One of the important traits of successful equity investors is the simple act of being patient with investments. To put it another way, building real wealth with stocks requires the ability to be calm when markets turn volatile and focus on the long-term goal. The age-old adage goes that time in the market is more important than timing the market.

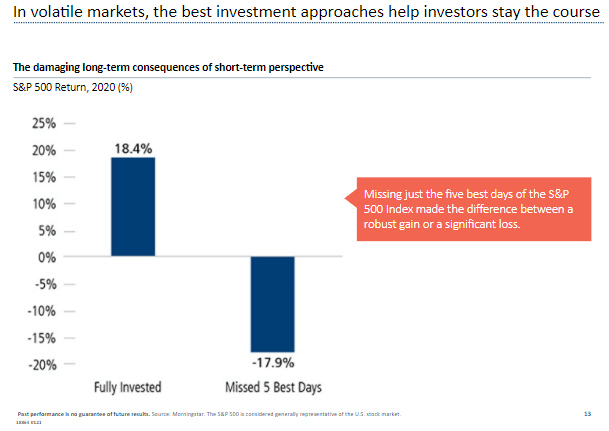

In the past few months US markets have turned volatile and in the past three days major indices have declined significantly. Though it may be tempting to sell everything and then buy back later at cheaper prices, it is wise to stay strong and not sell out. This is because while selling is easy when markets fall buying back is difficult since no one knows when the markets will turn around. The dramatic decline and the sharp recovery in US equities early last year shows the importance of staying the course. The simple chart below vividly shows the astonishing difference in returns between staying invested and missing the five best days of the S&P 500:

Click to enlarge

Source: Morningstar via Bourbon Financial Management

Related: ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions