The contribution limits for 2021 for the various retirement plans has been released by the Internal Revenue Service(IRS). The contribution limits for Traditional IRA and Roth IRA stands at $6,000 per person (provided one is qualified to contribute). The catchup contribution limit for those aged 50 or higher is $1,000. For college savings, the Coverdell ESA contribution limit also stays at $2,000.

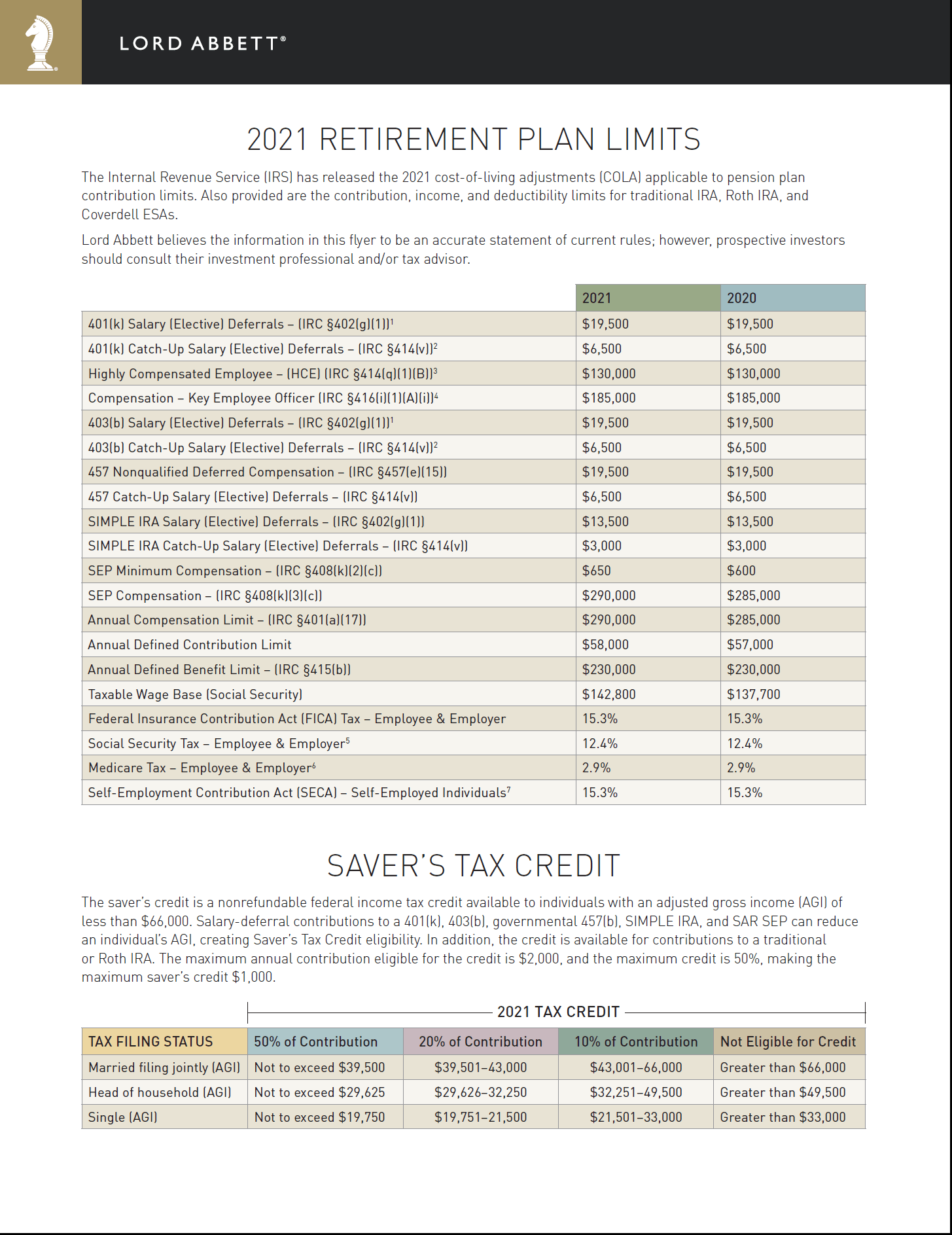

Every year the folks at Lord Abbett publish a simple and easy to use cheat sheet listing all the retirement plans and the latest contribution limits. This list is very useful for investors. The following table shows the contribution limits for 2021. As we head towards the end of this year, its wise to plan ahead for 2021.

Click to enlarge

Source: Lord Abbett

Note: This post is applicable for US residents only

Download: Contribution Limits for 2021 for Retirement Plan Accounts (pdf version)