The US equity market crashed dramatically in the past weeks as market participants woke up to the fact the US is not immune from events happening in far-away countries. The utter madness that prevailed in the market before the collapse such as the constant hype over Tesla(TSLA) and other hot stocks now looks dumb.These days nobody is talking about how AI is going to change the world or when tourists will be flying to space and other planets on Virgin Galactic (SPCE) spacecrafts. Not to mention the other crazes that have disappeared such as crypto currencies, blockchain, etc.

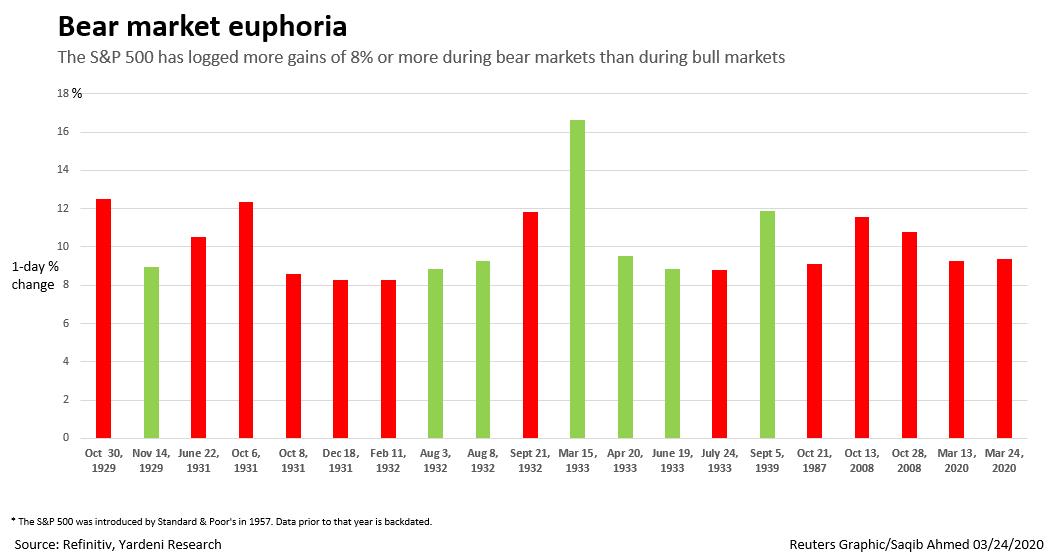

Though stocks plunged heavily from record highs, in the past 3 days they have shot up like a SpaceX rocket. The Dow is up 21% in just 3 days putting it in squarely in a bull market. The million dollar question is this: Are we already in a new bull market? The answer is an absolute no. According to a recent Reuters article, more huge one-day gains have occurred in the US market during bear markets than bull markets as shown in the chart below:

Click to enlarge

Source: Treat with caution: rocketing stocks aren’t cause for comfort, Reuters

From the piece:

All the same, data suggest investors should treat the rally in stocks with caution.

Of the twenty past instances when the S&P rallied 8% or more on a single day, thirteen of them took place when stocks were in the embrace of a bear market.

“These 8% rallies are not necessarily signs of health,” said Christopher Murphy, co-head of derivatives at Susquehanna Financial Group.

In a note on Tuesday, Murphy wrote, “It is important to remember that some of the largest one‐day rallies in SPX’s history took place during bear markets, implying that one day pops are not uncommon in a down market.”

Nor are such sharp rallies a herald of better days.

In 2008, for instance, the two biggest gains during the market crash that fall, both in October 2008, were actually followed by five more months of double-digit declines, data showed.

“You can’t take this bounce and say that (the market) will turn around next week or the week after,” said Quincy Krosby, chief market strategist at Prudential Financial in Newark, New Jersey.

See also:

- The Dow’s 21% surge in 3 days puts it back in a bull market — here’s why the coronavirus crisis makes it feel utterly bearish, Marketwatch

- We’re Now In a Bull Market? Thank the Dollar, Bloomberg

- Bear-Market Stock Rally Comes Undone in Canada Amid Wild Swings, Bloomberg

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions