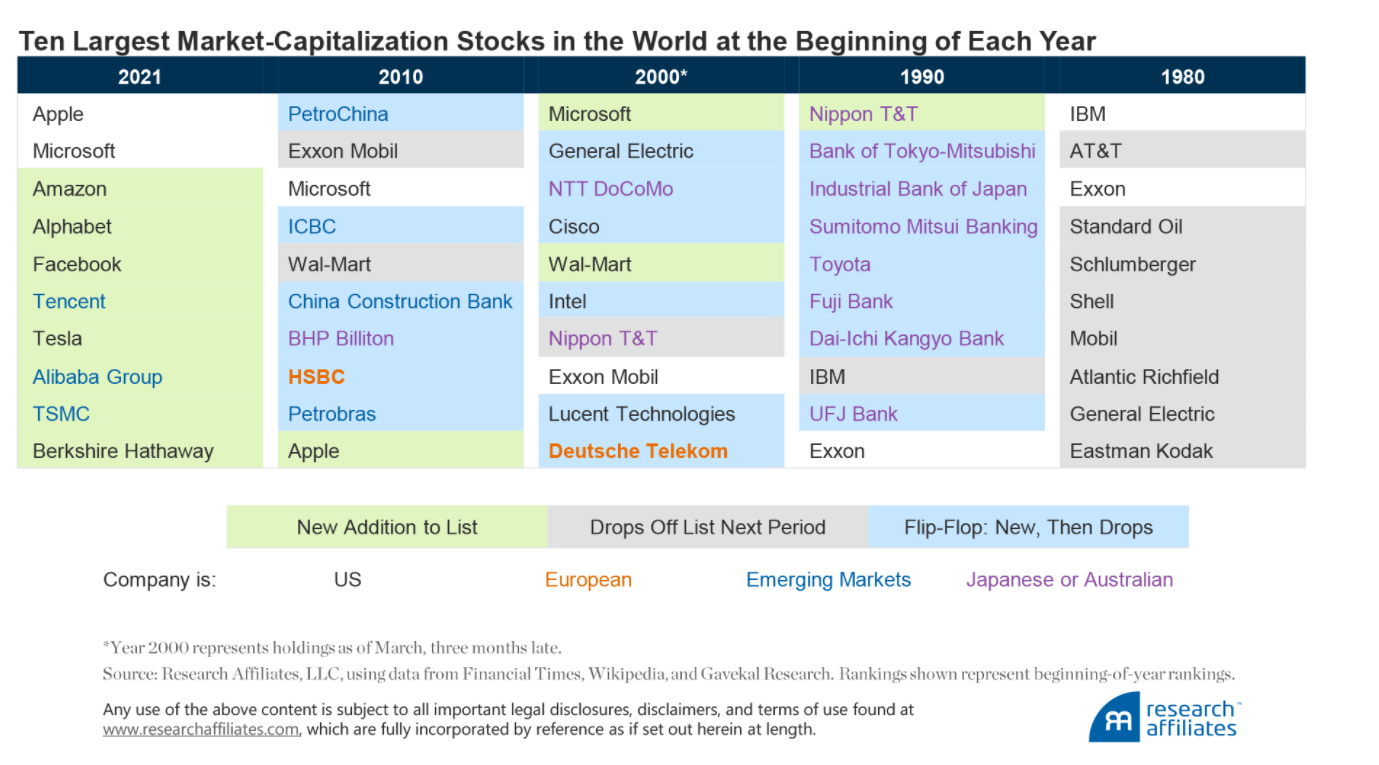

Below is another chart from Research Affiliates showing the changing nature of the top firms by market capitalization in the world at the beginning of each year. In 1980 and 1990, IBM(IBM) was in the top 10 list but has now disappeared to turn into another average tech company surviving on its former glory Similarly in 1990, Japanese firms dominated the top 10 list and today none of them even appear in the ranking. Oil giant(XOM) is another former investor darling that has lost its coveted status.

Source: The Fall of the Titans!, Research Affiliates

Indeed, the top 10 stocks by market value change dramatically from one decade to another. As history shows, today’s leaders such as Apple(AAPL), Facebook(FB), Amazon(AMZN), etc. may not necessarily be the top company in the next decade.

Disclosure: No positions

Update (3/26/22):

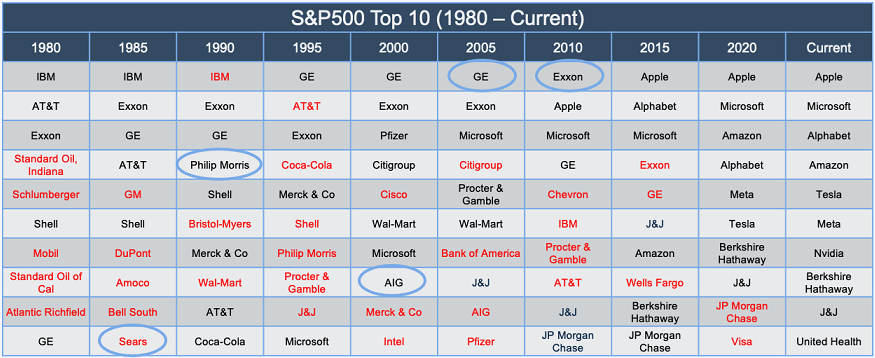

1.The Top 10 Companies in the S&P 500 Index From 1980 To Current 2022):

Source: TFS Post

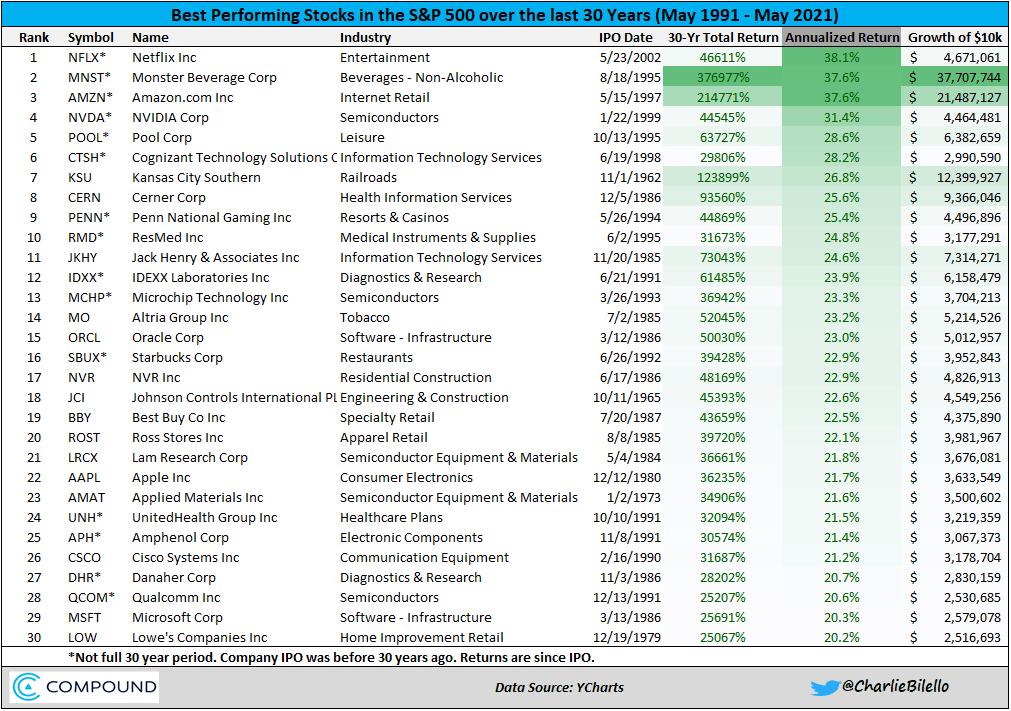

2.The Top 30 Stocks in the S&P 500 over the Past 30 Years:

Source: TFS Post

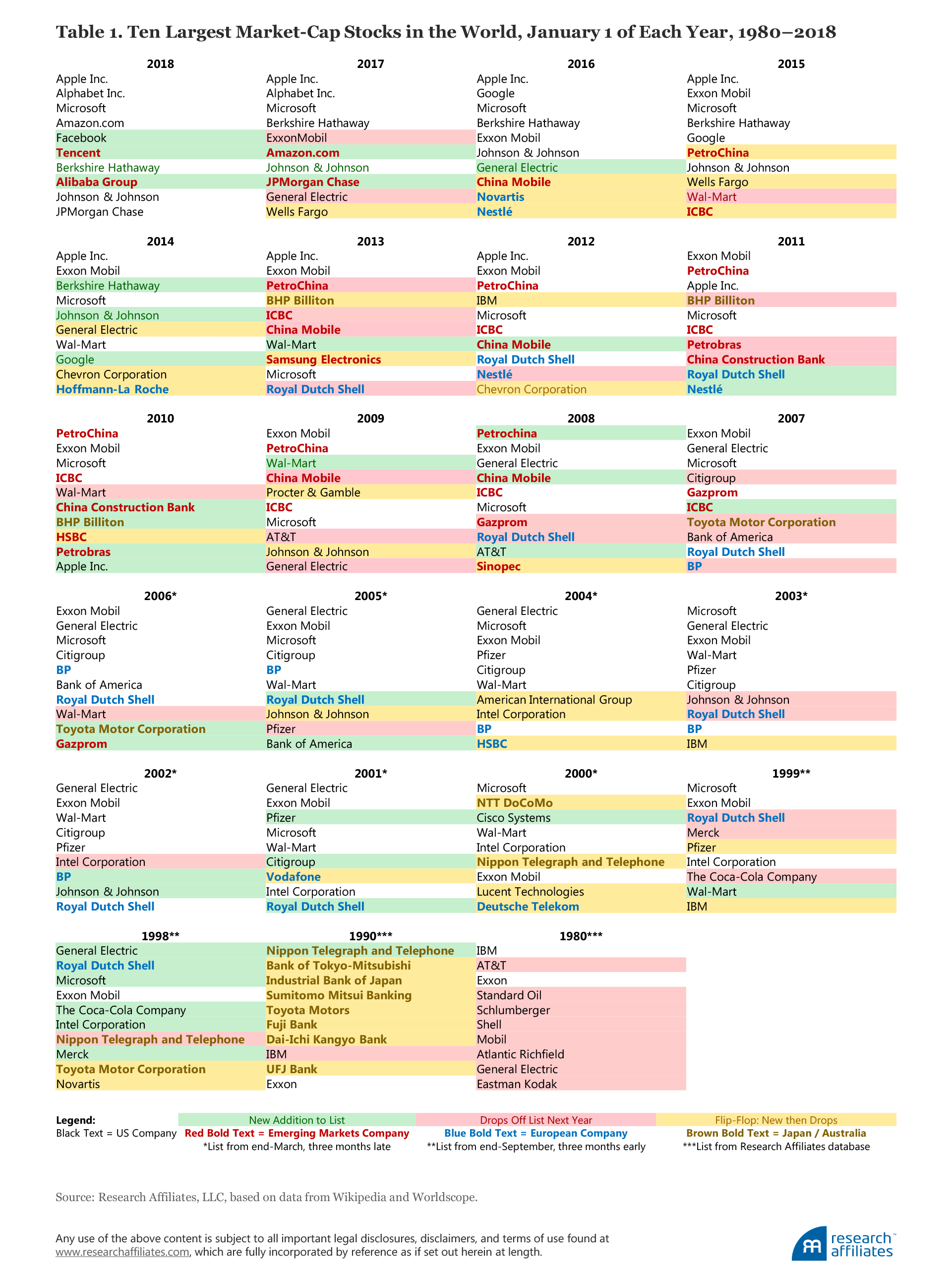

3.Ten largest market cap stocks in the world on Jan 1 of each year, 1980 to 2018:

Click to enlarge

Source: Buy High and Sell Low with Index Funds!, Research Affiliates