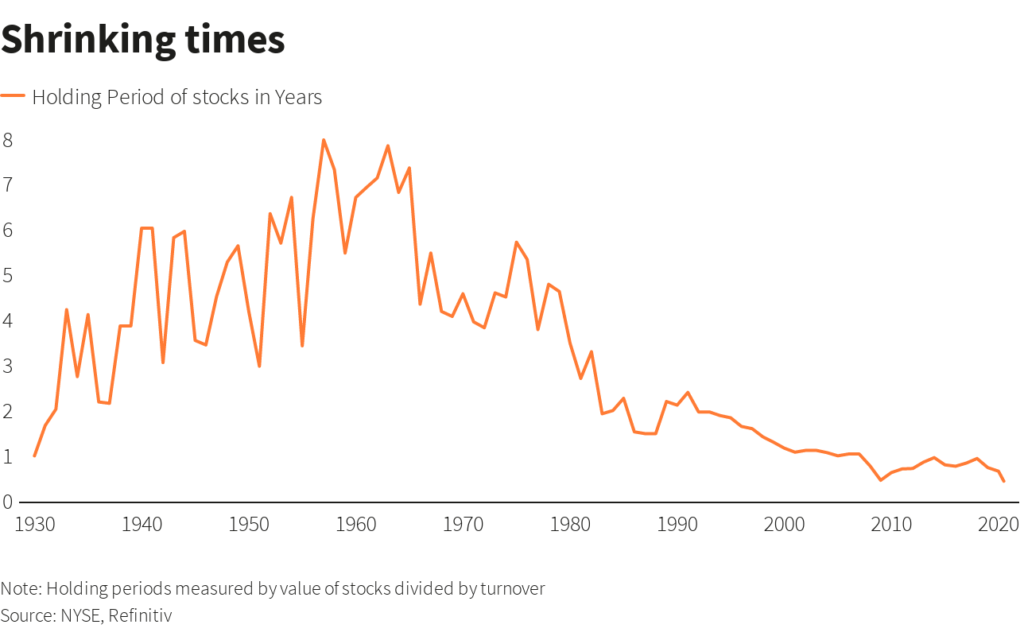

The average holding period for US stocks has been declining for many years now. In the 1940s the average duration was 7 years. By the turn of this century it had fallen to below 1 year according to an article I wrote in 2010. A recent study earlier this year by researchers at MFS showed the holding period for NYSE-listed was 9 months.

A Reuters article noted that the average holding period for US stocks has declined to 5-1/2 months in June. From the article:

The length of time that investors hold shares has been shrinking for decades but the trend accelerated this year in volatile markets that have made people nervous about sitting on investments for too long.

There are different ways of slicing it, but Reuters calculations based on New York stock exchange data show the average holding period for U.S. shares was 5-1/2 months in June, versus 8-1/2 months at end-2019.

The previous record low of six months was hit just after the 2008 crisis. In 1999, for example, 14 months was the average.

Europe displays a similar trend, with holding periods shrinking to less than 5 months, from 7 months last December.

Source: Buy, sell, repeat! No room for ‘hold’ in whipsawing markets, Reuters

The reasons for the continuing decline in holding periods are many. Some of them include commission-free trading from discount brokers to others, 0% interest rates, pandemic-induced volatility, sports gamblers that are bored to death at home due to lack of sports betting, millennials living in their parents’ basements with nothing else to do, day-traders by the millions playing the market using the Robinhood app, unemployed people trying to multiply their $600+ weekly unemployment checks and also have fun doing it, the same people also throwing the $1,200 stimulus checks into the market to make some money to pay bills, etc. Not to mention algorithm-based machine trading by big institutions, locked-down realtors unable to flip houses finding their luck in the stock market, etc.

Whatever the cause, ultimately the inability of investors to hold stocks for the long-term is negative for the market and investors. Simply churning stocks all day long or even holding them for only a few months will not lead to a strong and growing equity market.

Related Posts:

- Duration of Stock Holding Periods Continue to Fall Globally

- Average Stock Holding Periods for NYSE 1929 to 2018 : Chart

- Average Stock Holding Period on NYSE 1929 To 2016

- Average Stock Holding Period in Asian Emerging Markets