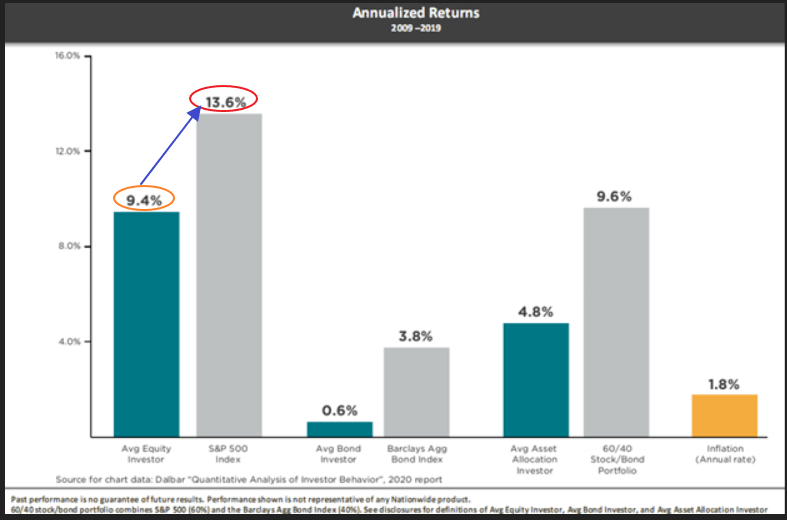

The average individual investor in equity markets earns less than the market return. This has been confirmed by many studies. The reason for the difference is that individual investors are affected by many human behavioral issues such as trying to time the market, excessive trading, buying high and selling low, panicking during market corrections, etc. Hence their returns are lesser than the market. For instance, from 2009 to 2019 the average annualized return on the S&P 500 was 13.6%. But the average annual return earned by individual investor was just 9.4% according to study by Dalbar. That is an astonishing gap of 4.2%.

Click to enlarge

Source: Dalbar via Bourbon Financial Management

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions