The US equity market has become highly concentrated. A handful of firms particularly in the tech sector account for most of the gains earned so far this year. I recently came across an article by Rory Kutisker-Jacobson at South Africa-based Allan Gray who noted a different perspective on the concentration in the US market. Below is an excerpt from the piece:

Concentration in the US market

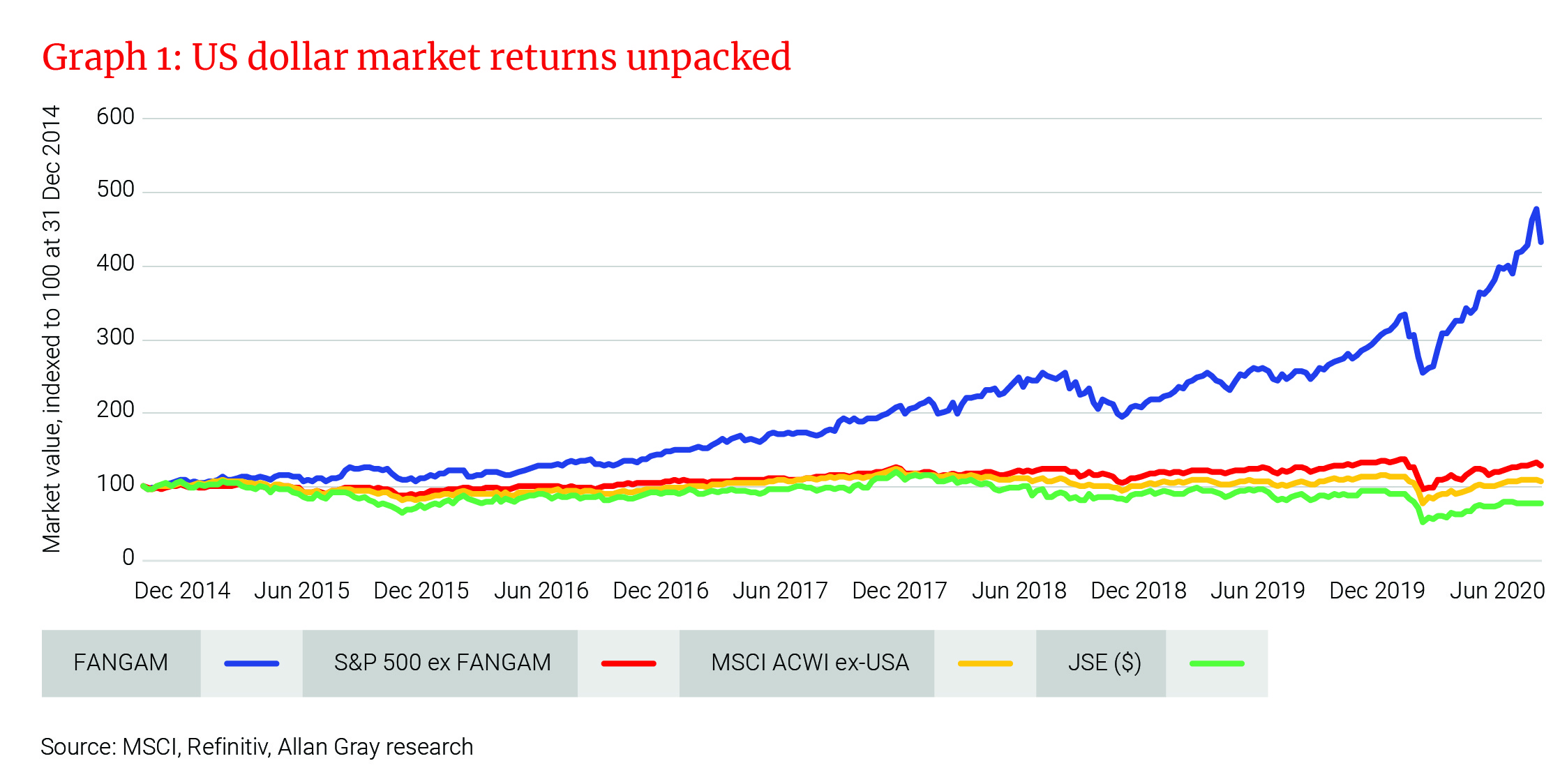

As shown in Graph 1, if we unpack the US market, we see a similar concentration in returns. Over this same period, the S&P Index is up a cumulative 65%, but if we strip out the largest contributors, a very different picture emerges. Just six stocks, Facebook, Amazon, Netflix, Google (Alphabet), Apple, and Microsoft (the so-called FANGAM stocks) account for most of the S&P’s returns. Excluding these, the S&P is only up 29% since December 2014. In contrast, the weighted average return of the FANGAM stocks is a stellar 333%. US tech stocks have been just about the only game in town. This has created huge concentration in the S&P, with the five largest companies (FAGAM) now accounting for more than 20% of the index overall. This level of concentration is higher than that seen at the peak of the dotcom bubble. (emphasis mine)

Make no mistake, these are high quality businesses, but when you look more closely at the numbers, there is a huge amount of positive sentiment priced into their current market prices. For companies that are already massive by global standards, it may become increasingly hard to achieve the growth prospects implied by their current multiples.

Source: Do fundamentals still matter? by Rory Kutisker-Jacobson, Allan Gray

The complete article is worth a read.

Disclosure: No Positions