Stocks can be volatile in the short-term. However over the long-term measured in years they tend to be outperform other types of assets such as bonds, cash, gold, etc. The trick is to be patient and not sell out when there is a downturn in the equity markets. Investors that ignore the short-term declines and hold steady usually come out ahead of those that sell out at the trough. The recent market decline in March this year is a classic example. After declining sharply stocks rose so fast that you would have missed it if you blinked. Past bear markets also confirm the same scenario repeat. A while I came across an article that showed the importance of long-term investing. From the article:

Propensity to recover from losses and make new highs subsequently

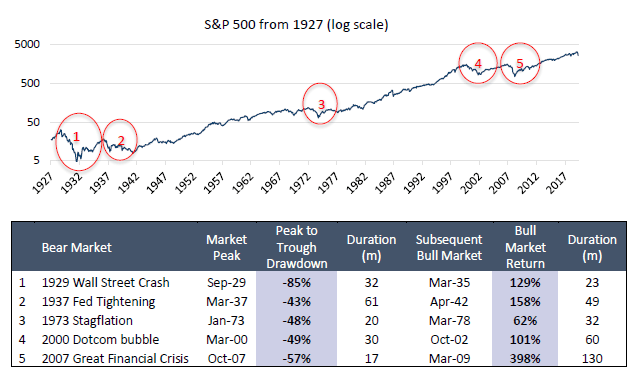

Owing equities, however, comes with risks, as stocks are subjected to large drawdowns during periods of market uncertainties. Nonetheless, equities—as history has shown—have rebounded after every crisis and even breached new highs subsequently. Referencing five of the worst equity drawdowns since 1927, stocks had suffered peak-to-trough drawdowns of around -40% to -85%. But no permanent impairment was experienced by investors unless they impatiently sold out of stocks during the market downturns. During subsequent bull markets, equities recovered all the earlier losses and generated higher returns thereafter (see Chart 3). As such, exiting equities in the midst of a deep sell-off could do more harm than good to investors, especially those with a long-term investment horizon.

Chart 3: Equities always rebound from sharp drawdowns and generate strong returns thereafter

Source: Long-term investors shouldn’t lose faith in equities, Nikko Asset Management4

The entire article linked-above is worth a read.

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions